Understand and overwhelm

Editor's note: Alan Hale is president of Consight Marketing Group, Chicago.

In business, the general consensus is that acquiring new customers is five to seven times more costly than keeping your existing ones. While customer acquisition is indeed important, so is holding onto your current customers and turning them into raving fans.

As defined by Ken Blanchard in his book, “Raving Fans,” a raving fan is a customer who is excited about your product, service or solution. Think of Apple and Tesla; these companies have waiting lists and long lines for new products. Raving fans are your brand advocates and are an extension of your company and its offerings.

For those who haven’t read the book, the characteristics of raving fans are as follows: they are extremely loyal and less likely to defect to a competitor; they will buy more; they are more likely to buy new products, services or solutions offered in the future; they are usually (not always) less price-sensitive and therefore are more profitable; they may give insight on possible new products, services or solutions; they often refer you to other friends and colleagues and/or provide testimonials.

Learning about your customer and their needs via market research and interactions with them is the foundation for making them into raving fans. Once you understand the needs and wants of your stakeholders in large key accounts, then you execute initiatives to endear yourself to the people who use your products or services.

I have been fortunate to have managed over 50 engagements on customer satisfaction and loyalty across a wide variety of industries. Based on this experience, I wanted to share some insights on using a research-based framework to create raving fans. Most of the following is applicable to both B2C and B2B, with the exception of the 80/20 rule, which is explained later.

Validate your customer segmentation and value proposition. If these are not correct, it will be difficult to impossible to create raving fans. For example, if you are selling a product with bundled service at a higher price point and the customer has their own internal technical support team, you most likely will not be successful. If you have a brand-new instrument and it is more difficult to use, you will likely fail. Use market research to understand if you are delivering the right value propositions. Why will the customer buy your product, service or solution over the competition?

Concentrate your effort by focusing on the 80/20 principle. In B2B, conventional wisdom is that 20% of your accounts make up 80% of your revenue. So, if you have 1,000 active accounts, there are 200 that your business depends on. Spend the bulk of your research dollars and effort obtaining insight from these top accounts. Another way to look at it is if your No. 1 account defects, how much turmoil would your business be in? Concentrate on over-servicing these key accounts.

Start by listing your accounts in descending order of revenue in a spreadsheet. When you hit 80% of your revenue, you have defined your top major accounts. These are your “gold” customers. Next, add large accounts that have either walked away or have significantly decreased their purchases with you. Then, add to that any accounts that you legitimately believe (not just based on the salesperson’s opinion) can evolve into a large account. Finally, add key target prospects who might grow into large accounts. This is who you should be trying to understand in order to deliver outstanding service.

Identify the stakeholders in each account, those who use the product or service, those who specify the product and those who make the purchase decisions. Usually, every key account has two, three or more key stakeholders. It could be the user, the specifier and the person who purchases. For a plastic-bottle manufacturer, for example, it is the packaging engineer, purchasing and marketing.

Get out of your chair. Go out and visit customers. Listen to your them. This is the absolute foundation for creating raving fans. You need to obtain insights that are seldom delivered from web-based surveys. Ask them: How are we doing? How do we compare to our competitors and your best-in-class vendors? What else should we be doing?

This is how Lou Gerstner changed the culture at IBM when the firm lost its way. In my opinion, it is negligent to not call on customers to determine how you can improve.

Implement the 10/30/90 rule. The CMO, VP marketing, VP sales and marketing or marketing director should visit key customers every 10 days or once every two weeks. Customer listening should be 10% of their time. Other functions like engineering, new product design, customer service and billing, etc., need to visit a customer a minimum of once every 30 days and talk and listen to the stakeholders. What improvements can we implement? What can we do to make you a raving fan? Even members of the C-suite can call on a key account every three to four months.

Supplement these personal interviews with other qualitative research. Include a variety of diagnostic questions in order to assess the current health of the client, uncover root causes for unhappiness and prescribe the key actions to work on. I am a strong believer in using qualitative VOC discovery research to obtain insights – the whys. This can be a combination of focus groups, in-depth phone interviews, personal interviews, ethnography and other qualitative research methodologies.

Let’s talk about the pros and cons of web surveys. Web surveys are inexpensive to administer, quick to get feedback and help to make the qualitative data more robust or even statistically significant. I have had numerous discussions with colleagues about statistical significance. If you are surveying into 80% of your sales in a B2B setting – for example, the previously mentioned 200 accounts out of 1,000 – you are not statistically significant on a pure number of accounts basis but you are obtaining insights into 80% of your revenue. Which is more important? Of course, it is the 80% of sales. B2C service providers sometimes have a difficult time with this concept because it challenges their paradigm about statistical significance.

Web surveys are easy to fill out but do not provide the insight, as well as the whys, with or without artificial intelligence. When you add qualitative questions to web surveys, a few things may occur. First, very few respondents take the time to fill the information out. Second, they use two or three words with little elaboration. Sure, you can use AI to count how many times “responsive” is mentioned, but if a respondent says, “They get back to me quickly,” there’s no way for the word “responsiveness” to be picked up and categorized as “responsive.” And word clouds are not insight. They are a visual way of showing the frequency of words cited.

When you do qualitative research, it is like peeling the onion to get to the issues that matter most. An example:

“What is our performance rating for delivery?”

“It is a 5 on a 1-10 scale.”

“Why?”

“The truck is late.”

“Can you further explain?”

“Yes, the truck misses the two-hour window.”

“Why is that an issue?”

“We have a small loading dock and lots of trucks.”

“How can the client deal with this better?”

“It would be great if they called when they are running late.”

There is a place for web surveys but only after the qualitative research has been completed, at least for B2B research. We prefer to use them as a way to collect information from the non-key accounts. From a B2B perspective, spend the research dollars where they have the most impact – your largest accounts.

In B2C, with millions of customers for a product like bleach or toothpaste, it makes sense to start with quantitative research to tease out opportunities where you then utilize qualitative methodologies.

Use a mix of Net Promoter Score (NPS) and CSAT in your market research methodology as well as qualitative and quantitative questions. There has been a lot of bashing of NPS lately in magazines and posts in business and social media claiming it is not actionable. Well, if you use it incorrectly, it won’t be actionable. I hear comments such as, “We have a 27% NPS, now what do we do?” Who knows? If you did not obtain the reasons behind it and how to improve, all you have is a number. If you try to use a hammer on wood screws, it won’t work. Don’t blame the tool.

In our opinion, NPS is very valuable because it measures the relationship using personal risk of recommending. It measures the overall relationship and not a specific transaction. The NPS number is a benchmark and checks on your relationship progressing over time. The real value is in determining the insights and crafting actionable tactics and strategies for each key account that will drive the number up. We have used NPS to predict accounts that will defect as well as those that will buy significantly more in the near future.

In general, it is critical to get the importance level of each criterion as well as our performance score in order to prioritize efforts. If the customer is willing to discuss the competition, the insight obtained will be valuable in showing how you much you need to improve versus the competition, as well as the best-in-class vendors. Ask your customers what actions they would recommend you take to improve during the course of the research.

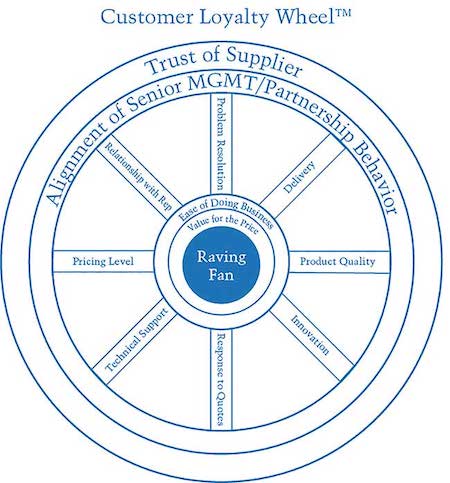

Figure 1 shows the Customer Loyalty Wheel, which is a framework for looking at customer satisfaction, loyalty and the creation of raving fans. It all begins with trust and alignment and ends in creating raving fans. Several elements of the wheel are addressed in further detail below.

Trust. If the supplier continually breaks its promises, there is no trust. The relationship will not deepen and might eventually be terminated.

Alignment. Are your values aligned? Are your objectives aligned? This information is best revealed by market research and executive discussions.

Quality. Quality is table stakes in any business. If your product does not perform according to your specifications or breaks down too often, the account will find another supplier. We had a client who moved its production overseas to reduce costs and increase margins. The client could not understand why it was losing business but customer research showed quality was very poor and the product frequently broke. In instances like this, research can be used to determine the frequency of product issues, their significance and how this compares to your competitors. If you are 30% of their purchases for this product category and have 60% of the quality problems, you are on dangerous ground.

Risk. Pre-sale, it is important to reduce or minimize the risk factor, so the customer is more likely to buy. When you buy the wrong toothpaste, your family might be disappointed. When you buy the wrong CRM or ERP system at work, you could be fired. We had a client who manufactured materials for road construction. When civil engineers were interviewed during market research, they wanted to make sure these materials would withstand heat-thaw cycles for 10 years! When pressed further, they said that tests from an independent lab and having a municipality use the product for two years on heavy-traffic roads in a climate that experienced extreme heat and extreme cold would help reduce their risk.

Be easy to do business with. Don’t be a difficult supplier. Exchange the defective product, have customer service solve the problem, issue accurate invoices. Train customer service, give them the power to make decisions up to a certain level. Everything being equal, a customer would rather give business to someone who is easy to transact with. Conversely, if you are 10% of their purchases and 50% of their problems, expect the possibility of being terminated. Everyone has situations come up; just make them easy to resolve. There is research showing that customers are more satisfied when a vendor heroically solves a problem versus having no problem at all. (Though of course we don’t recommend trying to game the system!) Use market research to understand how you compare to the competition in ease of doing business.

Be responsive and proactive in communications. If, for example, you know you are going to have a delivery problem, call the customer. Isn’t that a novel idea? Nobody likes surprises but if you communicate with them, they can make other arrangements and adapt. Whether it’s sales reps or tech support taking days to return customer calls, many companies do not want to admit that there are problems with their communication. They hope the problems will magically go away. But sometimes it’s the customer who goes away.

New product development. It all starts with the customer. Use market research to determine if your product is filling a need or want, if it is a disruptive product or a me-too product. Think of research as an investment, one that helps you get your product or service launched quicker, leading to earlier profits. We are constantly astounded by the number of companies that develop new products driven by engineers without any significant customer input and then wonder why the product fails. We once had a client that had a new commercial ceiling grid system. It was beautiful and architects loved the appearance. The problem was, the general contractor would not award our client the project as the subcontractor was higher than the bids of other installers because installation of this product required 15% more labor. Higher labor costs = less profit. No one had bothered to get the input of the ceiling installation contractors.

Ease of use/UX. The customer needs to find the product easy to use. A maker of sophisticated lab instruments introduced a next-generation product that was far more accurate than anything currently on the market. But it was harder to use and required frequent calibration from a third party. The client had neglected to obtain the input of lab technicians. Using a combination of phone interviews and ethnography, we were finally able to understand the perspective of the end user.

Partner or just another supplier? It is important to use research to determine if you are perceived as a partner or as a supplier to your accounts. How do your customers and channels view your organization? If your product is insignificant, like a valve, for example, users don’t want or need a partner. But if it’s a crucial product, such as a stainless-steel pump on a pharmaceutical skid or a plastic bottle for a soda-filling line, you’re a partner. If you achieve partner status, ask how you can help them help their own customers implement their objectives. This will set you apart from the competition.

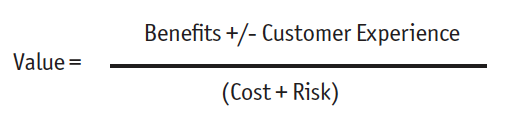

Price. Price is important but more often the real factor is value. Rolex and Timex each have different value for the price. Some customers want a Timex, some want a Rolex. Our formula for defining value in the mind of the customer is as follows:

If you reduce costs or risks at the same benefit, the value goes up. If the costs or risks stay the same and you increase the benefits, the value goes up. It is truly in the eyes of the customer. CPG companies do a much better job at identifying how to add value than many B2B companies. Obviously, you need to use research to define these variables based on the mind-set of the customer.

Use other data inputs. This can include tracking purchases of key accounts over time, analyzing comments from salespeople, call reports, assessing commentary on websites, customer comments on chat rooms, IVR or social media, etc.

Conduct exit interviews with accounts who defected. Why did they leave? Do not assign this task to the sales rep; it is too important. You need to uncover and internalize learnings so you don’t make the same mistake again.

Map the buyer’s journey and moments of truth. The objective is to walk in the shoes of your customers and observe experiences, how they make decisions, etc., as well as how your employees interact with them. Great experiences create raving fans. Bad experiences create brand assassins.

One needs to plot the buyer’s journey pre-sale, during the transaction and then post-sale. What are the most important activities or interactions? How do they search out and evaluate potential vendors? How did we do? Where can we improve? How can we make their search process easier?

I have found many companies are good in both the pre-sale and transaction phases but they often stumble post-sale. Lack of sufficient customer service and technical support creates dissatisfaction. Companies treat customer service as a cost center, appearing to not want to spend on the back end since they’ve already made the sale.

Close the communication feedback loop. Deliver account-specific information to the sales rep and then go back to the account and ask, “This is what we heard, is this correct? What else are we missing? How can we improve?” Create an action plan customized to that account. “This is what we are going to do. We will meet every quarter to see how it is going.” Communicate your performance to the rest of your employees.

Design actionable strategies and tactics in general, as well as for each major account. The CEO needs to drive this across the organization and across silos. It is not owned by marketing, it is owned by every employee in the organization. Each large account should have a high-level advocate.

Making progress

Creating raving fans is a journey, not a destination. Stick to your process so that your research becomes a smart investment rather than just a cost. Measure every 18-24 months after you launch initiatives to ensure you are making progress. After this audit, modify the initiatives accordingly. We wish you much success in your own journey!