Editor’s note: Emma Diehl is content writer and engagement writing specialist at research firm CivicScience, Pittsburgh.

The first time I encountered a TiVo, I felt as though I had discovered time travel. No more hurrying back after class for a show, no more staying up too late for an episode. You could reserve time to catch your favorite program with the simple “bloop” of your remote.

The DVR has no doubt transformed the way we watch television. From watching live to watching two weeks later, DVR use has posed a challenge to networks and advertisers alike. With this technology, how have our viewing habits changed and how can we learn from them?

When looking into this question, I used data collected from a CivicScience study that asked the question, "When you record a TV show or movie on your DVR, how long do you typically wait to view it?" The study received 5,119 responses from June 16, 2016 to July 7, 2016. Respondents voluntarily opted-in and their answers were anonymous. All results were weighted according to the U.S. Census figures for gender and age, 18 and older.

Forty-nine percent responded that they do not watch recorded programs, which could be interpreted that they watch TV exclusively online or they simply watch all TV live. After removing those who don’t use DVR at all we get a better look at DVR users on their own. Overall, the majority, 58 percent, watch content between one and three days after recording, while 18 percent wait more than a week to watch recorded shows. The 33 percent who wait a week or more might be saving multiple weeks of content so they can binge a show all at once.

Age and household size

Age is a great predictor of how soon people watch recorded programs. Generally, the older you are, the less likely you’ll watch a show while it’s recording.

Conversely, 61 percent of viewers under 18 said they never watch recorded programs. Forty-three percent of Gen Xers responded similarly. The viewership curve fell evenly – 36 percent of those who use a DVR said they watch the recording two or three days out.

Household size can also predict viewing habits. The bigger the family, the faster you watch. Thirty percent of households with four or more people reported they will watch a show as it’s recording. With more people in the house, I’m sure viewers rush to watch a show before it’s deleted.

Results showed that married couples tended to watch a show between four to seven days after it’s recorded. Single people reported being more likely to watch something as it is recording, making up 46 percent of the response group.

Gender

Men and women have somewhat different viewing habits. The study showed women were 22 percent more likely than men to watch a show while it’s recording. However, men were 22 percent more likely than women to watch a show within a day of its recording.

Among those who never watch recorded programs, it’s split 50/50.

Income

Perhaps most surprising is the correlation between income and viewing habits. Twenty-four percent of households with incomes less than $25,000 a year said they have never watched recorded programs. In the $150,000-and-over bracket, the results showed households record shows and tend to watch within three days. Only 9 percent of the high-income respondents have never watched a show recorded on their DVR.

Primary viewing patterns

Predictably, many of the findings revolved around how and with what device people consume media.

The survey revealed viewers who primarily watch TV via online streaming were much more likely to watch a DVRed program as it is recording and were much less likely to watch live TV at all. For those who wait at least one day to view a recorded program, roughly 42 percent said they primarily watch TV live.

The period of time between recording and watching also plays into whether respondents said they watched programs with a streaming device, like a Roku or Google Chromecast: The longer you wait, the less likely you are to own a streaming device. Those who watch something as it’s recording were more likely to watch Netflix at least once a week.

Heavy TV viewers – people who watch four or more hours of TV a day – were the largest segment of those who watch a show as it is recording. People who watch less than two hours of TV a day said they were more likely to wait between four and seven days to watch something.

What about network preferences? Patterns emerged among age groups. CBS fans said they were twice as likely as ABC/NBC fans to say they never watch recorded programs. This is very much related to age, as CBS viewers skew much older than both NBC and ABC viewers.

There’s also an interesting divide when it comes to which cable provider people use. The study showed that Comcast subscribers were 50 percent more likely than Time Warner/Fios users to watch a program while it records. In addition, Time Warner customers were more likely to watch a program after a day, while Fios customers were likely to wait between two and seven days.

Viewing habits

Passionate TV viewers don’t wait for spoilers on social media. They were more likely to watch a show as it’s recording. I have friends who watch Game of Thrones live on Sunday night to make sure they can get in on watercooler chatter Monday morning at the office.

For those engaged in social media, live TV can be an opportunity to interact with fellow fans, or cast members, as most successfully exemplified by television produced by Shonda Rhimes. Live-tweeting has become a great way for networks to engage with viewers in real time.

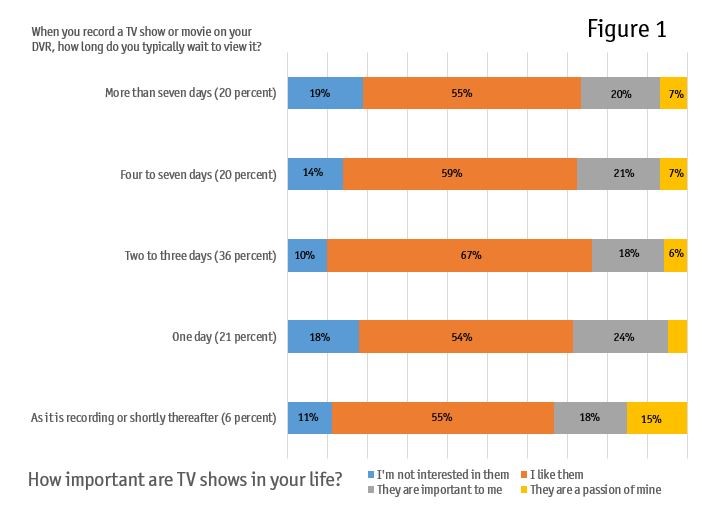

Viewers who love TV were the most likely to say that they wait two to three days to watch (Figure 1). If a viewer is watching the show as it records or shortly after, they’re more likely to be distracted by a second screen.

Advertising to DVR users

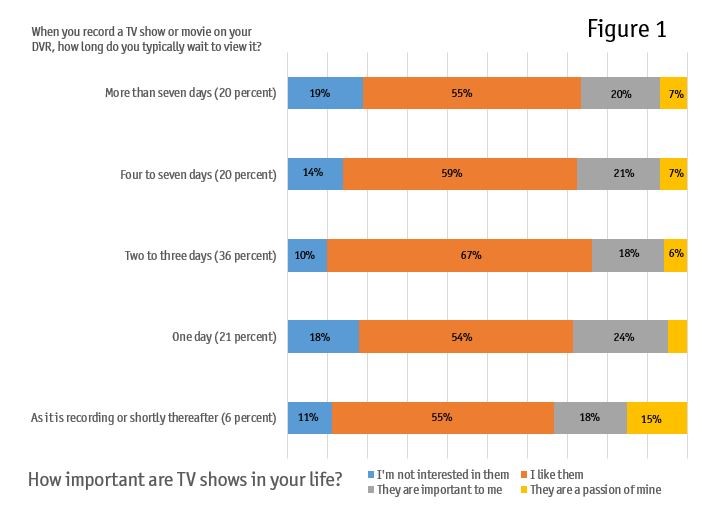

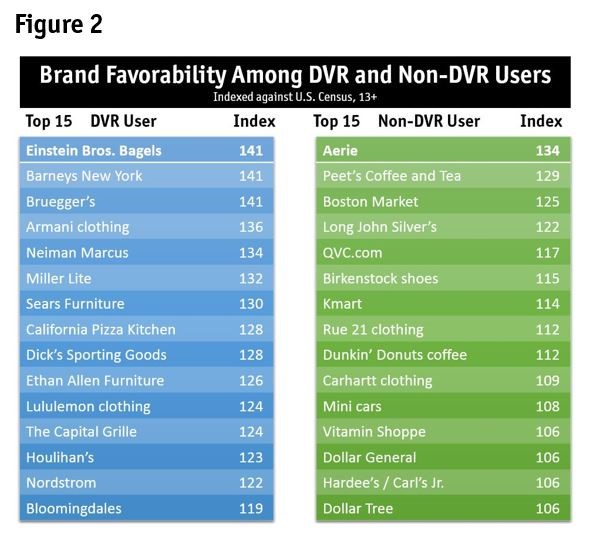

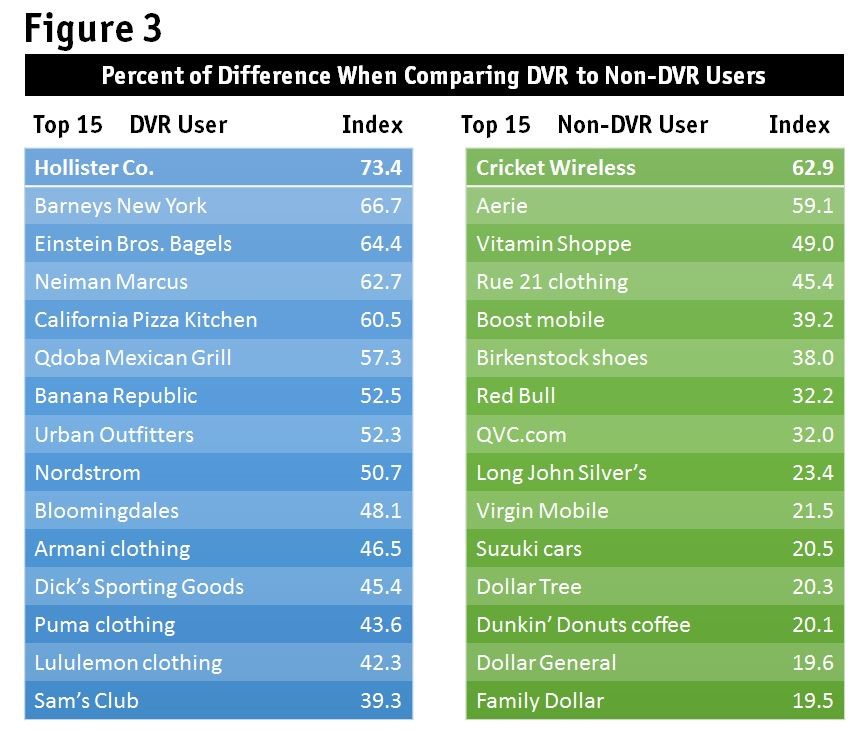

When it comes to viewing behavior of customers, are some brands wasting their time advertising to DVR users? Using study data, the team compared DVR users to non-DVR users against over 200 brands in our database, then indexed favorability. Figure 2 shows the 15 top brands for DVR and non-DVR users.

Breaking it down even further, we compared the percentage difference across the two segments (Figure 3). For example, fans of Hollister Co. were 74 percent more likely to be a DVR viewer, while fans of Cricket Wireless were 63 percent more likely not to be a DVR viewer.

What does this data tell us? DVR users trend toward high-end or quality luxury brands. To contrast, many of the non-DVR user brands were smaller and known for price and value. This lines up with the earlier data that higher-income households were much more likely to watch programs using a DVR.

Based on viewing habits, some brands could get a better bang for their buck by purchasing media other than a 30-second TV commercial. The DVR isn’t the end of TV advertising but brands should take notice of consumer behavior to maximize the impact of their advertising dollars.

Data source: CivicScience