Still waters run deep

Editor's note: Jon D. Morris is CEO of AdSAM Marketing, a Gainesville, Fla., research firm. Cathy Gwynn is executive vice president, director of analysis at AdSAM Marketing. The authors wish to acknowledge the contributions of Jeffrey McKenna, senior consultant, Chadwick Martin Bailey, to this article.

If you attended a marketing or marketing research conference in the last few years you would think that understanding the feelings of the target market is paramount these days. Most speakers spend much of the time talking about the input from consumers or other audience groups and a portion of that time is directed toward mood or affect. Why, then, is so little attention being paid to effectively measuring these emotional reactions?

In some cases it may be that the marketer believes that determining liking or likability is sufficient. But many studies including Morris et al (2002) have shown that liking is not only poorly descriptive but it is often confounded. Respondents, for example, are unable to bifurcate liking of the stimulus from the product. In many instances, “liking” does not fit as an accurate description of the emotional response because emotions are much richer and more complex than simply level of appeal.

Another reason this important variable goes missing is the difficulty in interpreting the response variations. Unlike the rational questions, where the answer is either yes or no or some level of response, with emotions the substance of the findings is segmented. This makes interpretation more complicated – but in most instances so much richer and more valuable.

There is also a tendency for marketers to mislabel need states, desires or even rational factors as emotions and, as a consequence, not truly understand the emotional dynamics at work. One example is the statement that being connected is an emotion. Emotions do provide connections, but ”connected” is not an emotion, even if people say they “feel connected.” Being connected or having a sense of connection may elicit a variety of different emotions that could range from stimulated, excited or victorious to confident, appreciative, secure, relaxed, etc., depending on situation and context. Measuring the strength of the connection is part of the picture but in order to determine the emotional response it is extremely important to also determine the affect by measuring appeal or valence (+ or -).

Accurately evaluating and interpreting emotional responses can yield actionable insights and help marketers break through and more fully understand the dynamics at work in the marketplace.

Powerful influencers of behavior

So how should marketers approach emotions? It starts with the understanding that emotions are not just touchy-feely reactions. Rather, emotions are powerful influencers of behavior, relationships, evaluation and consideration. In fact, human responses are generally a combination of rational and emotional processing. In actuality there is no such thing as a purely rational decision but there are purely emotional decisions.

Affective neuroscience, at the turn of this millennium, has firmly entrenched itself in brain scan research. Drawing from the findings of forerunners such as Damasio (1994) and LeDoux (1989), researchers have established the fact that the brain circuitry of emotion and cognition is interactive but is now shown to be separate. Data has shown that there are parts of the brain that are dedicated exclusively to affect and the dimensions of emotion (Morris et al., 2009). Emotional response is hardwired in the brain.

Recent studies have shown that the architecture of the brain does not honor the age-old concept of segregation of cognition and affect. Most compelling, cognition appears to be rudderless without emotion. Studies in cognitive neuroscience and behavioral science should not be conducted without taking emotion into account (Morris et al., 2009; Morris et al., 2002).

It is also important to remember that not everything that lights up or produces the bold signal in the brain when seen on an fMRI is the measurement of an emotional response. It is clear that some neuro-responses are reactions to reactions.

Another important point to understand – one is often overlooked in market research measures – is that emotions consist of three dimensions. Effectively measuring and understanding the implications of the dimensions provides greater diagnostic insight during analysis. A three-dimensional concept of emotion has long received acceptance in psychological research because a one-dimensional construct is not robust enough to incorporate all aspects of emotional response (Osgood, Suci and Tannenbaum, 1957; Mehrabian and Russell, 1977). For example, some researchers have used a discrete self-report approach that focuses on specific emotions such as happiness and anger (Izard, 1977; Plutchik, 1984). The discrete approach assumes that individuals can regularly distinguish their feelings using the correct words. If this were case, then phrases like “I hate milk” or “I love orange juice” would never be heard. Emotional responses are a judgment of sensations and those are better analyzed or estimated using a dimensional rating scale.

One example of this three-dimensional approach is the pleasure–displeasure (appeal), arousal–calm (engagement) and dominance–submissiveness (empowerment) model (Mehrabian and Russell, 1977). These three bipolar dimensions are independent of each other and the variance of emotional responses can be identified with their positions along these three dimensions. The dimensional approach helps differentiate emotions postulated by the discrete approach by providing a numeric level of each dimension to describe the specific emotions. Specific combinations of the dimensions can identify each discrete emotion. The meaning of these specific adjectives may differ by individual, culture or other influences; nevertheless, the method for identifying the response is universal.

The three-dimensional construct has been found to be more valid, more reliable and contained more pertinent information about emotion than the categorical models (Havlena and Holbrook 1986). One neurological study using fMRI has confirmed the presence of these dimensions of emotion in the brain (Morris et al., Human Brain Mapping, 2009).

Two different techniques

Measuring emotional response using the three-dimensional concept of emotion (appeal, engagement, empowerment) can be accomplished with two different techniques: a verbal checklist composed of up to 16 bipolar adjectives in a questionnaire, or a nonverbal manikin (graphic character) for respondents to use to express their feelings about any stimulus or in response to questions. The verbal process accumulates scores from the checklist, and then collapses them into the three dimensions. The manikin measures the dimensions directly.

The SAM (self-assessment manikin) scale was found to be effective and less time-consuming than common verbal measures of emotional response because it does not require the respondent to translate complex emotions into words. When adjective checklists or semantic differential scales are used to assess emotional response, the precise meaning of the emotional words may vary from person to person. There is also the lack of universally-accepted adjectives. The use of open-ended questions that ask respondents to describe their emotional responses to communication messages is also problematic (Stout and Rust, 1986; Stout and Leckenby, 1986). Both approaches require a significant amount of cognitive processing.

It is also difficult to design a word-based instrument where the meanings are the same when translated from language to language. Clearly some words are similar but some are not. The nonverbal measurement system, SAM, eliminates the language biases and was shown to be a reliable method for measuring the three dimensions of emotion: pleasure (appeal), arousal (engagement), and dominance (empowerment) (Lang, 1980; Lang 1985; Morris and Waine, 1993; Morris, 1995).

More fully comprehend

Tapping into and understanding emotions enables researchers and consultants to more fully comprehend why people think, feel and act the way they do. The understanding of emotions and the measurement tools available have evolved to better arm researchers with the ability to reliably extract robust insights. There seems to be a tendency, however, for marketers to limit the measurement of emotion to what are deemed to be intuitively emotional contexts, rather than seeking to also understand the emotional dynamics at work in what is perceived to be functionally-oriented or information-oriented contexts. For example, marketers may limit the incorporation of emotional response measures to communications messages intended to be emotionally focused or to categories of products where purchase is considered to be driven more by emotions. Pigeonholing the measure of emotion, however, can cause marketers to miss valuable insights or connection points with their audiences.

It might be difficult to comprehend that emotional response plays an important role in something as mundane as car rental. However, measuring and evaluating emotions can be highly beneficial to a brand for several purposes, including segmentation. Standard metrics may focus on customer satisfaction or may include segmentation based on demographics, rental preferences and behavior and perhaps psychographics. But that only provides part of the picture.

In this case study example, several questions were composed and included in a Consumer Pulse omnibus study to better understand the emotional dynamics involved in renting a car, with the goal of gaining insights that a company could use to differentiate within an often price-driven category. The emotional response was measured with a nonverbal measure of emotion (AdSAM), while open-end questions were used as follow-ons to identify specific factors triggering or contributing to the feelings. Questions included:

How did you feel about your overall experience during your most recent car rental with (brand)? What specifically made you feel that way? (open-end)

Now, thinking about a time when a car rental experience exceeded your expectations, how did that make you feel?’ What specifically made you feel that way? (open-end)

Thinking about a time when a car rental experience did not meet your expectations, how did that make you feel? What specifically made you feel that way? (open-end)

The analysis was composed of two phases: 1) specific brand experience comparisons and overall assessment of the emotional dynamics surrounding expectations and rental experiences; and 2) market segmentation based on emotional impact of rental experiences.

The nonverbal measure of emotion, AdSAM, used in the study measures emotions on three dimensions: appeal, engagement and empowerment (to see examples of the manikins go to www.adsam.com/survey). The nonverbal manikin measures the dimensions of emotions directly by having respondents select one graphic character on each of three rows (representing level of appeal, level of engagement and level of empowerment).

Lack of differentiation

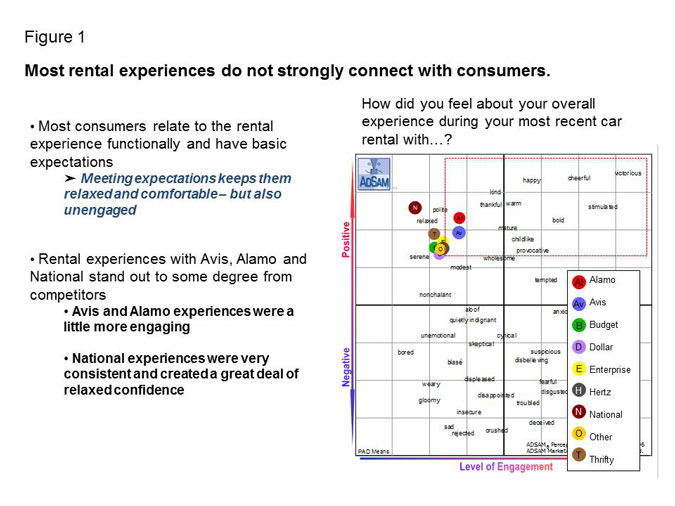

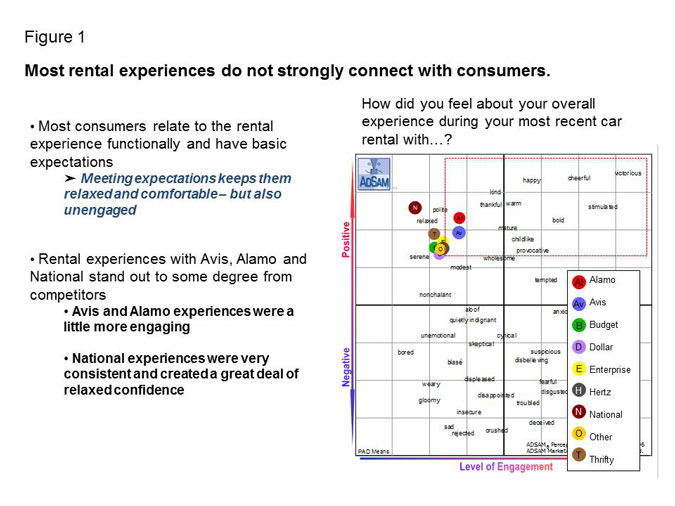

The first phase of analysis demonstrated the lack of differentiation between feelings about brands based on the actual rental experience and reflected a marked lack of engagement associated with the category. As long as expectations are met, the silent majority of customers may feel positively but the passive nature of their feelings indicates that marketers who stop there and only focus on level of appeal, or only focus on satisfaction, may overlook opportunities to strengthen engagement and hence, brand loyalty.

Being satisfied or having a “good” experience does not necessarily mean that customers have an emotionally gratifying experience, nor does it mean the experience helps to develop strong affinity or advocacy for a brand.

In the perceptual map showing the results for feelings about their most recent rental experience (Figure 1), the vertical axis represents levels of appeal, from very negative at the bottom to very positive at the top. The horizontal axis represents engagement, ranging from very unengaged on the left to highly engaged on the right. The level of empowerment or control the respondent felt during the experience is depicted by the size of the mean response dot. A larger dot reflects higher feelings of empowerment or control, a smaller dot reflects lower levels of these feelings. In the car-rental example shown here, all of the dots are the same size, indicating uniform levels of empowerment or control. The adjectives in the space are derived from the modeling database. Each emotion adjective has a measured appeal, engagement and empowerment score to define it. The emotion adjectives are used as frames of reference on the map to describe the types of emotions that exist in the specific areas of the emotion space.

As can been seen in the map, none of the rental car brands strongly engage or empower consumers, although the rental experience with the brand is positive. Specific feelings evoked among the majority of renters for each brand include subdued, consoled, modest and reserved. These feelings are not particularly rewarding or high in engagement or empowerment and are largely a result of fundamental expectations being met (e.g., the car being ready, having a “good” car, not experiencing any problems/everything going smoothly, receiving good service).

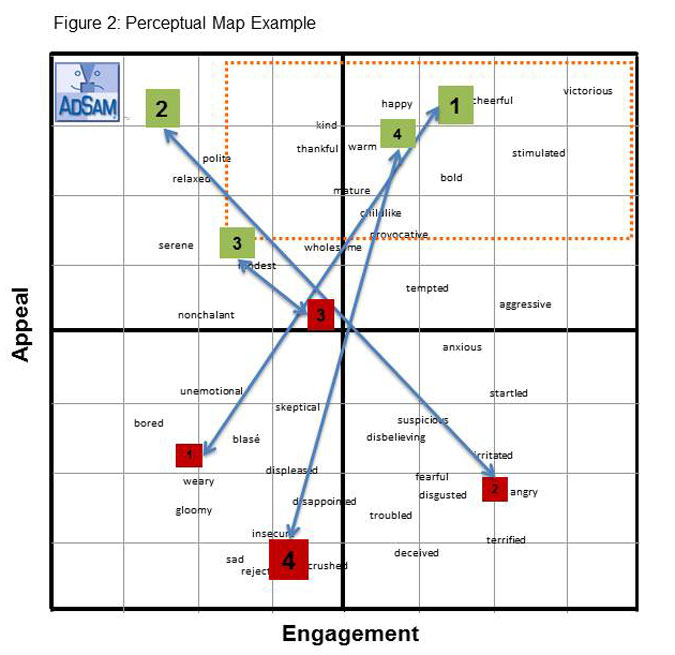

Digging deeper, the second component of the analysis evaluated the emotional dynamics of experiences that exceeded expectations and experiences that did not meet expectations and then incorporated the results into a segmentation approach. Four segments were identified by computing and analyzing differences between the type of emotional gratification renters receive from an experience that exceeds expectations and the type of emotional impact an experience that does not meet expectations elicits. Segments were then profiled by demographic and attitudinal variables related to car rental.

The perceptual map in Figure 2 shows the differences between each segment’s mean feelings when a rental car experience exceeds expectations (green squares) and when the experience does not meet expecations (red squares).

Although smaller in market size, Segments 1 and 4 represent the greatest potential for developing brand advocates through experiences that go above and beyond expectations. On the flipside, the greatest risks to a brand come from not delivering on expectations to Segments 2 and 4. Understanding the emotional dynamics and characteristics of each segment can provide direction for operational emphasis, loyalty and retention programs and marketing communications.

Segment 1: “Delight Me”

(11 percent)

This group is thrilled by unexpected upgrades and surprise VIP treatment. This segment is the most motivated and empowered by experiences that exceed expectations. The car is a key driver of their emotional gratification. Experiences that exceed expectations make them feel victorious, triumphant and alive – feelings that reflect receipt of motivating benefits. For these consumers, reinforcing the value or reward of their rental experience (e.g., nice car, great price, feeling appreciated as a customer) and having clear contracts and documentation are things that can make them feel empowered. Moreover, they are delighted by unexpected upgrades, proactive customer appreciation (e.g., extra gas money if they have to wait) and being made to feel special. When this group’s expectations are not met, they become saddened and emotionally disengage. Empowerment significantly diminishes.

Older, dirty or unreliable cars are key drivers of disappointment and leave these renters feeling cheated. Customer service representatives who do not take responsibility for issues greatly sadden them and turn them off to the company. The passive nature of these feelings indicates that these renters are more likely to quietly reject a company rather than voice their dissatisfaction.

A key to connecting with this group is to make them feel rewarded, not taken advantage of. This segment is more likely to consist of women, ages 35-64, who are college-educated. Psychologically, they are security seekers who are driven by the need to feel safe and in control.

Segment 2: “Put Me In Control”

(56 percent)

This group needs to be in control and empowered. For Segment 2, experiences that exceed expectations keep them relaxed and secure rather than excite and engage them, thus they are difficult to develop into advocates. This group wants to be treated with respect and to have few worries. Anything that makes the process easy, pleasant and efficient resonates well with them and elicits relaxed, untroubled, secure, protected feelings. Counter-bypass privileges or procedures and professionalism that get them in and out with no hassle reinforce emotional gratification.

Of greater importance to pay attention to is the fact that these consumers actually feel betrayed and disadvantaged if a rental experience does not meet their expectations. Experiences that do not meet expectations make them lose their sense of security and control, eliciting intense negative, low empowerment feelings (aggravated, stressed and horrified) that can do damage to a brand.

Not having the car that they reserved available creates a great deal of stress; while long waits, rude associates and unexpected charges cause aggravation. The intensity of their negative feelings is a good indicator that they will actively share their experience with others (negative word-of-mouth) and will be unlikely to rent from the company again. This group consists of more men than women, is better-educated and indexes higher as thinkers who are curious and have some drive for power and status.

Segment 3: “I’m Indifferent and Don’t Really Care”

(23 percent)

Segment 3 is largely apathetic about car rentals and shows the least difference emotionally between a rental experience that exceeds expectations and one that did not meet expectations. Many of these renters have never had a rental experience that they believe exceeded their expectations and are mostly ambivalent (aloof, cynical) about a situation that does not meet their expectations. In fact, because of their vanilla expectations, many have not had an experience that did not meet their expectations.

Although they are difficult to engage through the rental experience, these renters do look forward to being treated well. Courteous, friendly service can warm them; however, they are some of the most difficult consumers to move because of their general apathy.

Upgrades and gifts reinforce feeling of power and status, while having their “name in lights” (counter bypass) signifies to them they are important, which can help build some affinity. This group consists of more men than women, skewing either under-35 or 50-64, with bachelor’s degrees. Psychologically, they are status seekers who are driven by status and having a position of power. Rental experiences, however, do little to either strengthen or diminish their feelings of empowerment.

Segment 4: “Don’t Reject Me”

(10 percent)

These renters have strong expectations and can be demanding. They want to be taken care of. Exceeding expectations can pay off well because these experiences excite and motivate, often coming across as a pleasant surprise (surprised, amazed, excited, cheerful). Customer service plays a substantial role in creating the emotional engagement. However, many of these consumers become dismissive (unimpressed, bored, unexcited, uninterested) and may write-off a company when an experience does not meet their expectation.

Another one-quarter feels enraged, angry, hostile or disgusted, which can spell trouble for a brand. Avoiding mistakes and keeping things on the level is the key to connecting with this group.

Segment 4 predominantly consists of women, ages 35-49, who hold a bachelor’s degree or have some college, earning $25,000-$75,000. Psychologically they are traditionalists who have a strong sense of right and wrong but want to be cared for rather than be strongly independent.

Offers multiple benefits

Emotional responses are an integral part of the consumer experience. Understanding the emotional dynamics that occur, whether during interaction with a product, in response to marketing communications or other experiential situations offers multiple benefits to marketers. All too often, however, this important variable goes missing from market research studies because of lack of understanding of emotions and what should be measured, because some may consider it to be a more “qualitative” analysis or because emotion is not deemed to play a role in decision-making for the particular product or in response to particular types of messages or communications vehicles. Nothing could be further from the truth.

Evidence from multiple disciplines, including neuroscience, psychology and marketing research shows that emotional response plays a central role in decision-making. Even emotions such as indifferent or stoic provide insight into what is going on with a consumer. Understanding the character and nature of emotions and efficiently measuring emotional response is a key component to effectively leveraging the insights within a marketing context.

As the importance of measuring emotional reactions in many different marketing contexts becomes more and more apparent, researchers seek an effective and useful scale that captures the full dimensionality of emotions. Some have attempted to devise checklists of emotions that consumers experience when they encounter brands, communications or other marketing touchpoints (Aaker, Stayman and Vezina, 1988; Zeitlin and Westwood, 1986). However, it is difficult, if not impossible, to create an exhaustive list of the full spectrum of emotions that products and marketing strategies generate. Furthermore, the large number of emotions or emotion clusters on these lists makes them unwieldy for research purposes (Nabi, 2010). In our view, a three-dimensional nonverbal measure offers a simple, reliable means of capturing the complexity of emotional responses and yields robust insights.

Completes the understanding

It is clear that determining how someone feels when you know what they are thinking about completes the understanding of behavior. This feeling, although complex, is best and most easily understood by segmenting it into the three key determinants: appeal, engagement and empowerment. Marketers who incorporate emotional response as a key measure can unlock a more complete understanding of what goes on in both the hearts and minds of consumers.