Flowing with the mainstream

Editor's note: Leslie Townsend is president and co-founder of Kinesis Survey Technologies, Austin, Texas.

For several years now, many within the market research industry have predicted that “next year” would be the year when mobile research methods become part of the mainstream. Based on the potential opportunities that mobile technologies present to our industry, and the growing popularity of smartphones, the “year of mobile” has seemed to be right around the corner for quite some time. The reasons for this repeated prediction are valid. Mobile data usage and smartphone market share continue to expand rapidly, and mobile data collection offers market research many (very real) advantages: access to location-based information; collection of data at the point of sale and consumption; and the ability to include media as responses.

Yet for all of the researchers foretelling a mobile revolution, there have also been many who disagree and argue that, while advantageous for some highly specific studies, mobile will always be secondary to traditional desktop-based research. Those in this group remind us that mobile Web penetration remains relatively low on the global scale and insist that most clients want to run long, detailed studies that simply are not practical for use on handheld devices. Individuals on both sides of the debate have watched each year pass and readied their arguments yet again. So which side is right? And how will we recognize when mobile market research is part of the norm?

In reality, mobile data collection has been steadily growing year by year, although the use of desktop devices for completing online research still greatly exceeds the use of mobile and tablet devices. Obviously we at Kinesis, as providers of platforms for mobile survey execution, are firmly entrenched on the pro-mobile side of the debate. And we believe that the market research industry has in fact finally reached “the year of mobile.” On what basis do we make this claim?

First, while the smartphone has been the most rapidly growing segment of mobile phone sales for the last few years, it has now finally become the dominant mobile device type in the U.S. Nielsen reported that as of March 2012, smartphone ownership has reached a majority in the U.S., with 50.4 percent of mobile subscribers now using smartphones (and two-thirds of the 25-34-year-old population using them). Smartphones are projected to gain 50 percent of global mobile market share by 2015. This is a staggering figure when you realize that 85 percent of the world’s population lives in developing nations, where the smartphone is equally if not more important to improving the quality of life and communications than it is elsewhere in the world, because often mobile devices are the only lifeline to news, e-commerce and other important services.

The rise in social media is another important signal that mobile is here, now, as a strong and present force to utilize in market research. Nearly half of all Facebook users access it from their mobile devices from time to time and the company has reported that one-third of its overall traffic is generated from mobile usage. Twitter reports even higher statistics – 55 percent of its traffic is generated by members who are accessing it from their mobile devices. While figures are much lower for LinkedIn (at only 10 percent of page views), its mobile traffic grew 400 percent during the last fiscal year. Additionally, location check-in services such as foursquare are readying consumers for expanding use of location-based technologies.

Through these social media channels, social listening has become a highly valuable means of qualitative data collection and several market research software solutions now offer integration to the leading social media sites for qualitative survey recruitment. The saturation of both smartphones and social media participation throughout the world opens up many new avenues for market research, both for mobile-specific projects as well as traditional desktop projects that now should be supported in dual mode. A substantial number of smartphone owners use their mobile devices to check e-mail (an April 2011 study sponsored by Google found that 82 percent of smartphone users check and send e-mail with their device). Whereas previously only a small population of respondents attempted to access e-mailed survey invitations via mobile devices, it is safe to assume that 82 percent of smartphone users – or at least 41 percent of the underlying population – is checking e-mail with their mobile devices.

Radical change

Another reason to argue that 2012 is the market research industry’s “year of mobile” is because of the dramatic increase in mobile survey participation. Kinesis has carefully monitored its mobile traffic for several years. For most of this time, the percentage of mobile traffic held fairly steady at 2-3 percent of overall traffic. These figures may, in and of themselves, seem high. At the time when the first iPhone was released on the market (June 2007), Kinesis’ mobile usage statistics made a radical change. Prior to the iPhone, mobile traffic was generated by a variety of devices that utilized WAP, the first generation of mobile browsers. WAP delivered a less than fully satisfying experience to respondents. For those who never attempted browsing with a WAP-enabled device, disappointments included a limitation of one question per page (thus making an “other, please specify” field awkward and table structures impossible). The iPhone incorporated a superior browser and almost immediately Kinesis traffic reflected high usage of iPhone devices. Within a month of its release, the iPhone represented half of our overall mobile traffic and shortly thereafter we saw as much as 5 percent of our overall incoming traffic utilizing mobile devices.

So why does our firm feel “the year of mobile” has finally been achieved? It is because today in the U.S., mobile device usage represents 25.5 percent of Kinesis’ overall survey traffic. This figure was pulled from the first quarter of 2012 and is comprised of all types of mobile devices, including tablets such as the iPad and Galaxy. It includes all traffic, which means that in some instances the projects are designed for mobile respondents but more often than not, the projects are programmed as “typical” online surveys. Some may doubt that this figure is representative of the overall industry, as Kinesis was early to market with a mobile solution and may have a more “mobile-centric” customer base than the industry at large. However, based on conversations with and published accounts by other survey software vendors, overall industry traffic is at or near this same level.

The escalating use of social media launches is a contributing factor but the increase is primarily a reflection of the underlying base of devices that respondents choose to use at any particular point in time. WAP usage is now insignificant in the U.S. In the last quarter, Kinesis had virtually no respondents utilizing WAP browsers to complete surveys, while only a brief year-and-a-half ago it still represented 23 percent of mobile survey traffic. Powerful HTML5 browsers have taken their place and render an experience far more enjoyable for respondents. This fact also points to rapid mobile evolution.

Variety of forms

Mobile data collection takes a variety of forms. Many research projects utilize mobile-specific methodologies and this is one of the exciting aspects of the mobile revolution in online research. What is equally exciting is that the mobile revolution impacts all facets of our industry – both qualitative and quantitative data collection; mystery shopping; communities and panels; and social media research.

Some of the techniques around newer mobile methodologies include:

-

location-based invitation triggers at the point of product evaluation, store entry or purchase;

-

product scanning during the shopping process, using scanner apps or cameras to capture the barcode;

-

larger sampling frameworks – but typically utilizing smaller data sets for each respondent (data sets are merged based on demographic or behavioral modeling);

-

data mining – collecting single or small snippets at multiple points in a decision-making process and tying them together through data warehousing;

-

marrying qualitative and quantitative methodologies (the camera phone is king – allowing respondents to upload media such as digital images, videos and sound recordings for qualitative-only exercises or to add a qualitative component to any quantitative project).

Significantly higher

As stated previously, 25.5 percent of U.S. respondents on the Kinesis platform are coming into online surveys using a mobile browser – either a mobile phone or a tablet. Our current findings show this statistic to be significantly higher than in Europe. This percentage only reflects those respondents attempting to complete a survey – it does not reflect the actual percentage of those who do complete. Given that the statistics are pulled irrespective of the underlying methodology, some of these respondents are intended for mobile-only projects (an example is mobile ad testing, in which respondents indicate recall of advertising that they have seen on mobile sites) and some respondents are entering surveys programmed to support desktop browsers or dual-mode (full desktop/mobile browser support offered) surveys.

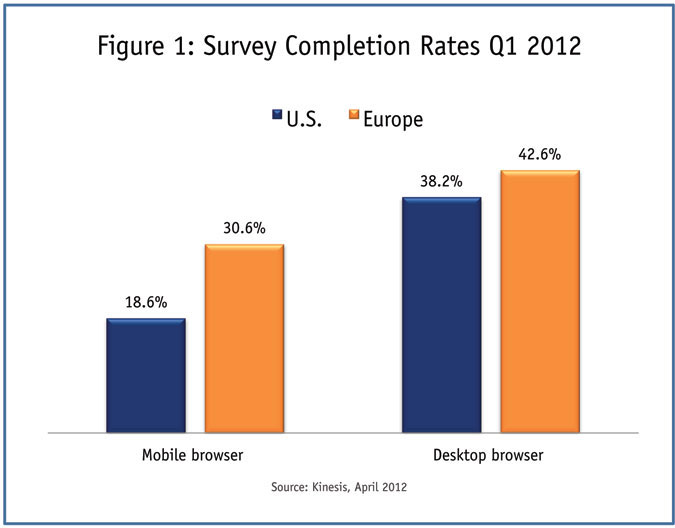

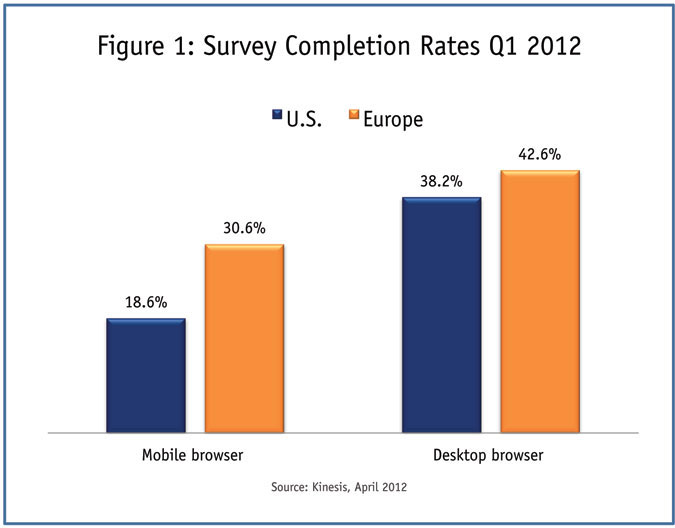

Figure 1 provides Kinesis’ survey completion rate statistics from Q1 2012. It differentiates completion rates based upon the type of browser used (in this instance, tablet devices are included with mobile browsers). In the U.S., 18.6 percent of those using mobile browsers on the Kinesis platform are completing the online survey that they enter, versus 38.2 percent for desktop browsers. These statistics are irrespective of whether the survey they entered was programmed to support mobile browsers or not, as well as irrespective of survey length and methodology. The data are reflective of mobile respondents across all surveys, regardless of type (desktop only, mobile only or dual mode). This statistic makes sense, since mobile respondents are more likely to terminate from a standard-length online survey, which represents the majority of online survey traffic.

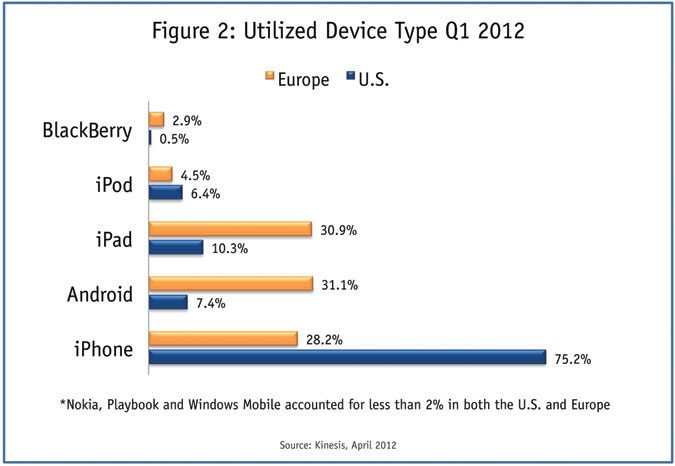

In terms of device preference for survey-taking, Kinesis sees a significant difference between the U.S. and Europe. While the iPhone dominates mobile survey participation stateside at 75.2 percent (in spite of the fact that it no longer holds the lead in smartphone market share), usage of Android and iPad devices are highest in the European region at 31.1 percent and 30.9 percent, respectively (Figure 2).

Must now embrace mobile

Ultimately, what does the recent and significant upswing in mobile survey traffic mean for our industry? It is evidence that anyone conducting online data collection must now embrace mobile respondents. Obviously mobile device usage and Web browsing is higher among certain age and socioeconomic groups, as well as in certain geographic regions, but market researchers should expect and anticipate that some percentage of survey access in nearly every research project today will be from mobile devices and therefore must support mobile respondents accordingly.

More exciting for us as researchers, however, are the tremendous opportunities to explore how mobile devices are used in the product marketing, shopping and purchasing processes and also the ability capture this information in real time. Mobile technology will enhance our data sets with location information and media capture, provide more immediate and dynamic feedback from respondents and increase the accuracy of data that previously relied upon recall. The challenge is now on to transform research methodologies and adapt accordingly.

This may sound overwhelming but in actuality mobile support starts very simply. If an online project cannot accommodate mobile respondents – either because it is too long, does not support mobile browsers or utilizes Flash or other question types that do not render on (or across most) mobile devices, a sentence can be inserted in the invitation or opening remarks to inform the respondent that the survey is not mobile-browser friendly. Another option is simply to detect for mobile browsers and terminate them based upon suitability of the project.

With either method, it is important to begin assessing internally the percentage of mobile respondents that are accessing your projects. Most online projects will require some modification to methodology in order to accommodate small device screens and a shortened attention span, especially ongoing trackers. Let’s extend courtesy to mobile survey-takers – they are our future and as an industry we do not want to discourage the use of mobile devices.

Necessitating change

The fundamental shift in the manner in which society communicates, shops and makes purchases is necessitating change within our industry. Market research practices are adapting to this change, not driving it. The underlying base of devices and browsers used in the future will be radically different than those used today and as a consequence, the incidence of mobile research participation will rise. Further, just as the iPhone ushered in a new era of smartphones, other devices will undoubtedly come along and change the computing landscape – and the terminology associated with it – yet again.