A temporary outage?

Editor's note: David C. Lineweber is managing director of YouGov America, a Portland, Ore., research firm.

Many electric and gas utilities in the U.S. have been talking to their residential customers about the value of energy efficiency for more than 20 years now. Part of this communication has been to explain the notion of energy efficiency and to persuade customers that more efficient appliances really do save energy – and money – over time. Beyond this, they have also needed to explain that higher energy efficiency is really good for everyone, in large part because it reduces the need to develop new sources of electricity generation.

Over that same time period, utilities have also offered customers a number of direct financial incentives that were designed to encourage customers to acquire those more efficient appliances when they added or replaced appliances or implemented other energy use measures that would help them to reduce their use of electricity and natural gas. Chief among these incentives have been a series of rebates that were designed to reduce the total purchase price of energy-efficient appliances, light bulbs and other, similar measures.

Recently, however, some U.S. utilities have begun to notice a number of things about these marketplaces:

-

While many customers choose to adopt higher-efficiency appliances, it is still the case that not all do so and it has been increasingly difficult to change the behavior of those who resist such measures.

-

At the same time, the customers who adopt higher-efficiency appliances (and who use utility-provided rebates to do so) tend to do so over and over again with each new appliance they purchase.

-

More and more residential customers are saying that they are “doing all that they can already” to effectively manage their energy use and to be as efficient as possible in their use of energy.

The clear implication here is that this may be (at least in some parts of the country) a maturing market for energy efficiency. Many customers believe in energy efficiency in a fundamental way and make purchases – and take day-to-day actions – that are consistent with those beliefs. While many of these customers use utility rebates to reduce the cost of energy-efficient purchases, those rebates may no longer be necessary for this population (since they would have purchased the higher-efficiency options even without the rebate). Alt ernatively, there is a group of people who, for some reason, tend to resist the pursuit of energy efficiency objectives or simply do not have the resources to do so.

ernatively, there is a group of people who, for some reason, tend to resist the pursuit of energy efficiency objectives or simply do not have the resources to do so.

Explain the value

Historically, the approach that most utilities have taken to marketing energy efficiency has been on what might be called education – attempting to explain the value of energy efficiency and the value of utility programs in helping customers to achieve efficiency goals. Perhaps, however, simple education is no longer enough and a revised approach that recognizes the different situations that customers are in would be more appropriate at this point. Let’s look at the data and explore some new options.

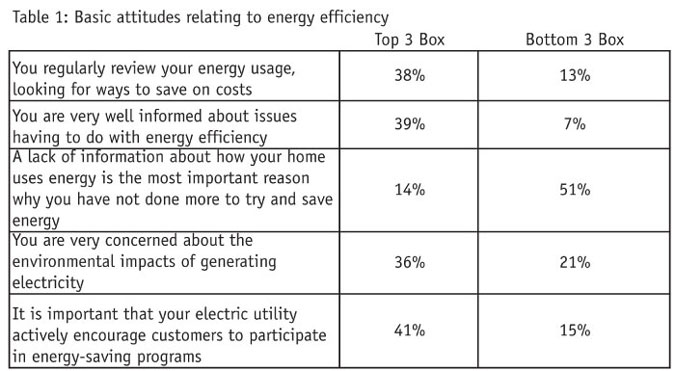

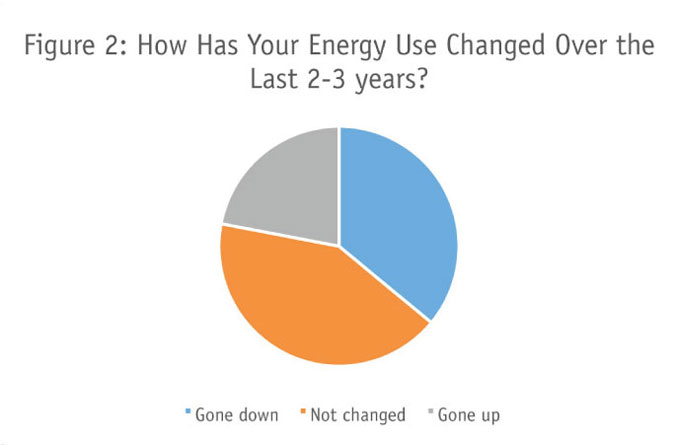

Table 1 reports some basic attitudinal information for electric utility customers in a group of Western states (including California, Oregon, Washington, Colorado and Arizona) that have been actively promoting energy efficiency for many years – in some cases for more than 25 years. The table reports the proportion of respondents from a survey conducted in late 2012 that rated each item as top three-box (8-10) or bottom three-box (1-3) for a selected set of attitudinal measures. (The survey was sponsored and conducted by YouGov America and included 600 U.S. adult heads of household who were directly billed for electricity service.)

The takeaway here is that a plurality of customers say that they care about, and are informed about, energy costs and energy efficiency. Most of these customers also tend to believe that their utility should be promoting energy-efficiency programs, while only a small percentage (14 percent) say that a lack of information inhibits their ability to be energy efficiency in their own home.

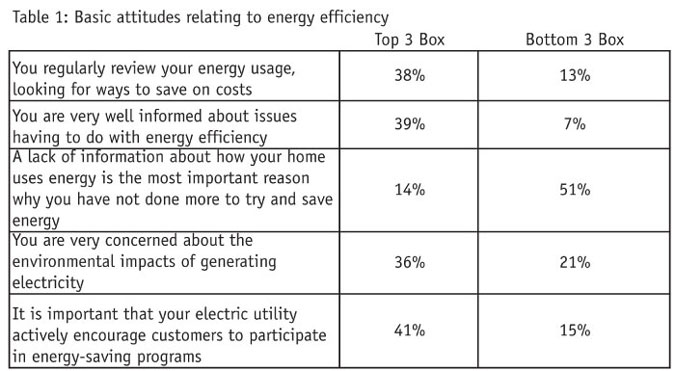

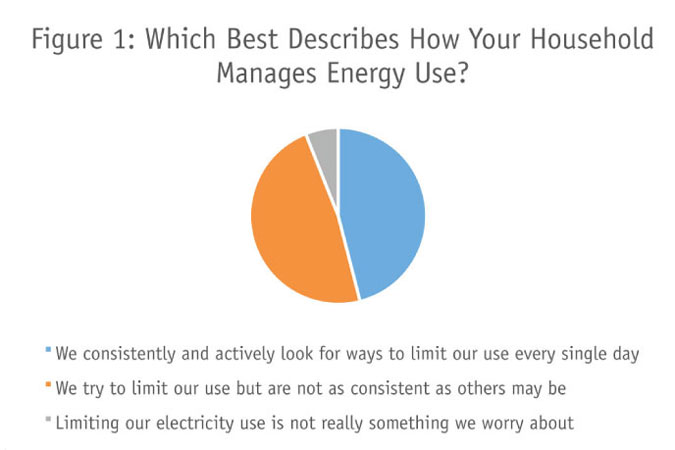

But how do these attitudes translate into behavior? In Figures 1 and 2, we see that nearly half of these customers say they “consistently and actively” look to reduce their energy use every day, while almost no one says that limiting energy use is not really something they worry about. As a consequence, most customers report that their energy use has either gone down – or at least not changed – over the course of the last two-to-three years.

Still an open question

While customers claim so far that they are already doing a good deal to pursue energy efficiency in their day-to-day lives, there is still an open question about whether they will purchase energy-efficient appliances on their own in the future.

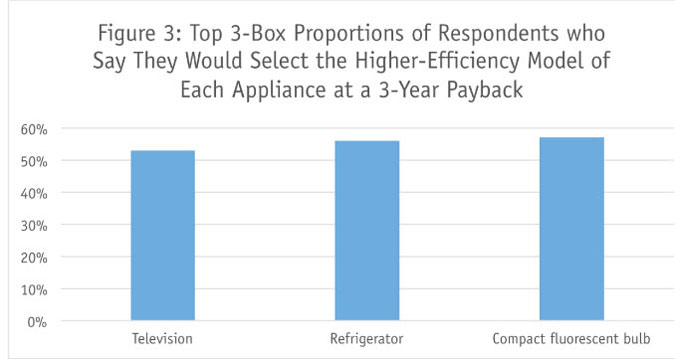

Figure 3 reports top three-box responses for questions around the likelihood that respondents say that they would actually choose to purchase a more energy-efficient version of an appliance. For these questions, survey respondents were told that they could purchase the more efficient model of each item at a higher cost or a standard-efficiency version of each appliance at a lower cost. With the inclusion of a utility rebate, the higher cost of the more efficient option would be recaptured in no more than three years.

As Figure 3 suggests, the findings are quite similar across different electric end uses. In each case, whether for major appliances or compact fluorescent bulbs, just over half of respondents say they would purchase the more efficient option if the payback was more than three years.

But realistically, do utility rebates really change customer behavior? Would the people who say they would purchase the more efficient options still make that decision even without the rebate? There is at least some evidence to suggest that this is true. In other questions, we found that – among the people who had received a utility rebate for purchasing a more energy-efficient appliance – only 24 percent said that they bought something different than they had planned to buy in order to receive the rebate. Most of the people who receive energy efficiency rebates, in other words, do not appear to require those rebates in order to purchase the more efficient appliance options. They would, for the most part, have probably purchased them anyway.

What’s going on?

So, given all that utilities have done on this issue, and all of the other changes that have gone on in other contexts that might affect customer choices in this category, what appears to be going on in customer thinking about energy efficiency?

-

A plurality of customers say that they care about their energy use and believe that their utility should be encouraging customers to be more energy efficient.

-

Most also say that information about energy efficiency is not a barrier to their actions in this category.

-

Most also say that they really do pursue energy efficiency on a day-to-day basis.

If all that is true, however, why do only just over half of customers say that they would purchase more efficient end uses if those products had a payback period of three years? Should utilities continue to work on creating more awareness of the benefits of energy efficiency or is some other tactic appropriate at this point?

Additional data from our survey points to two issues that are contributing to the less-than-overwhelming adoption of energy-efficient end uses, neither of which can be addressed by building more “awareness.”

1. The absolute cost of higher-efficiency options. The reality is that in this age of fast-food dollar menus and slow economic recovery, many U.S. households are still facing very constrained financial situations. Consistent with this fact, in response to an open-ended question in our survey about reasons why their household has not taken more actions to be energy efficient, for example, the most common answer by far was “inadequate funds.”

As a result, at least for some portion of the population, as long as there is some incremental cost in the near term to adopting more energy-efficient options, those options will be off the table. The implication for utilities here is probably obvious. Offering rebates or other incentives that “buy down” payback periods to three years, or even one year, will not be sufficient. Until more efficient options are equivalent in cost to the options that these customers would otherwise select, then these more price-sensitive customers cannot be expected to select the more efficient options.

2. The impact of political ideology. It is also important to recognize that some customers simply do not support the adoption of more energy-efficient technologies, especially for reasons associated with environmental impact. It is not the case that these customers see themselves as less informed about these issues; quite the contrary. They simply do not believe in the importance of energy efficiency or its environmental benefits.

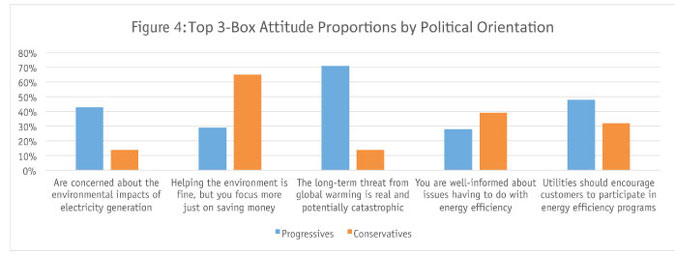

As Figure 4 suggests, when we parse customers into broadly liberal/progressive and conservative groups, based on their expressed political preferences, we find that these groups differ significantly on their attitudes on these issues.

Conservatives, not surprisingly, are less likely than progressives to be concerned about the environmental considerations that progressives typically see as some of the primary reasons to pursue energy efficiency. This is not because conservatives are less informed on these issues, however. In fact, conservatives are more likely to rate themselves as better-informed on energy efficiency.

Consistent with these attitudes, conservatives are also, on average, 20 percent less likely to say that they would adopt a variety of – higher-cost – energy efficiency measures at the three-year payback we tested. A total of 65 percent of progressives, for example, say that they would install a compact fluorescent bulb, given a three-year payback, while only 43 percent of conservatives indicate that they would take the same action.

Taking reasonable steps

While there is clearly some additional room for increasing customer awareness of the potential benefits and value of energy efficiency, it may be the case that – at least in more mature energy markets – the portion of the customer population for which these are real gaps is small. In fact, most customers think that they are reasonably well-informed about these issues (whether or not their assessment is accurate) and they also believe that they are taking reasonable steps to actually be energy efficient.

This is not true for everyone, however, but at least for some of the groups that are not as focused on energy efficiency, more education is not likely to make much of a difference. For those with very restricted budgets, the bottom line is that highly energy-efficient options that have even small cost margins over viable alternatives are not going to be acceptable. Unless utilities, or other market actors, can reduce the differential cost of more efficient end uses to zero, then adoption of these options within the very price-sensitive segment is likely to be very limited.

Additionally, education is not likely to change the view of conservatives on the value of adopting more efficient end uses. The issue is not that they are unaware of these options; rather it is more the case that they simply do not see the value in adopting those measures (in particular, they do not see much value in the claimed environmental benefits of energy efficiency). In order to win over this group to implementing higher-efficiency options, utilities will likely need to focus on more hardcore cost savings assessments – demonstrating clearly that energy efficiency investments make sense because they can save people money – and without resorting to “softer” societal benefits.