When opportunity calls

Editor's note: Lisa Holmes is senior survey analyst in the Chicago office of research firm Euromonitor International.

The role that mobile phones now play in the lives of many consumers worldwide is one of the most significant trends impacting brands and retailers today. Smartphone features and constant Internet access allow shoppers to research, compare and buy nearly any product or service from anywhere at any time.

Nowhere is the impact of mobile technology more apparent than among the many smartphone owners in emerging markets. While BRIC markets have long been a focus for retailers and brands hoping to share in the recent economic success of consumers in these countries, Indonesia stands out as a prime emerging market opportunity for companies targeting mobile consumers who are ready to engage and shop on their smartphones.

Over the past several years, smartphone sales have skyrocketed among Indonesian consumers. According to Euromonitor industry data, the number of smartphones purchased in Indonesia grew by nearly 600 percent from 2010 to 2015 and is predicted to grow an additional 81 percent by 2020. Indeed, many Indonesians are skipping more traditional technology such as laptop computers and going straight to smartphones, which are expected to be found in 71 percent of households by 2016 (compared with only 19 percent of households expected to have laptops).

Smartphones play a critical role in the lives of mobile phone users in Indonesia, who regularly turn to their phones for, on average, at least 18 separate activities during their day-to-day life. This heavy reliance on mobile technology shows no sign of slowing as access to smartphones continues expanding among Indonesian consumers and current owners broaden their usage of smartphones into more and more areas of life. In light of this expansion, it is essential that brands and retailers move quickly to ensure that their own mobile presence and marketing efforts align with the current and future habits of this target market.

In December 2014, Euromonitor International surveyed 8,100 online consumers in 16 countries, including Indonesia, about their use of technology in everyday life and integration of technology into shopping. In this article we draw on these survey results to explore the role that mobile technology plays in the lives of Indonesian smartphone users, focusing in particular on how this segment uses their mobile phones for shopping activities and how brands and retailers can develop stronger strategies to reach this growing set of consumers.

A perfect example

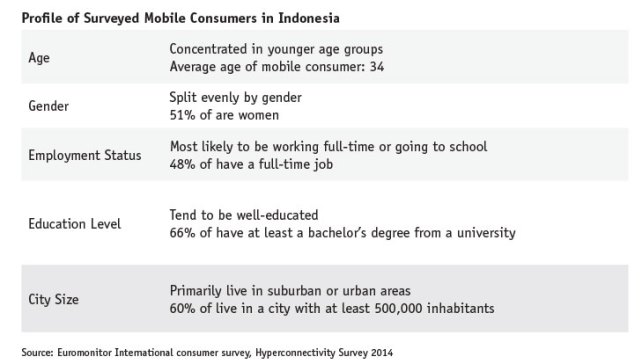

For multinational brands and retailers, one of the most appealing features of many emerging economies around the world is their growing populations of young, educated consumers with disposable income. Among our survey respondents, mobile consumers in Indonesia are a perfect example of this type of growing consumer segment: they tend to be young, employed full-time (with money to spend) and living in urban areas within easy reach of both physical and digital advertisements and marketing campaigns (see table).

Not only do mobile consumers in Indonesia share many of the key demographic and economic traits that are so appealing to brands and retailers, they are also among the most active on their smartphones and, therefore, among the easiest to reach across the markets surveyed. Mobile consumers in Indonesia turn to their smartphones for more activities than their peers in almost every other country surveyed. Indeed, mobile consumers in Indonesia rely on their phones for more activities than they do on their laptops or desktop computers.

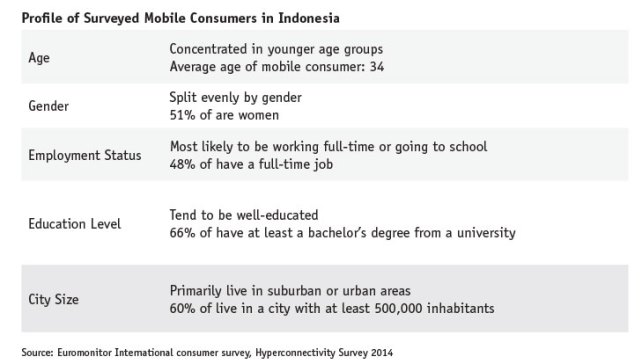

Figure 1 shows the common smartphone activities of mobile consumers in Indonesia. Many of these activities are social; whether using a communication app such as the hugely popular BlackBerry Messenger, WhatsApp and Line apps, updating a social media profile on Facebook or sending an e-mail, mobile consumers in Indonesia rely on their smartphones as a means to stay connected with their friends and family. Capturing and sharing moments are also common smartphone activities for this group; 89 percent regularly take photos with their phones and 76 percent use this mobile technology to record a video.

Because they rely on their smartphones in so many areas of life, it is only natural that mobile consumers in Indonesia turn to their phones when deciding what to buy, whether to read product reviews, write their own user review or purchase an item or service. Sixty-seven percent regularly use their smartphones for shopping-related activities. Below, we explore this use of mobile technology while shopping in greater depth.

Rely heavily on their smartphone

Once a mobile consumer in Indonesia has decided to begin shopping for a particular item or service, they rely heavily on their smartphone for information, reviews and price comparisons. This reliance is particularly significant when these consumers are shopping for products with higher price tags that typically require more consideration before buying. For example, nearly half of mobile consumers in Indonesia turn to their smartphones to get product information and compare prices when shopping for electronics and appliances. In comparison, reliance on mobile phones to gather information before buying everyday purchases such as household essentials, including groceries, is much lower; only one-third of mobile consumers in Indonesia turn to their smartphones to research these common products.

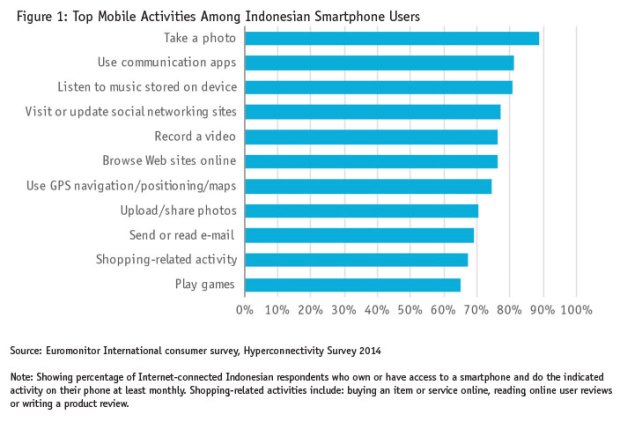

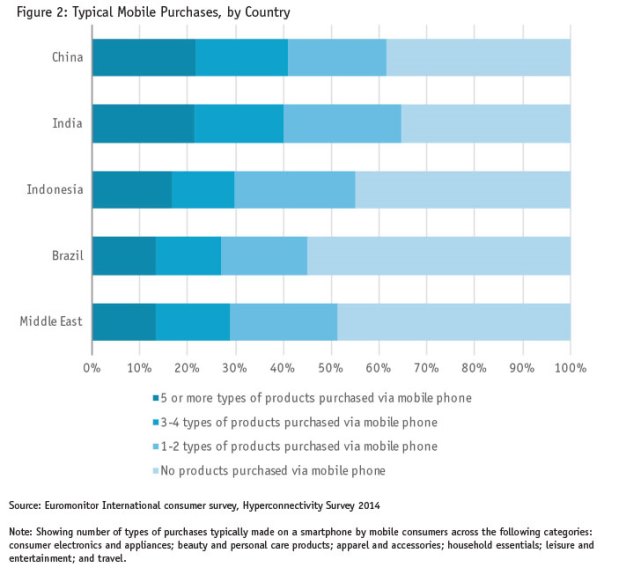

After researching a potential purchase and evaluating their options, mobile consumers in Indonesia frequently continue relying on their smartphones to buy (Figure 2). Even compared to mobile consumers in other emerging economies, smartphone users in Indonesia are among the most reliant on mobile purchasing features: over half turn to their phones to make regular purchases across at least one product category. Furthermore, 17 percent of mobile consumers in Indonesia use their smartphones to buy products across all categories surveyed, hinting that mobile shopping will continue to become more common for these tech-savvy shoppers as more and more retailers optimize their online shopping platforms for the mobile experience.

First to incorporate new technology

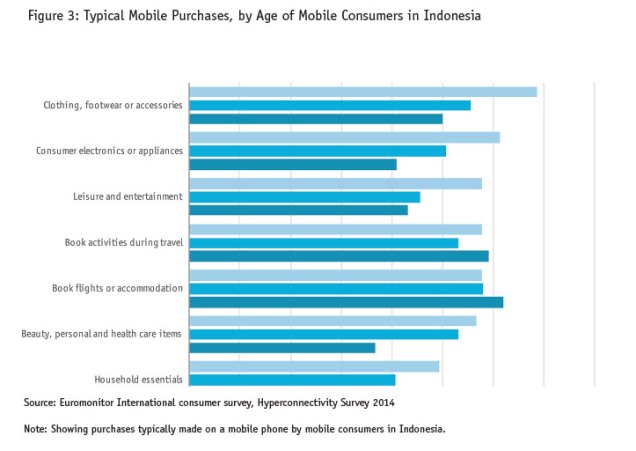

Smartphone-buying habits among mobile consumers in Indonesia reflect broader trends in new technology adoption seen throughout the globe (Figure 3). Namely, younger consumers tend to be the first to incorporate new technology devices or capabilities into their everyday lives. In this case, we see that mobile consumers in Indonesia under 30 are the most likely to use their smartphones to buy products across many different categories. Mobile consumers in older age groups, particularly those over 45, lag behind in these mobile shopping habits, perhaps because they are less comfortable using the full range of features that their smartphone provides.

Notable exceptions to this age trend, however, are travel-related mobile purchases. Travel activities, flights and accommodations rarely require a customer to examine in person before purchasing and many shoppers are taking advantage of their ability to buy at any time from anywhere on their phone to book while already traveling. Roughly the same number of mobile consumers in Indonesia across all age groups rely on their smartphones to make travel-related purchases.

Regardless of the product they are buying on their phone, mobile consumers in Indonesia tend to stick to three main payment platforms. Two-thirds use some combination of traditional Web sites, mobile-optimized Web sites and mobile apps, while only one-third have experimented with paying via a social media platform and even fewer use mobile messaging or text to pay.

Vast opportunities for retailers

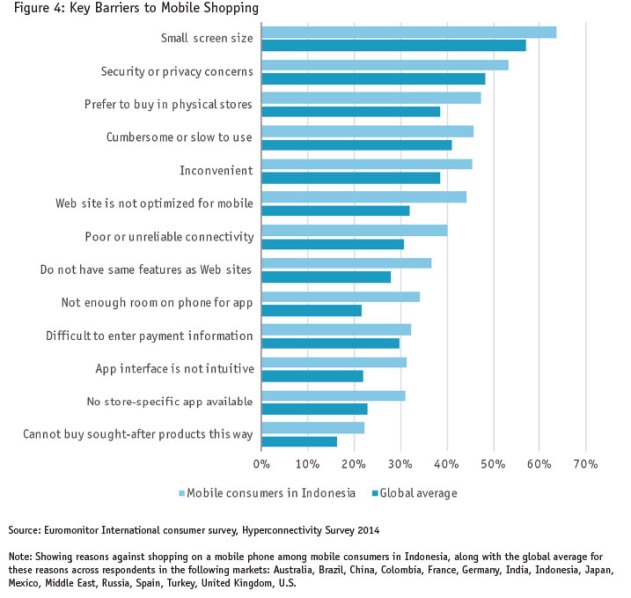

Although many mobile consumers in Indonesia take advantage of their smartphone’s shopping features, there remain vast opportunities for retailers to expand their sales with this segment by removing key barriers to mobile shopping. Indeed, we see that mobile consumers in Indonesia are more likely to face a broad number of barriers than their Internet-connected peers in other markets.

At the top of this list is concern over small screen size: 64 percent of mobile consumers in Indonesia report that small screen sizes prevent them from making more purchases on their smartphones (Figure 4). This may be a particular pain point for the many Indonesian mobile consumers who use BlackBerry smartphones, often with built-in keyboards that limit screen size. While the industry trend toward larger screens and phablets may diminish this concern in the future, it is essential that retailers continue to optimize their mobile shopping platforms to make it as easy as possible for customers to buy using a small screen. Apps that remember a shopper’s payment information and past purchases may also help make mobile buying easier on a small screen. However, size concerns are closely followed by security and privacy fears among Indonesian respondents, reminding retailers that not all of their mobile customers are yet completely comfortable sharing their payment and personal information via a potentially unsecure mobile Internet connection.

Improve their positioning

Beyond simply providing a new screen through which consumers can navigate to a retailer’s Web page and buy a product, mobile phones are perfect vehicles for both physical and digital retailers to connect with their customers. Even before a mobile consumer is considering a purchase, brands can improve their positioning with a strong social media presence, enabling both passive and active interactions with potential customers. Tech-savvy retailers are now also using mobile marketing, targeting customers based on their physical location with hyper-relevant promotions and incentives to entice them to buy while out and about. When customers are ready to make a purchase, in-store mobile payment technology allows them to pay without reaching for their wallet.

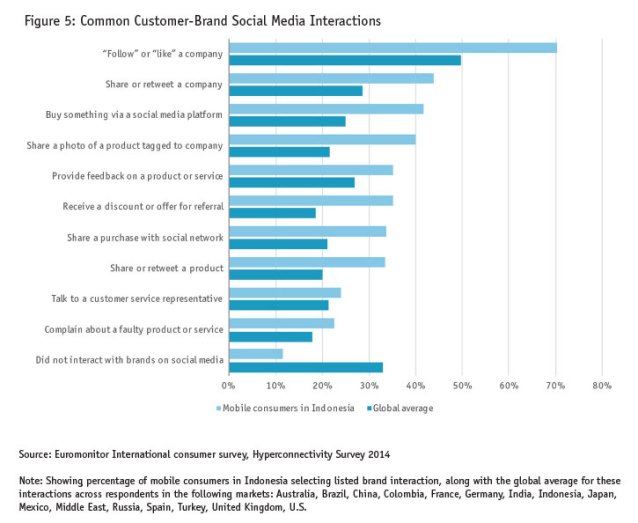

In an age when any shopper can easily read reviews from other consumers about a particular retailer or brand, it is critical that companies make themselves more accessible to potential customers, if only to stay in control of what is being said about them online. A strong social media presence can engender trust and strengthen brand positioning – but only if shoppers are willing to engage. Mobile consumers in Indonesia are particularly active in their interactions with brands on social media, with Facebook and Twitter standing out as two of the most common social media networks in the country. Seventy percent are at least passively engaging with brands by following or liking them on a social media platform (Figure 5). Other Indonesian mobile consumers take a more active approach and use social media to provide feedback on a product or share a purchase with their social network.

This high level of social media interaction means that brands and retailers can begin to build interest in their products with mobile consumers in Indonesia by reaching them through various social media platforms and piquing their interest in a potential purchase. Active social media interactors with brands can also become de facto advertisers when they share a purchase or mention a particular company to their social network. In order to facilitate these valuable word-of-mouth recommendations, brands should make it as easy as possible for their customers to share positive experiences on social media, whether a past purchase or a favorable review.

More convenient

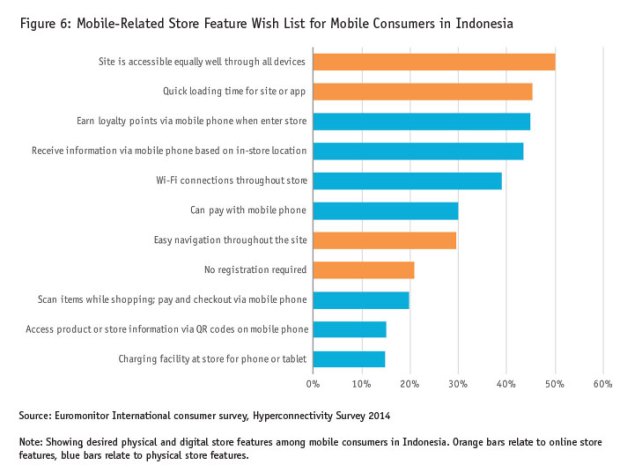

There are many strategies both digital and physical retailers can take to improve the shopping experience for mobile consumers in Indonesia. Most of the desired mobile-related store features for this segment revolve around making the use of mobile technology while shopping, whether in a brick and mortar store or online, more convenient than it is today. Indonesian smartphone users want options when shopping and look for Web sites, apps and platforms that are equally accessible (and usable) on all of their devices (Figure 6). In physical stores, these shoppers are looking for in-store technology that interacts with their mobile phone, whether by providing hyper-relevant product suggestions and information based on their location within the store or by allowing them to scan products and pay using their smartphone.

While there are many opportunities to engage with mobile consumers in Indonesia with apps and smartphone-optimized shopping platforms, the truly tech-savvy consumer is already looking for more ways for their smartphone to improve the shopping experience. Some of the most recent innovations are being implemented at the checkout line of brick-and-mortar retailers through in-store mobile payments, enabled through a physical interaction between the customer’s mobile device and some type of technology at checkout, such as a QR code scanner or NFC chip reader. In-store mobile payments have yet to gain widespread adoption but the potential is high in Indonesia. One-fifth of mobile consumers in this market report using in-store mobile payments at least weekly. Even further, 89 percent of mobile consumers in Indonesia who do not currently use in-store mobile payments are interested in using the technology in the future, particularly if the technology is verified as secure and can be accessed through an easy-to-use app.

Make it easy

There is no question that Indonesia is an important market for brands and retailers hoping to expand their mobile presence and engage with tech-savvy mobile shoppers. The most successful strategies to target this market will appeal to consumer desires for convenience and immediacy, two features that have become synonymous with smartphone activities. Companies that make it easy for customers to find transparent information about their products and make a purchase through any channel, whether via a mobile app, traditional Web site or in a physical store, will position themselves well to capture the growing segment of mobile consumers in Indonesia.