Editor's note: George Stephan is managing partner of Stephan Partners, a branding and digital marketing company, and founder of WebLife Research, New York.

Big data has been a hot topic for a few years now and as it grows ever larger – literally and figuratively – researchers are still trying to define the relationship between big data and marketing research: Is there a relationship? Is it working? What are the issues?

To seek answers to these questions, WebLife Research and Quirk’s conducted an online survey in April 2013. The survey was completed by 246 respondents – most of whom are market researchers at large corporations. About two-thirds work with big data to some extent.

Not nearly as insightful

Based on the survey results, it’s obvious that both big data and market research are here to stay. Big data is valuable as a Web analytical tool but thus far not nearly as insightful as market research. Responses to the question “How actionable are the online behavioral insights you get from big data vs. from qualitative and quantitative market research” show that big data’s actionable insights significantly lag behind market research, with a top three-box rating of 18 percent vs. 56 percent. In fact, one-third say that market research is more important now, as it helps understand the whys behind big data.

“Web analytics are used intensively.”

“Better access to big data has made it possible for us to group and track (to some extent) our most desirable visitors.”

“Big data is mostly used to explain held beliefs. Not for insight. Certainly not to question anything.”

“Right now big data is used on a very operational level. The research team is working to integrate this data to now tell customer ‘stories’ and journeys.”

“Big data tells me what visitors are doing but not why!”

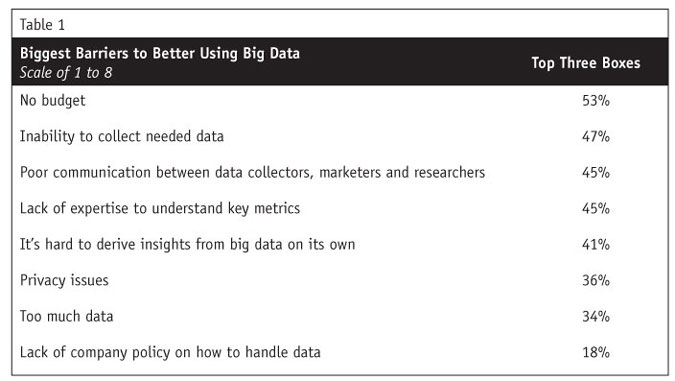

It appears that it will be more than two years for big data to truly impact marketing efforts, as only 29 percent feel that it is very likely to happen in the next two years. If researchers and marketers worked together, this timeline could be accelerated. Other barriers to the better use of big data are budgets, inability to collect needed data and lack of experienced staff (Table 1).

Isn’t happening yet

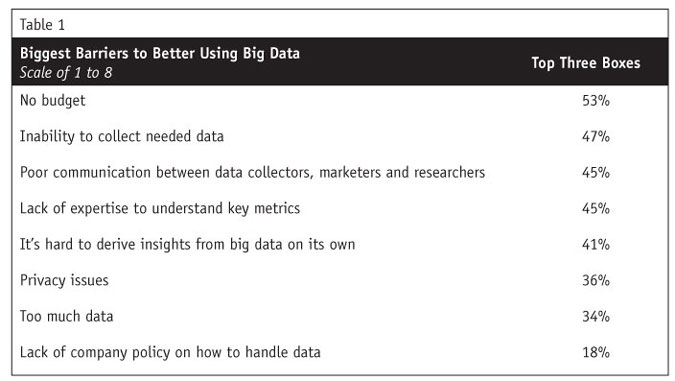

Big data and market research teams don’t work much together (Table 2). Researchers indicate a desire to integrate the two but repeatedly say it just isn’t happening yet. Only one-third say that the two disciplines are part of a cohesive team. Very few companies have figured out how to get users of big data and market research together to develop actionable insights (only 19 percent use them together frequently).

“I don’t use big data – it is used by our marketing department but not by market research.”

“We are just beginning to determine how market research and big data can work together, trying to form a cohesive team.”

“They work together ‘sporadically’ – no time, no budget, too thinly resourced to be any good.”

“We understand that data can only give us the what and we need to do qualitative research to understand the why.”

“Big data results focused, market research directional.”

“Big data free with Google Analytics, market research expensive.”

Oddly, innovative qualitative tools designed to help understand online behaviors are generally not used to understand those behaviors right now. In fact, existing qualitative research techniques are still used much more often and most corporate researchers (64 percent) say market research does not take a back seat to big data and they are not worried that big data will threaten their jobs.

Great opportunity

There is a great opportunity to integrate big data and market research to better understand online behavior to grow businesses. Corporate management should consider training their staff, integrating the disciplines and exploiting this opportunity before competition does.

If you’re looking to take action, consider making integration part of corporate policy; asking for an insights integration budget and staff; training market researchers and analysts to understand each other’s disciplines; hiring a team leader who can insure that both disciplines work cohesively together; and trying out the new qualitative tools designed to understand online behavior.