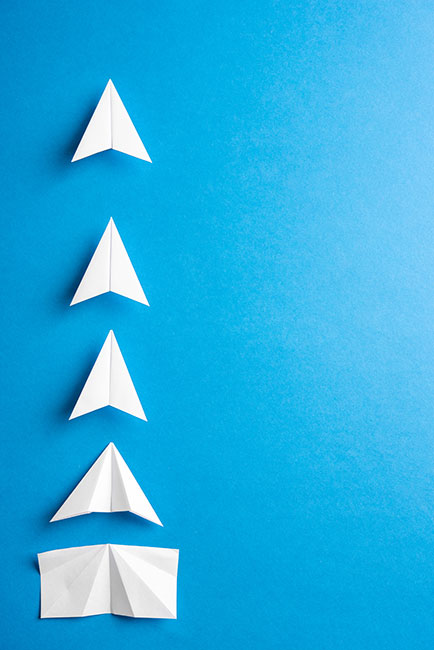

Maintain the momentum

Editor's note: Michael Carlon is director of strategy at marketing services firm DCG ONE.

The COVID-19 pandemic has significantly impacted the ways U.S. consumers are shopping for fast-moving consumer goods (or FMCGs as they are known in industry-speak). We’ve heard from many of our clients that, while store trips are down, basket sizes are up as shoppers are spreading out trips to reduce the risk of exposure to the virus. Additionally, as more meals are being made at home our food and beverage clients are experiencing unprecedented year-over-year growth. This dynamic is a double-edged sword; while sales are strong, evaluating performance at the same time next year versus the previous year may tell a somber story that growth rates couldn’t be maintained. As a result, FMCGs are scrambling to find ways of making growth sustainable. Our firm believes one way of doing this is to invest in a retail channel driving growth: e-commerce.

While e-commerce has historically represented only a small percentage of a CPG brand’s sales, there is no denying that it is a growth channel. Online U.S. CPG sales rose 35.4% in 2018, according to a report released in early 2019 by research firm IRI. That’s a lot faster than the 3.4% growth in sales at food and beverage stores, including the supermarkets that sell most CPG products, according to the U.S. Department of Commerce. Of course, these statistics are all prior to the COVID-19 era. A poll from Inmar, a provider of data analytics solutions to retailers and manufacturers, found that nearly 80% of U.S. consumers reported shopping online for groceries after the COVID-19 outbreak.

Having explored e-commerce channels for leading manufacturers including Unilever, PepsiCo and Mondelez, we know that the biggest barrier of switching from traditional retail channels to digital ones is the fact that, oftentimes, when a consumer realizes they are out of a product – say, toothpaste – they can’t wait one or two days for it to come from an online merchant; they need to replenish it immediately. As such, off to the store they go. However, two innovations in the e-commerce space address that reality head on: curbside pickup and same-day delivery.

If there’s one universal truth we’ve heard from shoppers time and time again it’s the importance of saving money. Hardcore Walmart shoppers will tell you it’s the primary reason why they brave the store during popular shopping times. Walmart’s everyday low prices and wide assortment of items, however, leads to a sometimes chaotic shopping experience that can include densely populated aisles, frequent out-of-stocks and long checkout lines – three things COVID-19 era shoppers want to avoid at all costs.

Over the past few years, however, Walmart has been investing in curbside pickup, giving shoppers the best of both worlds: the convenience of online ordering and the ability to pick up items from a physical location. The latter aspect is important to those who may not be able to be home to take delivery of an order or who want to be able to check over fresh items, such as meat and produce, before bringing them home. Additionally, shoppers who use this service tell us that it helps them save money by staying on budget as they are not tempted to impulse-buy. To them, it’s all the benefits of shopping at a store like Walmart without any of the familiar hassles.

Same-day delivery is also becoming a reality for more and more online buyers. In September, Walmart announced the launch of Walmart+, a subscription service priced below that of rival Amazon Prime that promises same-day delivery of just about anything the retail giant sells – including groceries. Considering that there is a Walmart within 10 miles of 90% of U.S. households and social distancing will be a reality for the foreseeable future, we can expect shoppers who can be home for delivery to use this service for trips of all sizes (provided the order meets the $35 threshold).

It’s worth noting, however, that at the onset of COVID, “click and collect” platforms (like Walmart Grocery’s curbside pickup) and delivery services were not without their pitfalls. Many shoppers complained that they had very difficult times getting delivery or pickup slots. Furthermore, frequent out-of-stocks led to unwanted substitutions that fueled shopper frustrations. Ultimately, though, consumers were willing to trade-off frustration for safety and this kind of pressure-testing of these capabilities can give retailers and developers insights to optimize these services in the future.

It’s also worth noting that e-commerce is winning over a sizable buying group that has traditionally eschewed the channel: elderly shoppers. In the past this segment put up a significant amount of resistance to buying everyday items online but given they are far more likely to get seriously ill from COVID-19 than younger shoppers, they are turning to their computers and devices in droves to shop for staple items. As such, this target must be considered when designing user experiences for these services.

Don’t see the need

With this backdrop – a changing retail landscape in which a pandemic is driving shoppers to e-commerce channels for everyday items – FMCG companies concerned with maintaining year-over-year growth must invest in the online shopping user experience. The problem is, many marketers don’t see the need to do so. As these CPG companies move away from brand.com-type sites and invest significant advertising dollars in online media and sponsored ads to drive shoppers to product detail pages on Amazon and other online retailers, marketers feel as if their investment in UX and UX research is unwarranted since brands have less control over these experiences. They couldn’t be more wrong.

Consider brand stores on Amazon.com. Many of our clients have stopped using online media to drive visits to their brand.com websites, opting to drive them closer to the point of purchase on e-commerce sites like Amazon. In fact, in some advertising programs, Amazon requires brands to invest in its advertising services. These ads have to point somewhere and in the case of Amazon, they likely point to a product detail page on the retail giant’s site. This is one of the final steps in the customer journey and it has just about everything a marketer needs to sell the shopper on the product including ratings and reviews, bullet points on product information, pack and product images and videos.

The structure of these pages and the content they include does more than just convert browsers into buyers. It also helps discoverability by optimizing search engine results. In the user experience research work we’ve conducted, we’ve found that the majority of people visiting e-commerce sites lean on the search features of those sites and use both brand-specific and category search terms to efficiently shop the store. Heat-mapping we’ve done through eye-tracking supports qualitative feedback we hear frequently from shoppers that suggests they value efficiency in the shopping experience and do not sift through more than one page of search results before either selecting a product or changing their search terms. As such, search engine optimization is paramount.

Aside from paying for better search results placement through sponsored ads, brands can improve their search results on e-commerce sites by optimizing their product detail pages and brand store pages. Doing so requires the marriage between content strategy and UX design best practices, which are both dependent on the foundational insights uncovered in user research. The answers to the following questions are paramount to developing both a content strategy and an impactful UX design:

- What need states influence online shopping behavior for these categories?

- How does that impact online retailer choice?

- How does a shopper build a basket online?

- What impacts basket size at the online point-of-purchase?

- What content do shoppers pay attention to on a product detail page?

- What are the barriers to conversion?

- What tools will help cross-sell our other categories online?

- How can the layout be optimized for shoppers with different degrees of technological sophistication?

Armed with these insights, UX designers can create an optimal user experience that will improve product detail page visits and conversions. In addition, manufacturers can bring these insights to retail clients as thought leadership – something that is expected of “category captains.”

More than a short-term trend

The e-commerce channel has been growing for FMCG brands and this growth will continue in the post-COVID-19 era as shoppers realize the benefits the channel provides. However, we also know that while shoppers are willing to put up with a number of poor experiences now as a trade-off for increased safety, there is a prime opportunity for brands and retailers to reevaluate the online shopping experience to retain the shoppers they’ve won and make e-commerce growth more than a short-term trend. Marketers must optimize the user experience of their product detail pages and brand stores on e-commerce websites as this will lead to greater shopper delight and satisfaction. If they do, we believe that the unprecedented growth FMCG companies have experienced in the e-commerce channel can be sustained.