A healthy interest

Editor's note: Based in Chicago, Antje Sardo is senior research analyst with research firm GutCheck.

The health and wellness foods category has expanded steadily over the past few years, with some sources reporting a growth rate more than double that of the total food and beverage retail industry. Consumers are shifting their purchasing towards better-for-you foods and beverages and are on the lookout for products that claim to offer health benefits.

The health and wellness foods category has expanded steadily over the past few years, with some sources reporting a growth rate more than double that of the total food and beverage retail industry. Consumers are shifting their purchasing towards better-for-you foods and beverages and are on the lookout for products that claim to offer health benefits.

Food and beverage companies are readily jumping on this trend, promoting their products with claims that convey they are better (or healthier) for the consumer and launching new products to meet increasing market demand. Retailers have also adjusted to this shift and are offering consumers a wider variety of healthy options to choose from. The growth of this previously niche category reflects an evolution in consumer mind-sets and lifestyles and looks like a trend that will continue into the foreseeable future.

To complement the work of our food and beverage clients, GutCheck decided to conduct our own research to explore the better-for-you food and beverage space. We wanted to be able to answer client questions such as:

- How important are health considerations to consumers, especially when compared to product prices?

- Which better-for-you claims are most important to consumers?

- How do different generations view the better-for-you space?

- What do consumers think about “clean” claims and where do those claims fit?

At the end of 2019, GutCheck conducted an online research study with 7,000 respondents, representative of U.S. adult food and beverage consumers and balanced by gender, age and region. Although mostly quantitative, the survey allowed qualitative input through open-ended answers and video upload options and also linked respondents with their behavioral data from various sources through GutCheck’s data management platform provider.

While this initial research was extensive and wide-ranging, it was also completed prior to the COVID-19 pandemic. Knowing that the pandemic and its stay-at-home orders would likely impact the food and beverage retail space, two additional waves of the same study were conducted to determine any meaningful changes in consumer behavior.

So, how are consumers shopping? Below are some of the most interesting findings from our research related to how consumers purchase better-for-you food and beverage products.

Health matters. Consumers pay just as much attention to the health benefits a product offers as they do to the product’s price. In fact, 56 percent of our respondents stated they do actually read the ingredient label and take that information into consideration when making a purchase.

So does price. Approximately two-thirds of those who shop mainly with health in mind are also looking for the lowest price. However, considerations do start to shift more towards health priorities if consumers have a very specific health focus. For instance, if someone is dieting and paying close attention to what they feed their body, or must avoid certain foods or ingredients (e.g., lactose or gluten), they are less concerned with price than others might be.

Target younger audiences with better-for-you claims. Millennials (ages 23-38) stood out in our research as the generation placing the most emphasis on healthy food and beverages. This fits with their general lifestyle: our behavioral data emphasizes that Millennials are twice as likely as the general population to be on a diet, go regularly to the gym and go running. However, it is important to note that Millennials still pay just as much attention to a product’s price as they do its health claims.

Taking care of the environment. Millennials are generally known as a group that is very environmentally conscious, with many leading the charge on eco-friendly initiatives. This extends to their food and beverage purchases as well. While those claims are not as important to them as health and price considerations are, we noted that Millennials are more receptive than other age groups to products that emphasize environmentally friendly and sustainable practices.

Taste is king. No matter what type of food or beverage product they purchase and what the consumer’s individual priorities are, the most important aspect to the purchase decision is that the product tastes great: 67 percent of consumers find taste or flavor important and 51 percent say that the quality of ingredients used is a critical purchase driver (Figure 1). While quality ingredients are more important to consumers on the lookout for healthy products or those searching for specific products that fit their dietary needs, taste remains the No. 1 priority for consumers across the board.

Youth shows less loyalty. Millennials and Generation Z are less likely to rely on previous food and beverage experiences than Baby Boomers, meaning they are more likely to try different brands and products they may not have consumed before. They are therefore the core target for new food and beverage products that are introduced to the market, especially if those launches are in the healthy product space.

Increasingly interested

As previously mentioned, consumers are increasingly interested in healthy products and are purchasing more food and beverages that display better-for-you claims. In fact, 65 percent of respondents state that either “most” or “some” of the products they buy fall into the better-for-you category.

This is especially true among consumers who have a special interest in healthy products. Those groups include:

- Millennials, approximately half of whom are currently on a diet or continuously follow dietary restrictions;

- parents looking out for their children and families;

- consumers with a special focus on health and fitness;

- consumers who follow a diet (either a general diet, like vegetarian or flexitarian, or more specialized, like gluten-free or vegan).

Generally, consumers consider better-for-you products as anything they perceive to be healthier than other available options. When asked on the spot which claims fall into this category, “organic,” “no or low sugar,” “reduced fat” or “fat-free,” “natural,” “non-GMO” and “low sodium” are mentioned most often.

Interestingly, protein does not appear as an important claim right off the top of consumers’ minds. However, when prompted with a list, protein emerges as the better-for-you claim that consumers find most important. We believe this is because they view protein less as a marketing claim and more as an ingredient. Calling out a specific ingredient is a credible claim and therefore is a major influence in the consumer’s purchase decision.

Besides protein, better-for-you claims around low or no sugar, no artificial ingredients (preservatives, flavors, fillers and sweeteners) as well as natural, resonate strongly with a broad consumer audience.

While these claims are important to Millennials, protein stands out as the one most important to them. Additionally, “organic” and “clean” claims also resonate strongly with this age group, more so than with other generations.

To summarize our better-for-you findings:

- Millennials are the most receptive generation to better-for-you claims and should be the core target audience for food and beverage products playing in this space.

- They are also more open than older generations to give new products a try, so aiming new healthy products toward Millennials is advisable.

- Protein claims resonate particularly well with Millennials and they are more inclined to find “clean” claims important.

No clear-cut definition

What are clean-label products? The fact is, there is no clear-cut definition. While the Food and Drug Administration has not defined what clean-label entails, it is generally considered to be natural products containing ingredients that consumers are familiar with and easily recognize and contain no artificial ingredients or synthetic chemicals.

Millennials lead all age cohorts in reacting positively to clean claims. In fact, 21 percent of Millennials state they exclusively try to purchase food and beverage products that are considered clean. Seventy-one percent of Millennials are also prepared to pay a little extra for food and beverage products that are clean.

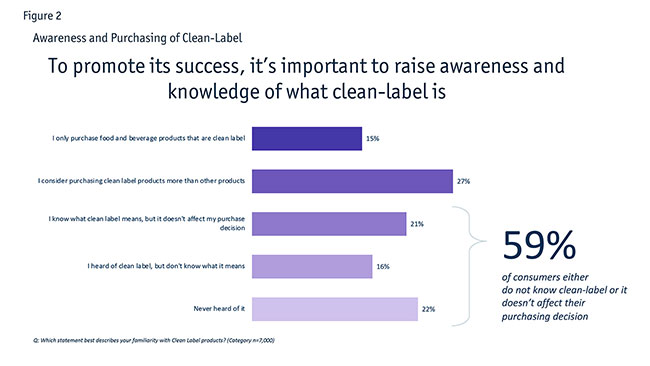

However, at a general consumer level, clean claims are not that impactful, yet: 59 percent of consumers age 18-65 claim that clean claims do not impact their purchasing, either because they have never heard of clean-label, don’t know what it means or simply don’t find it compelling enough to affect their purchase decision (Figure 2).

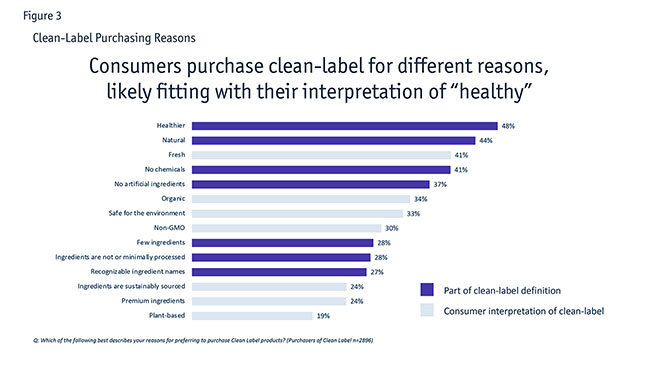

The issue is that clean-label seems to have a bit of a labeling problem. Consumers interpret much more into clean than intended and this is particularly true for Millennials. Not really surprising, since there is no official or regulated definition. Purchasers create their own meaning and can include claims such as: safe for the environment; organic; non-GMO; sustainably-sourced ingredients; plant-based; premium ingredients; locally grown (Figure 3).

None of the above terms are a part of the core meaning of clean-label, yet consumers associate them with this claim. The general lack of understanding and misconception around what constitutes clean products may hinder their growth potential. However, these misconceptions emphasize what is important to consumers and what they associate with clean.

What does this mean for companies who play in the clean-label space?

- Have a clear understanding of who the clean-label shopper is. They are more likely to be Millennials, tend to be more focused on health and dieting than general consumers and are more likely to shop online, at health or specialty stores like Whole Foods or at club stores.

- Market products to the clean target. Due to a blurred perception of what the term means, brands can control the conversation and educate consumers on what the clean category includes and why their product fits.

- Consider other causes important to your target consumer, such as environmental impact and sustainability, and find ways to incorporate those into your messaging and marketing.

Much more health-focused

Everything mentioned up to this point confirms that Millennials are much more health-focused than other generations when it comes to the foods and beverages they purchase and consume. And that makes sense, since behavioral data suggests that Millennials are twice as likely as the general population to: be health-conscious and focused on eating well; stay fit; pay attention to their overall wellness; maintain a diet and active lifestyle by participating frequently in outdoor sports, running regularly and going to the gym.

How do other generations differ from Millennials?

- Generation Z (aged 18-22) also care whether the products they purchase are healthy and have limited impact on the environment. While not as committed to these causes, they are still paying more attention to them than older consumers.

- Price plays a major role for Gen Z. With less disposable income available, these young consumers are more concerned about what they can afford, even if they would like to purchase healthier and more sustainable products. The older consumers are, the less focused they are on searching for the lowest-priced products.

- Older generations, like Baby Boomers and to some extent Gen X, tend to be more interested in gut health, low/no sugar claims and no artificial add-ins in their food and beverages.

- Baby Boomers are the least interested in clean claims. Instead of jumping on the clean trend they are happy with looking for products that display claims like no preservatives, no artificial flavors, no synthetic chemicals, etc. Does this then mean that Baby Boomers are not interested in clean products? We don’t think so. Technically, there may be little difference between a “no preservatives” claim and a clean claim. The difference lies more in Baby Boomers’ hesitation to adapt to new trends and accept new terminology. Baby Boomers have quite a clear understanding of what clean-label stands for. They just think that established claims like “no preservatives” that they have likely been purchasing for a long time are good enough.

Time will tell

The COVID-19 pandemic has disrupted our lives in the U.S. and elsewhere. Shelter-in-place orders have changed consumers’ habits and behaviors. Despite reopening in phases, some of these changes may become the new norm, but only time will tell.

As mentioned, we re-fielded our better-for-you study during the pandemic to determine how, if at all, consumer behaviors and priorities may have shifted. The second wave of our research took place between March 28-30, 2020. For reference, by March 30, 30 states had a stay-at-home order in place, while just one week prior, only nine states had such measures in effect. Wave 3 was conducted five weeks later (May 1-6, 2020). At this point about 17 states had just issued some type of reopening order – the extent of which varied by state – and other states started to discuss plans to reopen in phases.

The pandemic indeed had a clear impact on consumers’ grocery shopping behavior. A few highlights are outlined below.

Consumers are less focused on the price of groceries. This is likely driven by product availability as well as the fact that consumers make fewer shopping trips. They are more likely to visit only one retailer and condense their shopping time. This allows less time to make their purchase decision if several choices are available. This diminished focus on price became visible early on during the pandemic and is most pronounced among younger consumers (Gen Z and Millennials).

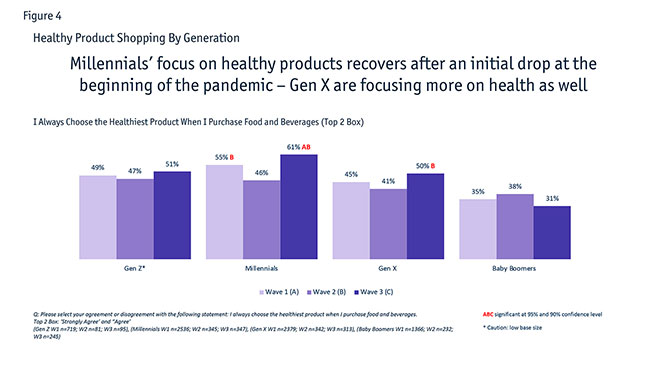

Priorities are shifting. At the beginning of stay-at-home orders, consumers also paid a little less attention to purchasing healthy products, likely driven by the need to stock their pantries to be able to feed themselves and their families over an extended period of time. However, towards the end of the stay-at-home orders, this focus shifts. Grocery shoppers overall regain a strong focus on selecting healthy products (Figure 4). Especially among Millennials and Gen Z, this focus clearly trumps price considerations and is further emphasized in consumers again paying more attention to reading ingredient labels.

Purchasing what was available

While the importance of better-for-you claims and product purchasing shows little impact during the COVID-19 pandemic, consumers’ focus on clean claims was impacted. Likely driven by Millennials focusing on stocking up and purchasing what was available, their focus on healthy and also clean products dipped initially. However, after this initial period, Millennials became used to the new situation and regained their focus on healthy products and, with that, clean claims.

There is even indication that clean claims gained traction towards early May. This may be because consumers are now less focused on price and had a chance to try out clean products during the stay-at-home orders or it may be an expression of a new, potentially more health-focused mind-set that consumers have developed coming out of the first COVID-19 wave.

Other selected insights we have noted since the pandemic began:

- There is an increase in consumers sharing grocery shopping responsibilities with others in the household. With more consumers working remotely from home or having lost their jobs, children being at home all the time and limitations in some states on the number of items allowed to purchase per person, splitting up shopping responsibilities among the adults is a natural development.

- Not surprisingly, with restaurants closed or only open for takeout, online ordering of restaurant food has increased.

- Online grocery delivery services have also gained momentum, particularly in the West and Northeast regions that were most affected by the coronavirus early on. Among Millennials, Gen X and Baby Boomers there were sharp increases of up to 10% in first-time online delivery ordering. These new users of online delivery are not only trying the service out, they are using these new services at least every two to three weeks. They are creating a habit that may well carry on after the pandemic.

- In addition to the online shopping explosion – which is driven by the social distancing rules – we also see some impact on retailers. Consumers are shopping more at club stores while some discount stores show declines in shopping visits. With the regained focus on healthy products, health food stores gain back some traction.

Bound to follow

What does this all mean in the long run? Millennials – with their confirmed focus on better-for-you food and beverage choices – are leading a trend that other age groups are bound to follow. With price concerns falling behind, the door to selling healthier, wellness-focused products is opened even further and we expect consumers to continue making healthier choices.

In fact, the rise of health and wellness products may even accelerate after the pandemic. The growth of online shopping could also lead to an increased variety of healthy products that will be available to consumers. However, once we are no longer sheltering in place, economic considerations may again start to impact consumers’ choices more than we are currently seeing, as we expect product and price comparisons to again play a bigger role in informing consumer decisions.