How pharmacists see the evolving conditions in the pharma industry

Editor’s note: Jarod Ricci is the global strategic insights head of general medicines at GSK and Abbey Ahearn is a partner at HawkPartners.

It is no secret that large retail pharmacy chains have been expanding their services over the past few years, with CVS Health adding Health Hubs and minute clinics and Walgreens acquiring VillageMD. Even Amazon has gotten into the game with One Medical retail locations. Previously, Intellus reported that the main driver for patients seeking health care needs was convenience (Understanding the Intellus Trends and Futures Survey: Key Themes in Consumers, Clinical Trials and Technology), where these pharmacy initiatives tap into that need.

This article looks to explore from the retail pharmacist point of view on how they have seen the retail pharmacy environment change over the last several years and what their role will be as it continues to evolve (Intellus Trends and Futures Qualitative Pharmacist Interviews July 2023).

Research looks at role of retail pharmacies

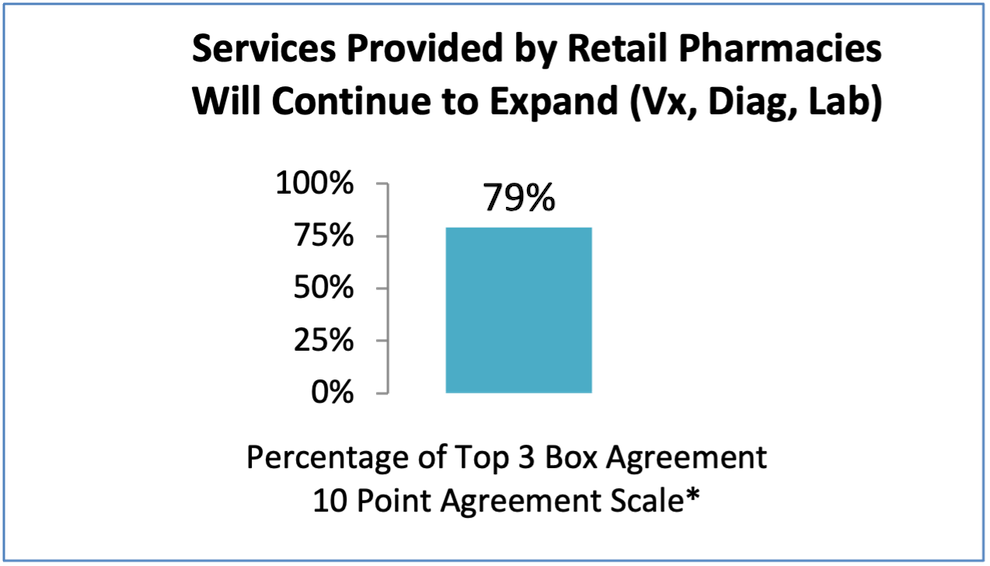

How do pharmacists see themselves and the services that they could offer relative to that of the care provided by physicians, nurse practitioners and registered nurses? Per the Intellus Trends and Futures Wave 4 survey, health care insights professionals believe that retail pharmacies will also continue to expand many services, including vaccination, diagnostics and lab services.

Like most health care-related businesses today, the pressure to drive down cost is significant, and pharmacies aren’t immune. To grow profits, the major retail pharmacy chains, grocers and large consumer big-box retailers have been expanding their pharmacy services to better serve patients.

The role of pharmacists through much of the last 20 years has been primarily focused on filling prescriptions. From a business perspective, the volume of prescriptions and the speed of filling them are the direct links to profitability. As the reimbursement per Rx fill have decreased, even more emphasis on more fill volume was necessary in addition to stretching existing pharmacy staff further. Though most pharmacists had pursued degrees anticipating more time with direct patient interactions, they had begun to find themselves valued more for efficiency.

“The past several years seem to have been very bottom-line focused. It’s all corporate driven: How many prescriptions we can fill and how fast. I went to pharmacy school to help people, so that was frustrating at times.” – Pharmacy manager, grocery chain (Intellus Trends and Futures Qualitative Pharmacist Interviews July 2023).

Pharmacists were forced to focus on keeping up with the prescription volume fill goals and time in overcoming the hurdles associated with what HCPs prescribe and insurance plans cover. The focus on filling reduced the time they had to engage directly with patients decreased. For many pharmacists who had gone to school in the hopes of serving patients more directly, this was frustrating.

Though pharmacists have had formalized training for immunizations since the mid-1990s, the pharmacy was more of a secondary site for vaccinations behind the doctor’s office. In the 2000s, vaccine volume continued growing with flu and then expanded as a site vaccinator in 2009 during the H1N1 pandemic. Today, partially due to COVID-19, several vaccines are offered in pharmacies, with vaccinations becoming a core source of business. As more pharmacists’ time was needed for vaccination, increased pharmacy staff and technology investment was necessary to improve transaction speed in areas where pharmacist time was typically spent such as e-prescribing, benefits verification and centralized filling.

Physicians are acclimating to a shifting role

In the post-COVID-19 world, pharmacists not only see the pharmacy setting as a site for health care increasing (as driven by their employers’ expansion of services offered by clinicians), but pharmacists also see their role in patient care increasing, as found by the Intellus qualitative research with pharmacists. In their view, not only did COVID-19 afford them more direct engagement with patients via vaccinations, but patients who experienced increased barriers to seeing their primary care provider were more inclined to lean on the pharmacist.

“Pharmacists are the No. 2 most trusted professional. We are the most approachable. You can get recs on drug therapy and common ailments. I want patients to know that we are a valuable resource. We aren't just putting white pills in an amber vial.” – Pharmacy manager, large retailer 2

Fortunately, with the investments made to support prescription filling efficiency and the expansion of vaccination offerings, many pharmacists suggest they have more time for patient consultation. Additionally, though not a new initiative, Medication Therapy Management (MTM) is becoming a more broadly executed program across community pharmacies. This practice of advising patients on management of their medications offers the pharmacist an additional touch point with a patient to further build a relationship and as a trusted source.

“It’s becoming that continuum of needs that patients have and being able to walk into a Walgreen's and talk to pharmacist who can help coordinate where they should go. Are you best served with an over-the-counter medication? Do you need to go to the room over there for an Hba1c test? Do you need to go to VillageMD next door? It’s providing that convenience and access that large health systems seem to be stepping away from … where it can take three to four months to get an appointment. That’s the gap that retailers are looking to support.” – Jim Carroll, head of Real World Evidence, Walgreens Clinical Trials, Walgreens Boots Alliance (from www.youtube.com/watch?v=z4lIneVueV8).

Coming full circle: Do patients want the return of small, family-operated pharmacies?

As we look into the crystal ball, what could be the future retail pharmacy environment and the role of the pharmacist therein? As published by the American Association of Colleges of Pharmacy, community-based pharmacy is evolving from a place of product distribution into a health care destination (from AACP’s The Future of Pharmacy: Direct Patient Care). However, quite a lot would need to happen beyond pharmacist training for community pharmacy to truly serve the primary care needs of patients. Even so, continued limited primary care capacity in unison with a patient desire for more convenience will continue to offer an environment for health care delivery innovation.

New regulations that permit “test and treat” and/or increased prescribing rights offer a new service that could meet at least some of the capacity needs. The U.S. government emergency authority permission during COVID-19 of pharmacists being able to prescribe Paxlovid potentially does set a precedent for a service that has opportunity to grow. Or, as suggested by some pharmacists, additional companion diagnostics could be conducted at the pharmacy even as the pharmacist relies on clinicians in other locations to prescribe. The pharmacist by training won’t become a medical doctor, but some feel that they can play a role, especially when they are in locations with doctor shortages, in coordinating care.

Ironically enough, as the big chains have dominated the retail pharmacy landscape, the mom-and-pop pharmacies are fewer and further between in number. However, could mom and pops be returning to the landscape? Some pharmacists would like to see their role come full circle, where the pharmacist is on a first name basis within the community. Patients tend to prefer going to a familiar HCP, if possible (Understanding the Intellus Trends and Futures Survey: Key Themes in Consumers, Clinical Trials, and Technology). It then may not be a stretch to assume that patients would prefer to return to a pharmacist who knows them by their first name, family, history, etc.

Increased engagement with customers/patients by pharmacists also fits well with some of the other innovations in care delivery being piloted by pharmacists’ employers. One of the trends that retail pharmacies have been piloting is establishing some point of care and or telemedicine capability within the general footprint that the retail pharmacy operates. A patient can visit the retail pharmacy, have a virtual consultation with a doctor, then move over to the pharmacy counter for consultation with a pharmacist to fill a prescription. And while the pharmacy and clinics are being run independently within the footprint of a store, whether it be a Walgreen’s or even a big-box store like Target or grocer like Kroger, this does not matter to the patient, who derive increased value from a visit to a single location.

And for those patients who ultimately don’t want to or can’t travel to the destination multiple times to get care and pick up prescriptions, some retail pharmacies are now offering more convenience by delivering medications, e.g., Walgreens’ partnership with Door Dash to deliver HIV medications within the same day.

As retail pharmacies continue to expand their services offerings, pharmacists are optimistic that this offers an opportunity for them to practice more of what they envisioned pharmacy to be; beyond filling prescriptions, coupling expertise about the medications they’ve been prescribed, even if that prescription comes from within the same four walls.

Methodology

Wave 4 of the Trends and Futures survey was fielded in March 2023. Subsequent interviews with n=10 retail pharmacists followed. Intellus Worldwide partnered with MedSurvey and Rare Patient Voice to conduct qualitative research with pharmacists, health care providers and patients.

Intellus Worldwide thanks the Trends and Future Committee for their leadership and tireless dedication to this effort.

Bhavani Moodabagil, Biogen; Jarod Ricci, GSK; Abbey Ahearn, Hawk Partners; Ian Crassweller, UCB; Emily Hoffman, Research Partnership; Julie Brown, Amgen; Jim Hickey, Spherix Global Insights; Leah Leochko, Astellas Market Access; Steve Yonish, Trinity Life Sciences; Dom Cocco, MedSurvey; Raul Perez, RP Insights