Strategize to optimize

Editor's note: Brady Silva is U.S. subscription practice lead for SKIM Analytical. Julia Murphy is E.U. subscription practice lead for SKIM Europe. Laurie Gaby is global decision journey practice lead for SKIM Analytical. Mike Mabey is global digital commerce practice lead for SKIM Analytical. They can be reached at skimgroup.com/contact.

Four thousand years ago in ancient Mesopotamia, someone etched symbols into a clay tablet. This is now considered the world’s oldest form of writing. After hundreds of years spent deciphering the text, archaeologists were finally able to understand the writing. Perhaps they expected a poem, a fable or a short story. Instead, they uncovered the world’s first shopping list.

This shopping list tells us something vital about people: the habit of making a list, heading down to a store, picking up products, paying and heading home is thousands of years old – as old as writing itself.

In recent years, however, shopping habits have shifted dramatically. People shop without even leaving their homes, at times even skipping ad hoc shopping altogether by subscribing for automatic delivery. As normal as this may seem to us now, it’s inarguably representative of a tectonic shift in human behavior – one that merits further exploration.

As students of consumer decision behavior (and frankly as geeks in behavior), we wanted to dig in and understand these changing consumer habits and their impact on how brands optimize their interactions with their target audiences. So we talked to 22,000 digital services and tangible goods subscribers in nine countries, across four continents.

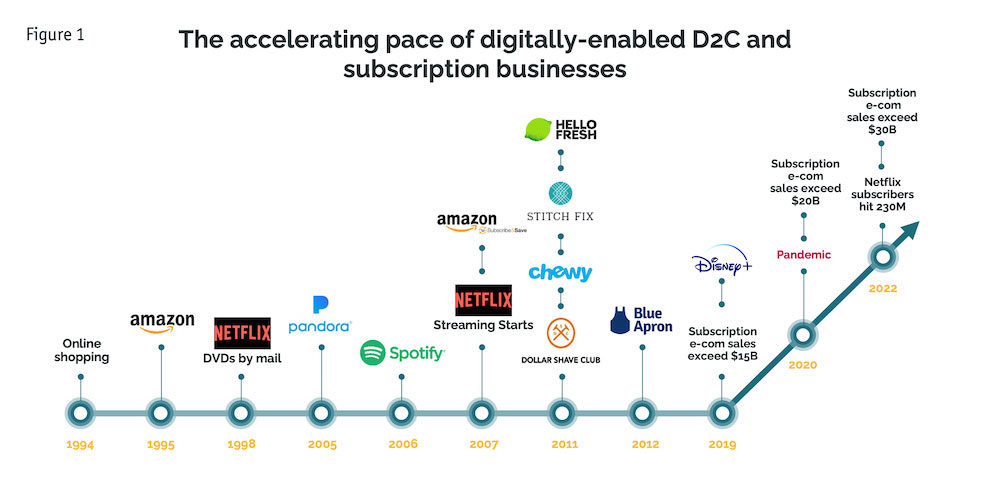

Our research gave us new insights into, and appreciation for, the differences that digital journeys bring to the traditional journey mind-set. These journeys are exemplified by the explosive growth in digital commerce, direct-to-consumer (D2C) and subscription buying, particularly in a direct customer relationship context (Figure 1). And this behavior is enabled by the pervasive influence of mobile phones. But make no mistake, digital journeys are not just traditional journeys with a phone in hand. Consumer decision behavior itself has changed.

Our research gave us new insights into, and appreciation for, the differences that digital journeys bring to the traditional journey mind-set. These journeys are exemplified by the explosive growth in digital commerce, direct-to-consumer (D2C) and subscription buying, particularly in a direct customer relationship context (Figure 1). And this behavior is enabled by the pervasive influence of mobile phones. But make no mistake, digital journeys are not just traditional journeys with a phone in hand. Consumer decision behavior itself has changed.

And as it has, businesses have also changed how they think about journeys as a strategic tool. Journeys have moved from being a component in how marketers identify where to influence a purchase to becoming the underlying construct of how to understand and influence consumer decision behavior.

As a result, businesses require a new set of go-to-market strategies to make this new framework actionable and we’ve identified four important strategic steps.

To ensure the digital journey framework is actionable, we have linked the consumer perspective with the business strategy, providing go-to-market strategies that correspond to each phase of the consumer journey. We use our research and experience in the digital subscription and D2C channel as the consumer archetype for discussion. However, most of the digital journey insights and the structure apply across the digital commerce landscape.

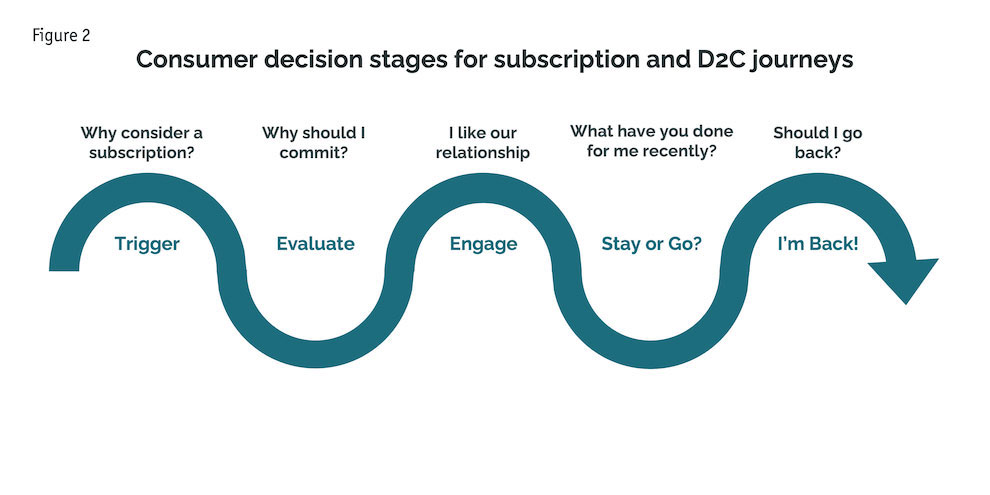

We identified five critical consumer decision stages in the digital journey framework (Figure 2). Each stage is actually a mini journey of its own. Of course, the stages overlap and interact – after all, journeys are still messy. But each stage has separate characteristics and drivers that need to be addressed. As you go through them, you will see our emphasis on triggers and barriers as an important tool for understanding journey-related decision behavior.

We identified five critical consumer decision stages in the digital journey framework (Figure 2). Each stage is actually a mini journey of its own. Of course, the stages overlap and interact – after all, journeys are still messy. But each stage has separate characteristics and drivers that need to be addressed. As you go through them, you will see our emphasis on triggers and barriers as an important tool for understanding journey-related decision behavior.

The five stages are: Trigger, Evaluate, Engage, Stay or Go? and I’m Back!

Clarity at each phase

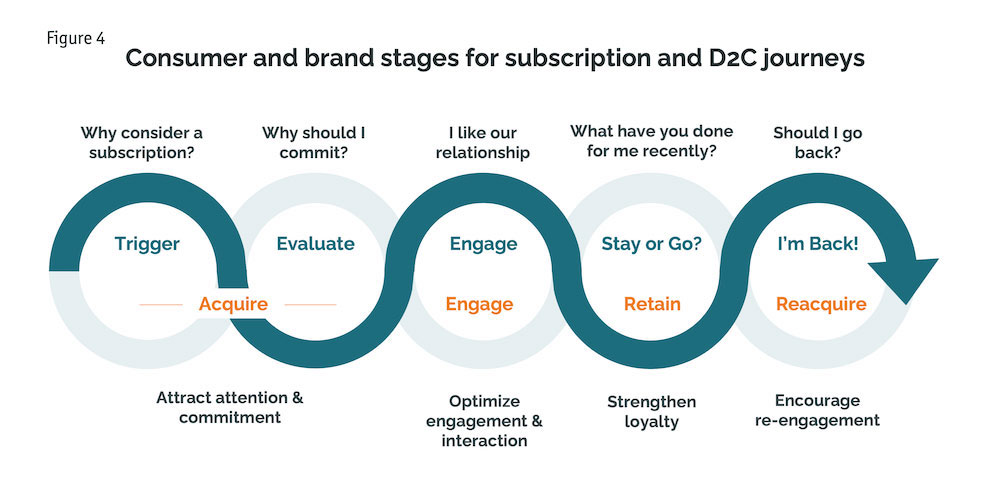

The impact of digital-enabled behavior on consumer choice creates tremendous opportunities for businesses to forge closer relationships with consumers. Leveraging these opportunities requires businesses to have clarity at each phase. Arguably, the business go-to-market framework is a bigger change than the consumer side of the journey. Traditionally, the whole path-to-purchase journey and consumer targeting strategy could fall into the first component – acquire. This new structure posits that there are four clear and separate go-to-market strategies (Figure 3) and that acquire is only the beginning – and perhaps not even the most important component.

The four strategies are: Acquire, Engage, Retain, Reacquire.

Now that we have shown the two sides of the coin – consumer decision stages and brand go-to-market strategies – we will discuss the stages and strategies together to show how they fit and overlap.

Trigger | Acquire

Considerations:

Consumers: What will catch their attention – introductory offers, gifting, convenience, familiarity with other D2C and subscription actions?

Brands: Ideal target audiences, identifying behaviors, how to get attention, potential touchpoints, opportunity mapping, triggers and barriers

At first glance, the trigger stage of a subscription or D2C journey may seem similar to the first stage of a traditional consumer journey. But further exploration quickly unveils clear, and impactful, distinctions. With a traditional consumer journey, the trigger needs to drive consumers to buy a particular product. But for a subscription or D2C journey, the trigger needs to push consumers to make a significant change of behavior. It’s not just about the product – it also requires consumers to rethink how they purchase the product, whether it’s in-store as they always have, online or via a subscription. Triggers need to adapt to this arguably more challenging job.

It's also worth noting the context and the environment in which the consumer makes the decision. This process only takes place online – which may make the barrier to entry higher because the brand needs to break the consumer out of their habit loops of behavior and activities.

Research exploring what drives consumers to evaluate the brand’s offerings fits best in this stage. Journey modeling can help identify priority consumer clusters, conduct opportunity mapping and develop entry-point strategies. Including questions about triggers and barriers in this kind of research should provide particularly actionable findings. In our own research, we have identified that introductory offers and gifting can be powerful barrier-breakers. For digital entertainment categories, new and high-profile content can attract attention and drive signups.

Evaluate | Acquire

Considerations:

Consumers: Additional value vs. traditional channels, trust, confidence, cancellation process

Brands: Triggers and barriers to commitment decision

The primary consumer question in the Evaluate stage is, “Why commit?” In this stage, consumers seek to understand what additional value the decision provides, given the commitment it requires. While a traditional consumer journey also has an important evaluation phase, what is being evaluated in a subscription or D2C journey is vastly different. It is not just about a brand or product on a shelf but also about whether they feel comfortable with a more long-term commitment or whether they trust the online environment they are buying from. In this stage, consumers are preoccupied with key questions such as, “Do I trust the brand?” and “Will I be able to change my mind?” These questions are less prevalent in a traditional consumer journey.

For consumers considering committing to a subscription, brand trust and confidence are vital in making the decision. This is because, in the subscription decision journey, consumers are not just buying a product but a service – regardless of what brands offer. Tailoring communications with this in mind is necessary to build an effective subscription or D2C model.

Beyond that, understanding what is valuable to consumers and defining the value proposition accordingly is key to success. Whether the value is in convenience (around 70% note signing up for a tangibles subscription to “make their life easier”) or in exclusive content offered by digital entertainment and fitness subscriptions, how brands message their offers is essential.

Engage

Considerations:

Customers: What do they like about the interactions and relationships? Can they try something new?

Brands: Ensuring a good user experience. What will build and solidify engagement? Are there strategies for Subscription Hoppers, Content Chasers and Try Something New customers? How easy is it for customers to modify their subscription or buying pattern?

OK, now they are customers, not consumers. The Engage stage might be the linchpin for both customers and brand. It is the place where customer lifetime value succeeds or fails. How do brands keep customers interested, engaged and paying attention once they are subscribed? It is important to look at how customers want to interact with brands and how to create a conversation that allows for the introduction of new products or services. Indeed, once acquisition is working smoothly, building a dynamic subscription or D2C model can drive further success by limiting churn and maintaining engagement.

But engagement can be a considerable challenge for businesses as they struggle to maintain the interest of Subscription Hoppers, Content Chasers and those who are always looking for something new to try. These groups, identified in our research, require intensive management from the business.

Luckily, one of the most appealing benefits of a D2C or subscription model for businesses is the ability to gather and utilize information about customers. Creating a clear process and strategy for leveraging this information can ensure success, particularly at the Engage stage. This information, alongside traditional market research, can inform the creation of new products or services, development of powerful communications campaigns and product and portfolio management. While all of these strategies can be facilitated by a digital environment – allowing for clearer measures of success and opportunities – they require a thought-out and evidence-based relationship development strategy to drive long-term engagement.

Stay or Go? | Retain

Considerations:

Customers: Provide a reason to stay, make it easy to stay and leave

Brands: What drives loyalty? Offer freedom not jail; develop “soft exits;” allow pausing

Loyalty is the question on the table at this stage. Why should customers stay? This is particularly relevant when you remember that, in a digital environment, choosing to leave is often as easy as opening your phone and pressing a button.

As with engagement, in-depth analysis of customer choices and behaviors is critical to keeping customers. But the key challenge here is to ensure that any retention strategy does not feel like a jail sentence to consumers. If they want to go, let them go: make it easy to cancel, pause or adjust subscriptions. While this may seem counterintuitive as a retention strategy, it ensures consumers feel comfortable coming back when the subscription feels relevant again in the future. Indeed, being “easy to cancel” is among the top five important benefits for tangible subscriptions and in the digital space, the proportion of consumers likely to rejoin a subscription drops to just 12% if it was difficult to cancel, compared to 46% saying they would rejoin after having an easy cancellation touchpoint. It is a long-term strategy that allows for healthier relationships with customers.

It goes beyond having a cancel button that’s easy to find and click. Offering a pause or skip option can also retain customers. The element of control is important for consumers and one that is becoming an expectation of the subscription experience. By offering this, brands can demonstrate an understanding of consumer needs and acknowledge that this is normal behavior in the subscriber-brand relationship.

Exit or pause surveys can be key here; are they leaving due to product buildup, disuse or lack of new content? Measurement of these reasons can feed back into brands’ Acquire and Engage strategies to improve the experience before customers arrive at the “stay or go” question.

I’m Back! | Reacquire

Considerations:

Consumers: What attracts them to come back – new touchpoints, new content, new products?

Brands: Understand why they return, identify and target serial “rejoiners”

This stage is the one that is most different in terms of consumer decision behavior and business strategy because it is a deliberate focus on reacquisition, rather than acquisition or retention. It is enabled by the digital capture of customer information through the building of direct customer relationships.

Life happens. Despite a brand’s best efforts at keeping users engaged or leveraging strategies to retain them, consumers expect to be able to “flip a switch” and stop receiving – and paying for – services. But, in many cases, they will be back.

On the consumers’ side, stopping a service may tie into life stages or circumstances that are temporary, such as cancelling a food service subscription because of children returning to college or planned travel. Digital entertainment providers might experience lulls in membership during the off-season of the NFL or consumers may pause or cancel a subscription based on family needs. In our research, about one-third of respondents indicated they’ve canceled and rejoined a digital entertainment or fitness subscription. Drivers for this rejoining behavior include content (finishing desired content or finding themselves bored by it but rejoining when something new comes out), cost (cutting back entirely) and time (more subscriptions than they have the time for).

It's important for brands to know more about rejoining behaviors specific to their product or target audience. Understanding what paths can be taken from the moment a consumer pauses or cancels can be used to build a strategy to get them back onboard as quickly as possible. In some categories it is important to know how likely serial rejoiners are to go through the process without any incentives or price cuts. This can save a brand money, resources and marketing dollars spent on serial rejoiners.

These paths will look different based on the product or service. However, over-engaging with consumers during a pause may damage the relationship if the pause is for reasons like cost or product buildup. A communications strategy should be focused on reasons for cancellation and whether their rejoin path is open-ended or has a set time frame.

For digital entertainment and fitness subscriptions, brands have more permission to continuously market to subscribers who are not current members, as content is constantly changing. Interest-based algorithms to identify relevant content and sharing hype for the next viral show are key to win a consumer back. However, identifying serial rejoiners or behaviors behind rejoining – like a new season of a show or a certain sports season – can help direct marketing spend. If a consumer shows a regular habit of cancelling and rejoining, a few well-timed communications may go further than constant marketing. A clear understanding of the behavior is crucial to get it right.

Finally, though paths look different between physical subscriptions and digital entertainment and fitness, they are constantly influenced by each other. In sectors where subscriptions have been heavily adopted, the customer experience in one area can set expectations in another. Just like Domino’s pizza tracker changed our expectations for customer transactions, expectations for subscription companies will be set by others raising the bar. A cancel or pause touchpoint may be happening for a very different reason when someone cancels their weekly food box vs. their streaming video subscription but if the process isn’t easy, doesn’t allow for control and isn’t personalized, it can damage brand equity, trust and confidence and chances of rejoining in the future – regardless of the sector.

Next steps

Digital commerce has allowed consumers to have much more information in their journey to a decision. As a result, brands must have deeper understanding of the stages that consumers are going through in the consumer decision journey. (Figure 4 shows how intertwined and connected the digital consumer journey and brand go-to-market strategy should be.) Our discussion has focused on subscription and D2C but for consumers, the digital environment and mind-set are as pervasive as the air they breathe.

Digital commerce has allowed consumers to have much more information in their journey to a decision. As a result, brands must have deeper understanding of the stages that consumers are going through in the consumer decision journey. (Figure 4 shows how intertwined and connected the digital consumer journey and brand go-to-market strategy should be.) Our discussion has focused on subscription and D2C but for consumers, the digital environment and mind-set are as pervasive as the air they breathe.

For brands, digital commerce has also been a boon. It offers brands many more opportunities to connect with consumers and to develop direct relationships. The result is the need to develop more targeted strategies to optimize each stage of the consumer connection opportunity. However, if we had to focus on one area, we would draw a box around the Engage section in Figure 4, since it is so critical to success. But the challenge is that all these connections are in a digital environment, with many moving parts and potential consumer off-ramps. As we all know, it is very easy to go down rabbit holes when we are online.

For brands to effectively optimize opportunities, they need key information about target audiences. The good news is that digital commerce provides many more opportunities to develop direct customer relationships and to leverage the first-party data that comes with those relationships.

Adapt and connect

Digital commerce presents a new set of conditions, context and consumer power. Consumer journey knowledge and go-to-market strategies need to adapt and connect to each other. You may want to use our considerations from each consumer stage as guides for adapting your plans.

Begin by deconstructing your consumer and customer journeys into stage-specific journeys to identify where and how to optimize each component of your business strategy. Use as many tools as you can to understand the journeys, beginning with touchpoint identification, triggers and barriers research and opportunity mapping to get a handle on what you will need to do and to identify your biggest potential wins. Once you have deconstructed stages, develop component-specific go-to-market strategies to optimize your communications with existing and future customers. Our four go-to-market strategy headings might be a good place to start.