Monitoring the evolution of detergent scent

Sahiba Puriis is a senior analyst with a focus on home and technology research at Euromonitor International. This is an edited version of an article that originally appeared under the title “Attribute Analysis on Scents in Automatic Laundry Detergents in Thailand.”

Imagine getting ready in the morning and putting on a freshly washed outfit with the right fragrance. The smell can instantly brighten your mood, lift your spirits and set you up for the day ahead. That is the power of scent. Fragrances or scents can spark memories, evoke emotions and enhance the user’s experience.

The rise of scent boosters in recent years is testament to the importance of scent in laundry care. In the U.S., the scent booster category accounted for $1.1 billion in value sales in 2021 against a CAGR of 12% over 2016-2021. In China, although this category is relatively new, it increased rapidly in recent years and accounted for $127 million in value sales in 2021.

In laundry care in Thailand, which was valued at $1.2 billion USD in 2021, scent plays a key role in the purchasing decision. While value-added attributes such as antibacterial, stain removal and reduced odor do also play an important role, scent is a key factor.

Detergent brands in the country are well-aware of this phenomenon, as they continue to innovate and launch new products with different types of scents. In this piece, we are using Euromonitor International’s e-commerce tracking tool to take a closer look at automatic detergents in Thailand to get a better understanding of:

- What fragrance types have been popular in the country over the years based on online SKU availability.

- What proportion of a brand’s SKUs have “scent” as an attribute.

The popularity of floral scents

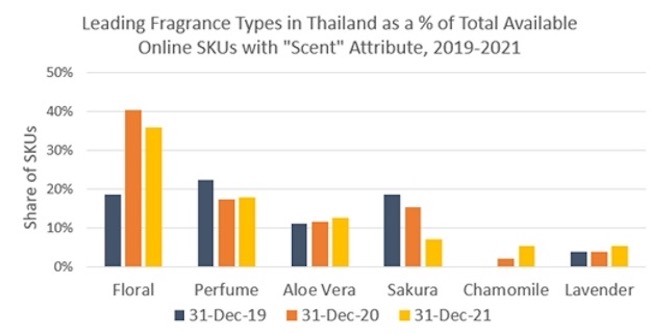

Source: Via; Sample size 2019 = 27 SKUs, 2020 = 52 SKUs, 2021 = 56 SKUs

While scent as an attribute has remained popular in Thailand over the years, the different types of scents can change due to evolving consumer preferences or by way of brand innovation and new product development. The chart above indicates the top scent types and how they have changed in proportion over a three-year time period based on online SKU availability.

Looking at the leading scent, floral grew significantly, gaining 22 percentage points in share from December 31, 2019 (pre-pandemic) to December 31, 2020 (post-pandemic). After this jump, the proportion of floral remained high on December 31, 2021, indicating strong online product availability, suggesting that retailers are continuing to stock automatic detergents with this scent. Even though fragrances like chamomile and lavender have a low contribution, their share has grown over time, according to the sample. Such scents, which are known to have a calming effect and mood-boosting properties, can contribute to making laundry care an extension of self-care.

As consumer preferences around scent types mature and evolve, different scent attributes could gain popularity and go from being niche to becoming more mainstream. Manufacturers could thus benefit from tracking attributes.

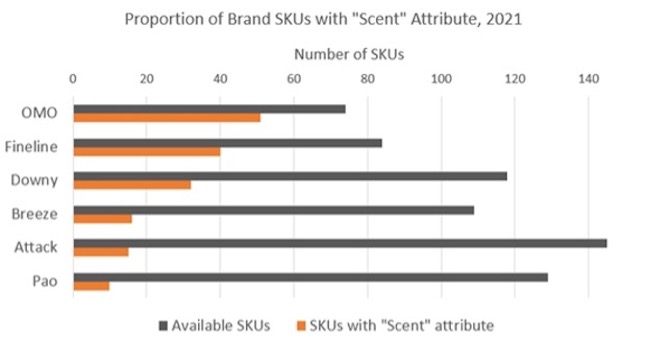

OMO offers the highest proportion of SKUs with scent attribute

Looking at the SKU prevalence of the leading players based on a sample of quarterly data throughout 2021 indicates that OMO offers a higher share of its SKUs with scent as an attribute. This brand, from Unilever, is one of the leading brands in automatic detergents in Thailand, second only to Breeze, which accounts for a lion’s share of the category in the country. OMO, through its OMO Plus Liquid range, offers a variety of scents, such as Paris Perfume, Morning Bloom, Sakura Blossom and Aroma Fresh.

Brands in automatic laundry detergents in Thailand can also benefit from the role that fragrance plays in wellness. While consumer awareness around health and wellness had been gaining traction prior to the pandemic, the pandemic exacerbated this trend. According to Euromonitor’s Voice of the Consumer: Lifestyles Survey in 2022, 48.5% of respondents from Thailand indicated that over the coming 12 months they intended to increase their spending on health and wellness.

Consumers are now actively looking for products that feed into their self-care routine and help promote wellbeing. In light of this, spending on “scent” can be viewed as a manifestation of the trend “self-love seekers”, which has been identified as one of the top 10 global consumer trends in 2022 by Euromonitor International. Thus, offering products that not only leave clothes smelling good, but also provide additional functional benefits, such as feeling energized or calm and relaxed, can further help create product differentiation in the crowded automatic detergents category.

Identifying the right product type for the scent is also crucial. Stand-alone products such as in-wash scent boosters have not gained significant popularity in the country, as consumers opt for laundry detergents with scent. This is not only because of the value-added benefit that such attributes provide, but also because they are not commanding an additional share of wallet.

As scent innovation in laundry care continues, companies can benefit by monitoring how fragrance types are evolving in their respective markets. This is not only to ensure that availability meets demand, but also that the right scent type is offered to consumers based on evolving trends.