Editor's note: Laura Cusumano is a St. Louis-based marketing research consultant.

There is nothing new about the slow decline of qualitative research over the past 10 years. It has been driven by many factors: increasing costs in an environment with increasing demands on research budgets; the need to quantify market trends and behaviors in significant detail; fragmented target audiences in the purchase decision; markets with increasing complexity and segments; increased reliance on technology by researchers and respondents ... the list goes on and on. Even though it is slowly becoming a lost art, qualitative research still has an invaluable and unique role in many types and aspects of market research. One of its most impactful roles is to support and complement quantitative research.

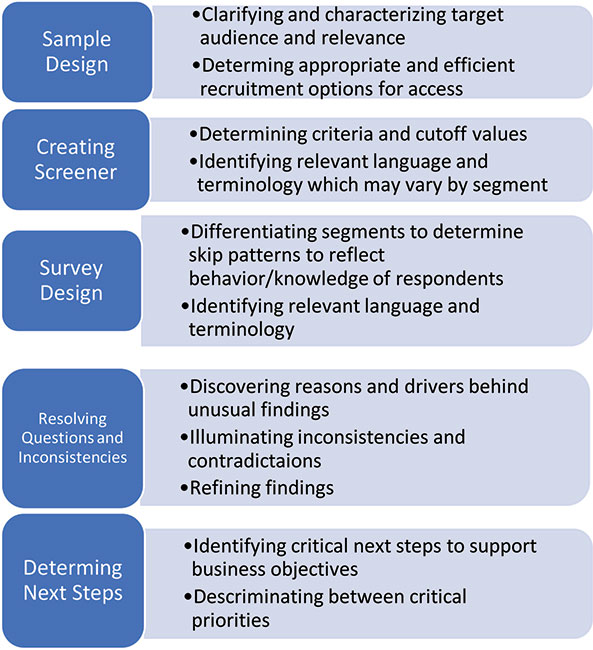

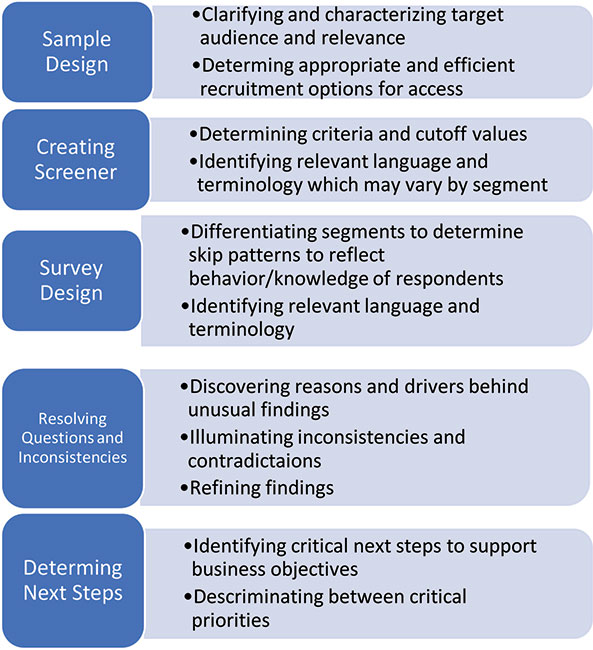

As shown in the accompanying chart, qualitative research can be intertwined with the quantitative process in several different ways and at different stages: methodology selection; sample design; screener development; survey design; resolving questions and inconsistencies; and determining next steps. There are several ways to exploit the value of qualitative direction and insight within each step of the process to direct, clarify, refine and optimize value.

Some quantitative firms see the need and value of the qualitative complement. They consistently integrate qualitative research into their studies. If they do not have the capacity in-house, they have established relationships with firms who do.

Unfortunately, many quantitative researchers are not using qualitative tools to complement their quantitative research. For example, why aren’t researchers building qualitative research into standard operating procedures of online research? The most common excuses are that doing so requires time and money. However, qualitative studies do not have ruin an already-tight schedule. There are many extensive panels available for recruiting respondents from even the most esoteric populations in a timely fashion. The cost does not have be significant as these qualitative samples are relatively small and the research is most commonly conducted using Web-assisted phone interviews which can be scheduled relatively quickly and with short notice.

In addition, most quantitative studies may only require one or two qualitative components integrated into the quantitative plan. Qualitative direction at various points in the quantitative plan does not have to be time- and cost-intensive. Generally, these qual components can be as small as 10 Web-assisted in-depth telephone interviews, depending on the number of segments and the complexity of the sample. Often the most useful and powerful input is from exploratory research before the screener is even drafted. These qualitative interventions can be essential in getting the online research right the first time.

The most sensitive barrier surrounding this issue may in fact be recognizing “We don’t know what we don’t know.” The inclusion of qualitative components requires we researchers and end-user clients acknowledge that we may have critical information gaps or misconceptions that could distort research findings. Yes, we are fallible. This can be compounded when a quantitative researcher has limited experience with, understanding of or comfort in the qualitative arena. In some circles, there is even a perception of a pecking order in which the quantitative researchers look way down to the second-class qualitative researchers and their contributions.

Sometimes, when a quantitative firm recommends integrating qualitative research to its client it can be seen as adding extra, non-essential work and expense; as a lack of understanding the market issues or as challenging the client’s market knowledge. Conversely, agencies can be hesitant to suggest qualitative research within the quantitative project for the very same reasons. Including qualitative research can be systematically considered, like pretesting and soft-launching online surveys, and not viewed as a lack of expertise or market intimacy on the part of the quantitative firm or the end-user client.

One last essential consideration is the design and execution of the qualitative research. It is important that it be truly qualitative and conducted with the same rigor as a standalone qualitative project. This is especially key when doing exploratory research prior to starting the online process. This research should go beyond a series of closed-ended or pre-directed questions and have some degree of iteration versus a strictly linear approach. The goal is to characterize and better understand the peg instead of forcing the peg into the preconceived hole.

Using a skilled moderator for this research is critical. Not all quantitative researchers are qualified or are interested in conducting the qualitative research. Selecting the right moderator, using the right tools and plan will provide valuable results to complement the quantitative research.

Even if the information and insights from the qualitative are of more of a confirmatory nature, the time and expense can be justified. After all, what’s the value of spending months and tens of thousands of dollars on a body of quantitative research that has missed some crucial market characteristic or dynamic that could have easily been recognized and integrated before fielding through the effective use of qualitative?