Units of measure

Editor's note: Ken Donaven is senior director with The Martec Group.

There is an increasing need among growing business-to-business companies to determine the value of a compelling brand. Often previously overlooked in the B2B space, the concept of brand value is becoming more readily embraced by the leaders of B2B companies, particularly small and mid-sized firms. B2B companies increasingly recognize the value of brand perception and brand positioning, regardless of size and industry sector, but often don’t know where to begin to measure the value of their brand.

A compelling brand is no longer the domain of consumer-facing companies, nor a luxury for only sophisticated, mature enterprises. In fact, if not nurtured with purpose and communicated with clarity, the lack of control over a company’s brand can very much become a liability, particularly if competitors are more purposeful and deliberate about their brand’s position in the marketplace.

Those new to brand insights and brand development suddenly find themselves in somewhat foreign territory. On one hand, they recognize the intrinsic value of maximizing their brand’s position in the marketplace; on the other, they often are unaware of how nuanced and sophisticated brand insights analysis can be. For a startup or fledgling entrepreneurial undertaking, the concept of brand often is relegated to the realm of a company logo, tagline and basic brand messaging.

To elevate a brand and maximize revenue, B2B companies need to understand the entirety of their brand’s value. This can only be accomplished by understanding how the market perceives it and then optimizing it at every potential customer touchpoint. Yet B2B companies have much less access to point-of-purchase data than their consumer-facing counterparts, who often can track and contextualize hundreds (if not thousands) of purchases per day to harvest data and statistics for valuable brand insights.

It is for these reasons that growing business-to-business companies and emerging franchisors typically strive to move from traditional (and often basic) brand analyses to more advanced methodologies that yield better insights and inform more confident and informed decision-making.

Brand insights methodologies, from basic to advanced

The more sophisticated brand insights methodologies become, the more granular – and, indeed, more actionable – the intelligence yielded becomes. While we feel all of the following have merit and application for B2B brands, we often start with the most basic brand insights and evolve to more advanced methodologies as our B2B clients become more sophisticated and purposeful with their brand positioning efforts.

Brand funnel analysis

Many insights professionals are familiar with using a traditional brand funnel to measure brand value. Traditional brand funnel questions include:

Awareness: How familiar is the market with your brand?

Consideration: What percentage of the market considers buying from your brand?

Purchase: What share of the market does your brand currently own?

Loyalty: How many customers make repeat purchases from your brand?

Advocacy: To what extent do people actively recommend your brand to their friends and colleagues and with what degree of enthusiasm?

Studying the behaviors of a market relative to your brand is a baseline for understanding the current state of brand health. This methodology is very valuable as far as it goes. But for many companies and brands, it doesn’t go far enough. That said, if a brand has yet to engage in this analysis, it is a logical starting point, as it will inform more advanced brand insights studies to follow.

Apostle analysis

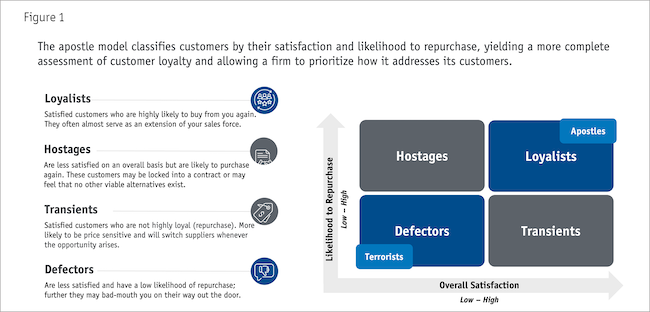

An apostle analysis (Figure 1) involves a combination of customer satisfaction (CSAT) metrics along with some grounding in customer spending. Apostle analysis dictates that respondents are divided into customer cohorts based on customer loyalty metrics, with each cohort studied as a distinct buyer persona rather than looking at the respondent pool as one homogenous group.

The apostles among the respondent pool are those who score the brand very highly for the CSAT metrics of likelihood to repurchase and overall satisfaction. On a scale of 1 to 10 against which to rate the brand, with 10 being the most positive responses, the apostle cohort includes respondents who rate both metrics a 10.

The value a company derives from its apostles in the market is almost always higher than other, lower-scoring cohorts. Apostles are often brand advocates and such individuals do some of the brand’s marketing and advertising for the brand. By understanding all satisfaction drivers and purchase motivators of this specific cohort, the brand is armed with valuable intelligence as to where to spend its marketing dollars and customer-nurturing efforts.

A brand obviously wants more apostles than it wants those less loyal to the brand – call them transients. Transients are likely to leave a brand over price or some other fickle desire. In many cases, you may also have cohorts who score the brand very highly on likelihood to repurchase but lower on overall satisfaction. These buyers are considered hostages and they are not your advocates. Such customers feel as though they are committed to a given provider out of contractual obligation or lack of viable options, so these customers are more likely to abandon your brand if other options become available. Even worse, some identify the extremely negative respondents as terrorists – those looking to actively detract from the brand, do it harm or discourage others from purchasing. Although these are extreme examples, in this day of rampant online reviews, identifying and eliminating brand terrorists is in your brand’s best interest.

Focusing the brand-value analysis on various cohorts – especially the apostles – yields far more actionable intelligence than looking at the entirety of the survey data and drawing overly generalized conclusions that might be imperfect (at best) or entirely inaccurate (at worst).

Brand mapping

Brand mapping is an extremely effective way to understand your brand’s market position. It is conducted by mapping customer perceptions of your brand across various qualitative or quantitative metrics, allowing the brand to draw direct lines from public perception to hard numbers such as sales, pricing strategy and other financial metrics that move the revenue needle in meaningful and measurable ways.

Brand mapping analyses – such as price-value mapping – allow the brand to uncover and visualize opportunities to improve upon key metrics according to the market’s preferences, rather than merely on internal hunches. For example, a common brand mapping study might examine two metrics – price and perceived product quality – beginning with internal stakeholder analysis then moving out concentrically until the perceptions of the customer are factored in.

Internal stakeholders may believe the brand is perceived very positively on both price and product quality. However, when considering the perceptions of the sales team, it might be revealed that both metrics are in reality less robust. Perhaps this team is closer to the front lines and can more readily access negative perceptions from the customers’ perspective. Finally, when customers are surveyed, maybe product quality scores are even lower.

Once all of these various insights are mapped against the competitive field, it becomes intuitive to visualize where the brand truly stands in the marketplace. Overlaying pricing study data allows informed decision-making relative to pricing strategy vis-à-vis customer perceptions. As a result, brands can identify otherwise hidden opportunities to increase product quality, customer service or the perceptions thereof. They may also uncover opportunities to position the brand at a more premium price point if that’s how the brand is perceived by the market against competitive alternatives.

Sentiment analysis

As we’ve highlighted in previous contributions to Quirk's (“Art and science: Injecting emotion into business-to-business marketing,” Quirk’s e-newsletter, July 5, 2023), even business-to-business brands need to work diligently to understand the human, emotional drivers behind the consumer’s affinity to a given brand. In fact, in some cases, it’s even more important for them than it is for their consumer-brand counterparts.

Businesses typically don’t purchase products and services from other businesses. Rather, people at businesses buy from people at businesses. Intrinsically, these human buyers and prospects are driven by emotion just as much as consumers in retail and other CPG sectors. Understanding the brand’s emotional value using emotion intelligence (EI) methodologies is perhaps the most critical – but the most often overlooked – brand insights analysis for B2B and consumer brands alike.

It’s important to understand which emotions drive consumer behavior in a given category and to be careful not to oversimplify the calculus. Some brands actually need to lean into what might otherwise be considered negative emotions, such as fear or avoidance. (Think insurance and personal injury law, to name two examples.) Other brands must evoke desire or attraction (say, fashion, hospitality or food brands).

However, the nuance lies in understanding the connective tissue between one’s target market’s preferred emotional state and that which your product or service can credibly deliver against. Sometimes a negative emotion (fear, say) can be a positive purchasing motivator. But just because the negative emotion may be driving the decision to buy, that doesn’t mean the market can’t have a very positive sentiment with respect to your brand.

An effective approach to studying and documenting these emotional drivers works along eight major channels/dimensions (Figure 2):

- Pleasant vs. unpleasant – as discussed above.

- Active vs. passive – Pepsi’s “joy” versus Coke’s “serenity,” for example.

- Inward vs. outward – Is a person feeling the emotion or is the brand expressing it?

- Passion vs. dispassionate – A sliding scale, ranging from 0 (no passion) to 10 (a great deal of passion).

Once these emotions are detected, documented and aligned along a matrix, the brand can build the emotional DNA of its brand messaging, visual identity, marketing and advertising strategy, packaging, customer service, product development and so on. It also empowers those who chose to lean into sentiment analysis to better identify, nurture and celebrate the brand advocates and ambassadors who will summon those emotions to maintain brand loyalty and affinity, as well as to enthusiastically recommend it to family, friends and colleagues.

Emotion intelligence is largely a brand-value-oriented analysis – studying the emotional connections between human and company, product or category. Sophisticated EI combines elements of both quantitative and qualitative data analysis, because emotions are so complex, often difficult to express in language (as well as interpreting that language) and can be deeply buried in a person’s subconscious.

Even neuroscience has begun to play in this area of research, deploying sophisticated technology and tools to study emotions in humans by hooking them up to machines to detect brain activity and monitor chemical changes that might demonstrate emotions that they won’t necessarily freely articulate.

Of course, AI is gaining favor in this arena, as it is in nearly all walks of life. However, because we are dealing in understanding emotions that only humans have truly experienced, we believe that it’s critical to inject human oversight and participation in such studies. We call this technique augmented intelligence – the empowerment of artificial intelligence applied with the supervision and scrutiny of human intelligence.

Lifetime value analysis

The important thing about brand insight analyses is that they don’t exist in a vacuum or as a single snapshot in time. In fact, another type of study not mentioned specifically above is lifetime value analysis, which is key to understanding whether the value of the brand is increasing over time, especially as the company grows, its market expands and the stakes get higher with each evolution of the company’s growth

Lifetime value analysis allows the brand to establish baseline metrics, using any or all of the methodologies explored above, and to chart progress over time. This dynamic data set also empowers leadership to zero-in on various cohorts over time to see how fluid various customers are relative to affinity and loyalty. We can measure the brand loyalist against the brand transient and observe brand perception and buying behaviors using time-series analysis.

All of this allows the growing mid-sized business, franchise operator or other B2B brand to apply the same level of granular analysis that consumer brands employ more readily, using real-time sales data that happens every day, everywhere, at scale. Most business-to-business companies don’t have access to such volume of data, so they need to mine for it to uncover its hidden treasure.

Brand as competitive advantage – yours or theirs?

At the end of the day, brand value analyses should be much more than merely intangibles that many often associate with branding and perception. Such studies should be rooted in data science and aligned with key performance metrics that drive growth and impact the bottom line. They should be used to capture market share, increase profitability and drive specific desired financial outcomes.

Regardless of the metrics your particular brand chooses to optimize for, what’s common to all is that better informed equals better decisions. Data is out there; it just needs to be mined and refined into intelligence. That intelligence, once converted into action, is the fuel that the winning brands use to separate themselves from the also-rans.