Editor’s note: Sarah Browne is founder of Redmond Browne Research, London.

In early 2017 I predicted that your next market research project might involve the cannabis industry. The boom in new product development, job creation, investment and marketplace disruption boosts the odds you’ll soon need to know the difference between indica and sativa; vaping and dabbing; and medical and recreational marijuana. You’ll need to know the impact of cannabis culture on product purchase and the influencers and influences that power today’s green rush.

In early 2017 I predicted that your next market research project might involve the cannabis industry. The boom in new product development, job creation, investment and marketplace disruption boosts the odds you’ll soon need to know the difference between indica and sativa; vaping and dabbing; and medical and recreational marijuana. You’ll need to know the impact of cannabis culture on product purchase and the influencers and influences that power today’s green rush.

The cannabis industry has the potential to impact the majority of market research categories. Whatever your specialty, your skills will be put to good use. In part one of this two-part article I’ll take a look at the industries that will be most heavily affected by cannabis, along with research and recruitment challenges. In part two I will provide tips on recruiting, looking at medical vs. recreational cannabis as well as tips for managing your project.

Corporations and careers

Your career may depend on your ability to dive into the cannabis industry, especially if you’re already working in sectors such as health and wellness; retail; consumer packaged goods; beauty; cryptocurrency; food and beverage; packaging; technology; financial services; and entertainment and media. Let’s take a look at a few examples to see how this is happening right now.

The beverage business: Cannabis is already jolting product use. Over 82 percent of people surveyed in a 2016 study said that using marijuana has caused them to reduce their alcohol intake. A whopping 12 percent of respondents said that they’ve quit drinking entirely because of marijuana. And after 30 years of brewing German wheat ale the founder of Blue Moon moved on to a new venture, Ceria, which is experimenting with cannabis beer.

Big pharma: The U.S. makes up 35 percent of the global pharma market. If the entire country legalized medical cannabis, traditional pharmaceutical sales could plunge by more than $4 billion per year. Is it any wonder these global giants are surreptitiously exploring their options? Previously, big pharma quietly funded anti-legalization efforts – now it has glimpsed the proverbial writing on the wall and advanced to alliances and acquisitions. Global mammoth Johnson & Johnson recently accepted two medical canna-businesses, Avicanna and Vapium Medical, into its Canadian JLabs Innovation network. Even Britain’s GW Pharmaceuticals, with its marijuana-powered epilepsy drug, could land U.S. federal approval – a historic first.

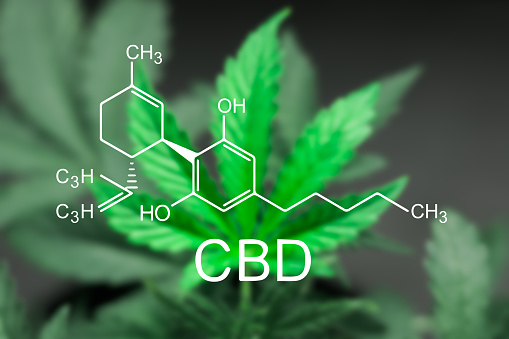

Beauty industry: Cannabinoid creams are about to be among the hottest new products in the $60+ billion global anti-aging market. From CBD to the hemp revival to the entourage effect of CBD + THC, cannabinoids are the next “it” ingredient, replacing the aloes, argan oils and sea proteins of the past. Fragrance is also turning weedy. Perfume company Xyrena has launched what it calls the first "strain-specific cannabis perfumes." Then there’s budding beauty company Whoopi and Maya, celebrity Whoopi Goldberg’s foray into cannabis. Since its California launch, the brand’s footprint has skyrocketed and is now available in more than 300 storefronts.

Food: Last year, the Specialty Food Association (SFA is parent of California’s famous Fancy Food Show) ranked cannabis number eight of the top 10 food trends to watch in 2018. “As more states legalize recreational marijuana, the varieties of pot-enhanced food and beverage will increase,” the SFA’s Trendspotter Panel wrote. “Look out for continued interest and acceptance in a host of snacks, treats and beverages with a little something extra.”

Food: Last year, the Specialty Food Association (SFA is parent of California’s famous Fancy Food Show) ranked cannabis number eight of the top 10 food trends to watch in 2018. “As more states legalize recreational marijuana, the varieties of pot-enhanced food and beverage will increase,” the SFA’s Trendspotter Panel wrote. “Look out for continued interest and acceptance in a host of snacks, treats and beverages with a little something extra.”

Legalization and opportunity

Despite the striking progress in both cannabis legalization and opportunity, market researchers should expect recruiting challenges. Here’s the big one: There is nothing national about the cannabis marketplace. Even California, Oregon and Washington cannot be easily grouped together for research purposes. Each legal state has separate rules, regulations and products. Should you conduct a survey on the state of the edibles market, you’ll soon discover that the best-selling edible in Oregon is a complete blank to cannabis users in Colorado.

In addition, it’s not legal to transport one state’s products to another state – even for testing. Should you want your respondents in Washington to sample California’s No. 1 topical during a focus group or IDI, you’ll need to study state regulations to ensure there is a legal workaround for bringing those pain relievers into the facility. Should you be researching strains of flower, make sure there is a legal place to smoke Over the Moon Kush, Sundae Driver or Motorbreath. Ice those facilities with a deck, terrace or open-air balcony ASAP.

Gifting

Some companies are tapping into so-called “gifting” provisions that are on the books in many states where marijuana has been legalized. They typically allow the exchange of small amounts of the drug so long as it’s given away – gifted – from one adult to another. This method should be discussed with your legal team. Fuzzy loopholes are not without risk.

Hemp

To confuse matters even more, certain types of cannabinoids – hemp, in particular – are largely legal to sample via traditional methodologies. The magic word here is non-psychoactive. If your client is asking you to conduct a competitive landscape of hemp products, go for it. Most CBD-only brands can be toted across state lines, mailed to your respondents and generally tested without calling on your gaggle of lawyers.

Global research

Lest you think you’re off the hook globally, several weeks ago I stood in the Barcelona, Spain, headquarters of award-winning hemp pioneers Harmony. Around me were boxes neatly labeled France, Germany, Spain, etc. And yes, each country has a different set of regulations, preferences and packaging. Harmony wisely maintained consistent colors, names and logos across regions.

Some concerns should dissipate as product manufacturers make licensing deals or acquisitions that extend their reach. But for the majority, what’s created in California stays in California.

Countless possibilities

Despite the obvious potholes, working in cannabis also delivers countless possibilities. This is the opportunity for those of us who delight in researching the next shiny thing. Stay tuned for part two – tips for marketing researchers looking to begin the recruitment process.