Doing the coolhunters one better

Editor's note: George Terhanian is chief research and analytics office at The NPD Group, a Port Washington, N.Y., research firm. Also based in Port Washington, Matt Powell is the firm’s vice president, industry analyst – sports. Jia Guo is executive director in the firm’s Portland, Ore., office.

Before Malcolm Gladwell became a super-famous writer, he penned a long article in The New Yorker in 1997 that chronicled the adventures of professional coolhunters searching for the next big thing in the athletic shoe industry. Gladwell wrote about people named DeeDee and Baysie who scoured the edgiest streets of big cities everywhere for what was hot, before it became mainstream hot. The companies they worked for – Converse, Reebok, others – then placed bets on which shoes to take to market.

If you dig deeper, you realize this approach didn’t deliver the goods. As Gladwell observed, there’s a fundamental challenge to coolhunting: “The quicker the chase, the quicker the flight.” In other words, once everyone knows what’s cool, it’s no longer cool. That’s not a good thing for an athletic shoe manufacturer, particularly when it can take 18 months for a shoe to move from the drawing board to the store shelves.

There are other challenges with coolhunting, too. It places a tremendous amount of faith in a small number of so-called experts, which runs counter to today’s more contemporary “wisdom of crowds” philosophy. Why rely on a handful of experts when, through technology, your customers and prospects can be at your near-immediate beck and call?

So if you’re Converse, Reebok, Nike, Adidas, Under Armour or any company trying to make killer products people love, you need to make sure you’ve got a trustworthy way to distinguish the winners from the losers, no matter how you come up with the product ideas. You also need to move fast to account for how quickly fashion trends change. You might even need to plan for a hot category’s imminent decline or even its obsolescence. Before we dive into the specifics, we’ll set the scene, beginning with a brief overview of the athletic shoe market.

Grown steadily

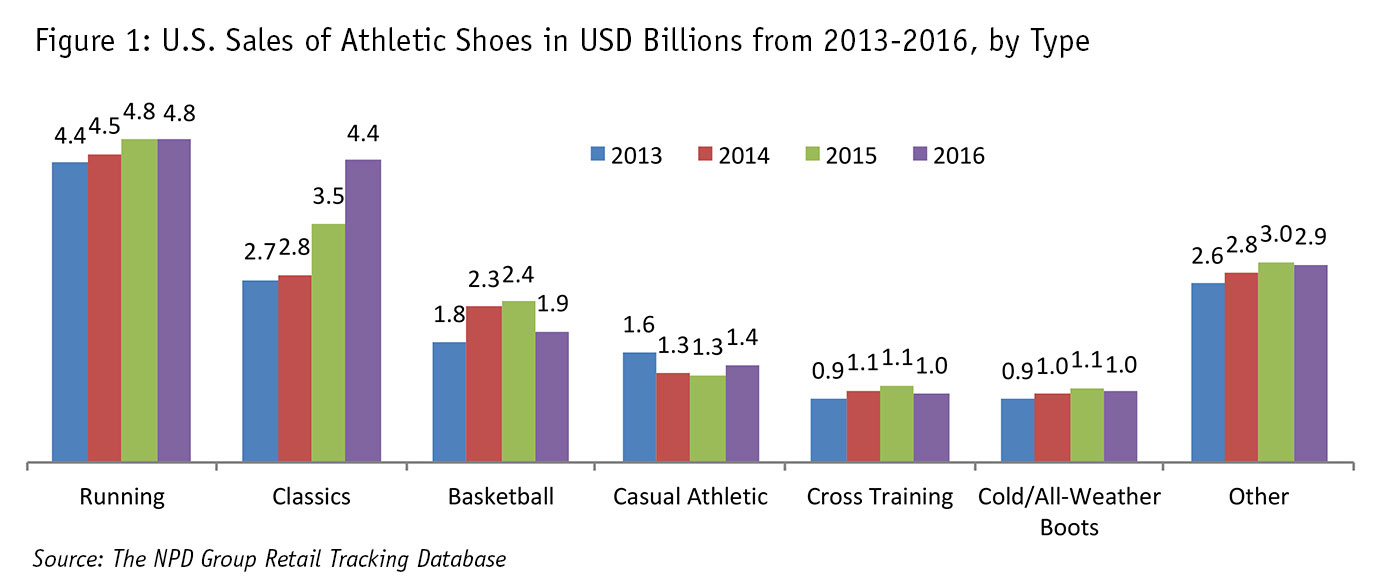

These should be decent days for athletic shoe manufacturers. The market has grown steadily over the past few years, with sales of $17.5 billion in 2016, a $400 million increase compared to 2015, and a $1.7 billion increase versus 2014.

But people’s tastes and preferences change quickly, with fashion cycles in sport compressing. These days, a three-year cycle can be a lifetime. That’s a dramatic decline compared to a decade ago, and a massive one compared to a century ago when Converse Chuck Taylors, in all their canvas glory, were about to embark on a four-decade market-leading run.

In 2015, as Figure 1 shows, classic kicks like retro basketball and running shoes were in high demand, growing in sales from $2.8 to $3.5 billion after near-zero growth the year before. Performance basketball shoes suffered the opposite fate, barely moving the needle in 2015 after fabulous $500 million growth to $2.3 billion in 2014. Basketball shoes didn’t exactly rebound in 2016, with sales of $1.9 billion, down $500 million compared to 2015. And if classics were hot in 2015, then they were red hot in 2016, with sales up another $900 million to $4.4 billion.

For a relatively young brand like Under Armour, the popularity of classics poses an obvious challenge: It’s hard to roll out classic shoes systematically when you’ve not been around very long. Nike and Adidas, in contrast, are positioned perfectly to exploit the opportunity, as evidenced by the ongoing re-release of various retro Jordan styles and skyrocketing sales of the old-school Adidas Superstar in 2015 and 2016. Both brands have got a lot of styles left in the vault, too.

Important considerations

Context and culture are important considerations for brands that are thinking about developing and taking to market a new shoe. A few years ago, for example, shoe companies knew that many kids wanted to be a baller or at least look like one. They dreamed about it. They practiced the moves. They mastered the walk. They talked the talk.

These kids aren’t that much different from those of earlier generations. For instance, it’s almost impossible to find a photo of a serious hoopster, or hoopster wannabe, from the 1920s through the 1960s not wearing Chuck Taylors. Then came the 1970s, when Adidas arrived on the scene. “If Adidas can make NC State’s David Skywalker Thompson fly, then maybe they can make me fly, too,” the kids would say. That’s until they saw Julius Erving in his signature Converse Dr. Js take off from the foul line, shift into mid-flight maneuvers, elevate to the rafters and then throw down a thunderous dunk.

Converse Weapons were the brand of choice thereafter. Magic, Bird, Isaiah – they all wore them. When Michael Jordan descended from the Carolina blue sky in the mid-1980s, things really started to change, with the big shoe companies recruiting and rewarding a bevy of basketball superstars – Sir Charles, Patrick Ewing, TMac, Penny Hardaway, Allen Iverson, Reggie Miller, Kobe, KG, Derrick Rose, LeBron, Kevin Durant, Kyrie Irving and Steph Curry, to name several – for signing their names to their shoes.

Although many kids today still want to be ballers, it’s less important to look like one. That’s a major reason for the decline in the performance basketball shoe market. But basketball shoes are still big business, with the major brands in a heated competition to sign and retain the best players, sometimes for life in LeBron James’ case. Most industry analysts also attribute Under Armour’s remarkable rise in the basketball shoe category to its relationship with two-time NBA most valuable player Steph Curry.

Speaking of Steph, we heard the buzz last year during the 2016 NBA playoffs about the Chef, the low-cut all-white version of the Under Armour Curry 2. Comedian Jimmy Kimmel anointed them “a great pair of shoes ... whether you are a Steph Curry fan or just a middle school lunch lady.” Others described them as the shoe of choice for the early-bird discount dinner crowd. And even we wondered whether coolhunters (if they exist anymore) would start combing the world’s hippest assisted-living centers for the next big thing. But none of that seemed to bother Steph. A hand in the face. A slap on the elbow. A poke in the eye. An elbow to the ribs. He deals with that stuff all the time. They’re “fire,” he said, when asked about the Chef.

Find out for ourselves

As much as we’d like to take Steph at his word, we decided to find out for ourselves. Through survey research, we assessed the appeal and then estimated likely first-year sales of the Curry 2 Low basketball shoes – not only the all-white Chef but its colorful siblings, too. We also assessed the Curry 2 High, the Nike LeBron 13 and the Nike KD 8 – all launched previously – to understand how they compared to the Curry 2 Low on key measures. (Although Under Armour launched the Curry 2 High a bit before the Curry 2 Low, we decided to produce a first-year forecast for it, as well. For additional details on methodology, please see the sidebar.)

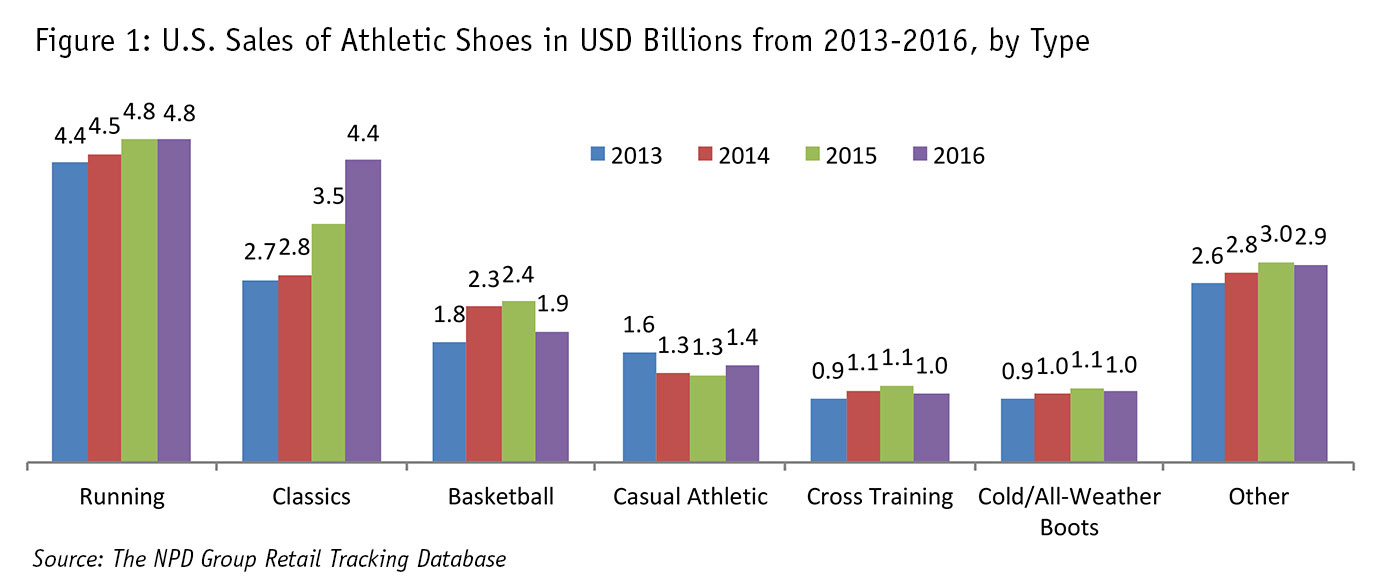

Through this process, we learned that you can’t always trust comedians or snarky sneakerheads. Despite being mocked, the Curry 2 Low turned in a slightly stronger concept test performance overall than its Curry 2 High counterpart. Compared to all shoes in our concept-testing normative database, however, the Curry 2 Low did not stand out. In fact, we identified no hall-of-famers among those we tested, with the LeBron 13 the only one to place in Quintile 4 or 5 in at least one category (Table 1), which is where you really need to be for sales to soar.

Really needs to appeal

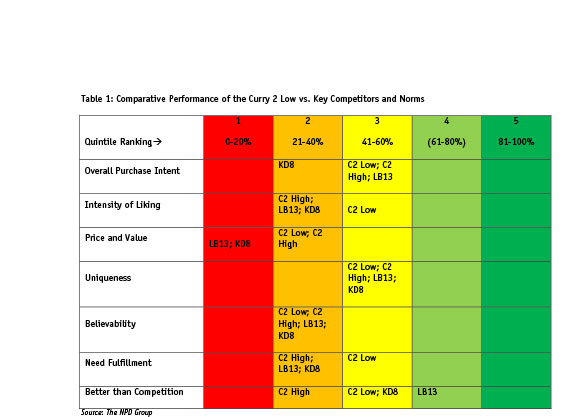

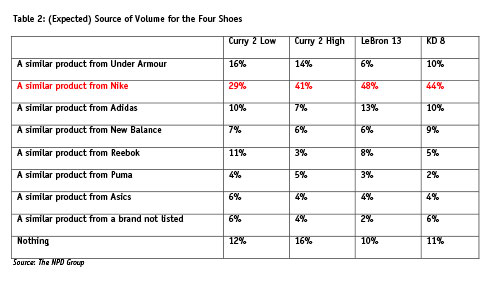

The dynamics of the basketball shoe market are fascinating, partly because the market is shrinking and partly because of Nike’s dominant presence. Including the Jordan brand, Nike accounts for more than 80 percent of unit and dollar sales in the U.S. That’s great for Nike but it can also present challenges. If Nike introduces a new shoe, then it’s likely that a lot of people who’ll buy it are previous Nike buyers. That’s how it works for a big brand with substantial market share. If a smaller brand like Under Armour rolls out a new shoe, however, then that shoe really needs to appeal to previous Nike buyers; otherwise, Under Armour won’t grow share. It needs to take sales from its competitors, not itself.

So how are these dynamics playing out? We explored this question within our survey by asking respondents who expressed interest in buying a particular shoe (among the four tested) what brand they would buy if that shoe were not available.

As Table 2 shows, Nike would be second choice if any of the four first-choice shoes were not available. On the one hand, that’s good news for Nike – it’s part of the reason why Nike’s the major player in the category. On the other hand, the Curry 2 Low and High are (Nike) share stealers. That should please Under Armour, not Nike.

So was the Curry 2 Low “fire”? We forecasted1 the Curry 2 Low to sell 54,400 units in its first full year in the U.S., a small number compared to our forecast of 862,000 first-year units for the Curry 2 High. Why such a seemingly low figure for the Curry 2 Low? There were at least six reasons:

- More people buy high- than low-top basketball shoes – that’s just the way it is.

- You could not find the Curry 2 Low in as many places as the other shoes we tested. But that may have been intentional; a successful limited-edition product can do wonders for a brand.

- Timing was not quite right. Under Armour launched the first Curry 2 Low in February, after the December holiday buying season and too late to take full advantage of people’s propensity to buy in February and March. An October or November launch would have been preferable from a sales optimization perspective.

- Steph Curry’s performance in the 2016 NBA finals was less than stellar. That didn’t help shoe sales.

- Sales of performance basketball shoes, overall, were declining, as Figure 1 suggested.

- It was our understanding at the time of the forecast that Under Armour had taken its foot off the Curry 2 pedal in preparation for the Curry 3 launch.

Of course, Under Armour may have factored most of this into its strategy. Case in point: the Chef was not available several months after its launch on the Under Armour Web site – it had sold out.2 So maybe it was indeed “fire,” as Curry proclaimed.

Near-perfect

So, how did we do? Our Curry 2 High forecast of 859,991 first-year unit sales was near-perfect, off by about 2,000 units. Our Curry 2 Low forecast of 54,440 unit sales was too conservative, primarily because we did not expect retailers to keep so many Curry 2 Low shoes on the shelves for so long. Nor did we expect Under Armour and retailers to break from the past and cut the Curry 2 Low price by about 20 percent at year’s end and more than double that at the start of the new year. Combined, these two factors increased Curry 2 Low first-year sales to 68,314 units. If we had worked directly with Under Armour to produce the Curry 2 Low forecast, rather than making our own assumptions about the company’s marketing activities, the input to our forecasting model would have been more accurate and our Curry 2 Low forecast would have been spot on. Had this been a slam dunk contest, we’d give our overall effort a score of eight, possibly nine, out of 10, but with room for improvement.

Testing new or enhanced product concepts systematically to estimate their sales potential makes a lot of sense, particularly when the resulting evidence informs important decisions on price, marketing, distribution, production, positioning, product features and the like. Mistakes can be costly. And they’re easy to come by in the athletic shoe industry – and other industries, too. A rigorous concept test replete with a precise forecast of future product sales is an important safeguard for any company to put in place.

Obviously, it’s important to come up with great product ideas, too. Maybe coolhunters like DeeDee and Baysie can help, although there are a lot of other ways – more effective ones – to generate product ideas today. But when you’re able to put a number (i.e., expected sales) on those ideas, as we’ve done here, it makes it much easier to make the right decisions.

So what can you learn from testing a new concept? Or testing the actual product – your own or a competitor’s – once it hits the shelves? Can you forecast sales? Ensure you’re able to stock the shelves to meet expected demand? Plan for future scenarios? Figure out what people want and need? Identify likely buyers and their characteristics? And, in basketball lingo, “beat your opponent to the spot”? Absolutely. That’s why we’ve shared this case study. Information. Insight. Intelligence. A 3-pointer.

References

1We forecasted sales for channels that NPD tracks, only. Our forecasts did not include direct-to-consumer sales from the Under Armour store/e-commerce site.

2The rest of the Curry 2 Low line is available online.

Details on the sales forecast methodology

To evaluate and compare the four shoes fairly, we assigned each survey respondent – 1,456 men aged 16-65 who purchased athletic shoes in the previous 12 months – randomly to one of four shoe concepts (specifically, shoe descriptions). Between 354 and 378 men with identical or nearly identical characteristics then evaluated one shoe concept only. Next, we forecasted first-year sales, taking into account several factors:

- Performance on key, predictive survey measures: purchase intent; intensity of liking; price/value; uniqueness; believability; need fulfillment; better than competition

- Normative information for similar products in our concept testing database

- Expected and actual shoe distribution, using our point-of-sale (POS) data

- Under Armour’s expected marketing spend

- The size and changing nature of the athletic shoe market using our POS data, and specifically, dollar sales, units sold, average selling price and sales velocity (which you can think of as sales adjusted for distribution) for: the athletic footwear category since 2013, by month; athletic footwear by type (e.g., running shoes, basketball shoes) since 2013, by month; high- and low-top basketball shoes since 2013, by month; brand share for Nike, Adidas, Under Armour and others

- Past sales performance of similar shoes, using our POS data

- In-market sales performance of each tested shoe, using our POS data, specifically: dollar sales, units sold, average selling price and sales velocity since June 2015