The race to keep pace

Editor's note: Carey Gervason is senior consultant, client services at Burke, Inc. She can be reached at carey.gervason@burke.com.

Purchase journey research has many names but one goal: drive sales. To that end, we study shoppers’ paths to purchase, create shopper journey maps and look for opportunities to minimize gaps in brand and category sales conversion. Success means that brands grow, retailer partnerships thrive and boost category growth and consumers benefit from a more seamless shopping experience – it’s a “win-win-win” for consumers, brands and retailers.

But amid the shifting sands of today’s ever-evolving retail landscape, success in purchase journey research can be hard to define. And if you don’t take an intentional approach to defining your objectives it can be hard to achieve.

Over the past few years, we’ve had numerous conversations with organizations that are concerned about what the acceleration of digital and e-commerce means for their business. Certainly, shopper behavior has evolved and shopper paths have expanded, becoming more complex and more challenging to study. So, not only are new growth strategies and tactics required but the tools and techniques we use to study the purchase journey have evolved as well. The largest risk brands face related to purchase journey shortcomings is knee-jerk, reflexive reactions to short-term trends – like commissioning clickstream analysis because it’s popular without understanding its limitations.

Consider the predictions made during the past year about the stickiness of e-commerce or, more recently, the return of in-store shopping. If we were to react myopically to each projection, we might embark on dozens of piecemeal shopper research studies that each lack a holistic view of the journey. We would then be trying to cobble together disparate, fragmented bits of data in an effort to make sense of it all. Missteps or inaction would be likely outcomes, diminishing brand equity instead of growing it, ultimately leaving gaps for sagacious competitors to seize market share.

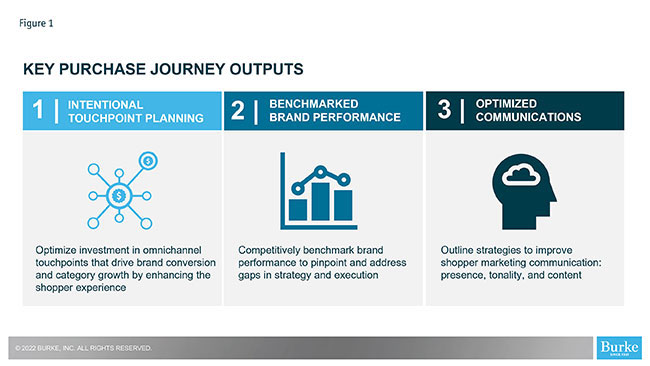

So, to harness the wealth of shopper data appropriately and support brand and sales teams in meeting their business objectives, we need an actionable framework that aligns the key inputs and outputs of purchase journey research into a winning story. Figure 1 is a framework describing three key purchase journey outputs.

There are about 50 touchpoints available for use across a shopper’s entire journey, from trigger to purchase. In-store buyers of FMCGs typically have five or fewer touchpoints while tech, durables and online buyers tend to have anywhere from five to 15. Touchpoint usage will also vary by subcategory. Initially, we might conclude that our objective is simply to identify the most prevalent touchpoints used. This approach is helpful but it only gets us halfway there. Many touchpoints are not optimized for conversion (if they were, more shoppers would be purchasing at that point).

In addition to touchpoint reach, we also need to understand which touchpoints are impacting conversion and which are serving another purpose – or, perhaps, are providing little value at all. From over 20 years of purchase journey experience, we have found that 20% of touchpoints deliver 80% of the impact on sales. So, we really need to identify those 20% of touchpoints that truly matter for our brand and category sales. This is the practice of touchpoint planning.

Needs, motivations and frictions

To achieve our goal of producing sales, we need to benchmark our performance across the most impactful touchpoints to prioritize those where we are underperforming. And second, we need to uncover shoppers’ needs, motivations and frictions at those moments to reveal opportunities to optimize communications in terms of both tonality and content. For high-investment categories and longer journeys, identifying purchase abandonment rates and profiling who is deciding not to buy, and why, can be another pivotal step.

As for key inputs and methods, it gets a bit trickier. There is no one perfect purchase journey methodology. In fact, effective purchase journey research will likely demand two or more carefully choreographed approaches. And while there are a multitude of shopper-journey solutions available from a multitude of research suppliers, what’s important is choosing an approach with the end in mind. Does the methodological solution lend itself to achieving the key outputs previously mentioned? Does it align with your organization’s business strategy?

Here are five overarching principles to support sound methodological decision making and help mitigate risk in your purchase journey investment:

1. Money is not the only currency you will spend. Perhaps the single most important decision is whether to partner with a full-service custom shopper research partner, a standardized tech platform research provider or go it alone with a fully DIY platform. Depending on which you choose (and this is, unfortunately, sometimes the choice of someone else), your team will pay in not only money but also time and energy (positive and/or negative energy).

It is critical to conduct a readiness assessment evaluating and comparing the required shopper expertise and available tools against the team’s resources. Anticipate that the three types of currencies will not remain in equilibrium but rather each will fluctuate depending on the others.

For example, a recent engagement with a manufacturer of shelf-stable cookies and crackers began with the goal of synthesizing clickstream data with findings from a DIY survey. Though they had the analytical tools to link the two disparate data inputs, no one on the team had the time or expertise to identify the common unit of analysis (i.e., the bridge variable they would use as a connection point). Upon deeper investigation, it was discovered that the gaps in conversion were primarily at the moment of purchase, rather than pre-purchase, where clickstream is most informative. In addition, one of the two categories was actually losing shoppers in-store. While we were able to help this organization, it necessitated additional research that was not in scope – or in their budget.

If there comes a point where you are feeling just a bit overwhelmed due to time, resource or expertise restraints, ask for guidance. Some research providers will engage with brands at multiple levels, from full-service to consulting to training sessions.

2. Keep your focus on the goal to avoid becoming enchanted by extraneous variables. Journey map infographics and content are pored over, refined and then refined again. Before accepting a “pretty” or “comprehensive” journey map alone, ask yourself and your potential research partner how all the data contained within a journey will be distilled down into the three essential outputs in a manner that will drive business decisions.

An electronics manufacturer came to us with the goal of winning more shoppers in the digital space. It had already pursued other avenues that did not bear fruit – the results of which it had trouble understanding and was hesitant to try to explain to its internal teams. We conducted a comprehensive discovery phase, including stakeholder interviews, social listening and a review of the previous research. While the previous journey results were thorough and the stages of the journey matched the organization’s view of the shopping process, specific unanswered survey questions and a handful of odd results led us to determine that the stages of the journey were not shopper-centric – in fact, they were overcomplicated. Electronics buyers did not think of the journey in a five-step fashion; in their view, they took steps to research the product and they took other steps to buy it.

3. Think about the journey holistically; don’t be wooed by passive data. Strive for a holistic omnichannel approach as your primary research foundation, adding onto it as needed. A more traditional qualitative-plus-quantitative research approach is currently the only single source of shopper insights bridging the O2O connection (online-to-offline and offline-to-online). Qualitative can take various forms, including digital shop-alongs, online bulletin boards or even triad/focus groups, depending on needs. For quantitative, mobile-first surveys are prevalent but some categories may benefit from longitudinal methods to get closer to shopping activities.

Behavioral/passive data (e.g., clickstream, URL tracking, eye tracking) can be extremely valuable in illuminating the purchase journey and supporting activation efforts as a supplementary data input but be aware of its gaps. Passive data is, inherently, only a slice of the entire picture:

• Passive data coverage includes only online journey touchpoints. Offline influences like retail flyers, prior store trips, word-of-mouth and print media are excluded, even though they may be top touchpoints driving conversion.

• Ask about device coverage. Don’t assume that digital behavior includes both desktop and mobile behavior, as it often does not.

• Ask about retailer coverage. Some e-commerce retailer sites block clickstream tracking, which can be a huge surprise if not anticipated upfront.

• Passive data is often sourced separately from your primary research approach. Best efforts should be made to find a linkage to be able to analyze behaviors with attitudes. Some suppliers, including Burke, use single-source sampling for clickstream data, which is a subset of primary quantitative survey respondents with opt-in digital behavior tracking enabled. This automatically provides a hard connection to the survey data. When mobile behavior is necessary, Burke uses its Geode|AI solution to fuse disparate data sources.

• Clickstream lends itself to rich insights during the pre-purchase/research stage. URL tracking and eye tracking offer deeper insights during the moment-of-purchase stage on the retailer’s e-commerce site. These methodologies should not be used interchangeably.

4. If it seems too good to be true, it likely is. Buyer’s remorse is real when it comes to purchase-journey work. Just as there are disruptors in your category or categories, there are disruptors in the marketing research field – many of which are tech startups with limited shopper or marketing research expertise.

• A good rule of thumb is that shopper journey work should cover the who, what, where, why, when and how of shopping in a category, wherever shoppers research and buy.

• Research methodologies tend to be specialized (e.g., quant measures, qual understands why, behavioral often dives into where and how, etc.) and you will probably need to blend multiple methods to achieve all your goals. So, ensure your research supplier has a plan in place to fuse disparate data sources, whether it be a hard or soft synthesis.

• If a supplier claims a single research methodology that solves all your issues, investigate further to ensure that there will be a clear understanding of the why behind the what.

5. Embrace partnership throughout and particularly at the bookends of the study. As a brand leader, you know your business better than anyone else. When you choose wisely, you partner with a research supplier who is an expert in shopper behavior. Better outcomes happen when we work together.

The last thing a research supplier wants to hear is, “Well, we already knew that.” To ensure research results are reliable, relevant and (most importantly) actionable, judicious planning is vital. Planning should include an inventory of the current landscape, anticipation of how current tasks affect adjacent work activities and recognition that different stakeholders may be able to add incremental value to research goals and design. Even when you and your research partner are excited to dive into the study, planning is an insurance policy for success.

The electronics study mentioned earlier is an example of true partnership. Our partner shared as much as they could as soon as they could at the beginning of the study. By leveraging existing qualitative shop-alongs, we were able to design a holistic quantitative survey with an added clickstream deep-dive into digital behavior.

Anchored in this approach, we were able to provide more strategic perspective:

• We took a holistic view of the brand’s impact throughout journey touchpoints and used Geode|AI along with attribution modelling to identify which were most impactful.

• Competitive benchmarks clearly established where the client was winning and losing in critical phases of the journey.

• We provided purchase abandonment metrics that shed light on who was choosing not to buy and why.

• The triangulation of qualitative data, quantitative survey data and clickstream data using Geode|AI pointed to earned media and the company’s website as the top areas of opportunity.

On the back end of the study, we set aside time for an iterative results process – building, refining and improving the output together. Our client is now leveraging our recommendations in a variety of ways, including: evolving its social media strategy, because earned media was identified as a gap; optimizing the experience on its website, making it easier to shop earlier in the journey, where many consumers were lost; and developing a playbook to help retail partners optimize their online experience.

Tools and techniques will also evolve

At times, it may feel overwhelming trying to keep pace with change. Innovation in new retail formats, new technologies and more convenient buying options will certainly lead to additional shopper behavior changes that we cannot predict. However, we can take comfort in the fact that the tools and techniques we use to study shoppers will also evolve.

All that said, the goal of any purchase journey research will always remain the same: produce sales. So, regardless of changing consumer dynamics, it’s important to keep that ultimate outcome in perspective. And, as you align your inputs and add dimension to your goals, hopefully the frameworks provided here will help you more effectively allocate your resources. Because while change may be a constant in retail, so is the need for intentional, actionable planning to drive brand growth. And that’s where you can make a difference.