Standing out from the pile

Editor's note: Mike Berinato is vice president, research and consulting at Market Strategies International, a Cambridge, Ma., research firm

Consider your wallet. There are probably a few credit cards in there – about three or four, if you’re like the average American.1 Why did you choose those particular cards? Was there a benefit or feature that swayed your decision? Are you interested in getting more benefits from your credit cards? Do you even know all the features your cards have?

Consider your wallet. There are probably a few credit cards in there – about three or four, if you’re like the average American.1 Why did you choose those particular cards? Was there a benefit or feature that swayed your decision? Are you interested in getting more benefits from your credit cards? Do you even know all the features your cards have?

For card issuers, understanding the answers to these questions is a key step to getting their card into more wallets. The competition among card issuers is tougher than ever. Issuers face pressure to constantly add new customers, either by convincing them to add a new card to their wallet or to replace a card. But a credit card is essentially a commodity and card issuers have to continually differentiate their offerings.

It’s no surprise then that credit card advertising often focuses on card features – miles, cash back, club access, concierge service, gift products. The payments team at Market Strategies identified 18 commonly offered features. While consumers can find a card that focuses on the availability of one of these features, most cards actually include many of them.

We started thinking about this market from our own perspective as credit card users – how focused are we on the benefits in our wallets? When issuers add more benefits to a card, does that strategy actually win customers? Or could it be that the credit card market is suffering from “feature creep” – a state where issuers one-up each other by offering cards with more and more benefits, regardless of their actual value to cardholders? If adding more features doesn’t work, how can companies most effectively use benefits, perks and rewards to attract customers?

To investigate these issues, we included a series of questions specifically about credit card decisions in our twice-yearly omnibus study. These studies are broad surveys that ask participants about their financial habits and decisions, among other things. We surveyed more than 1,000 people who qualified themselves as financial decision-makers.

We examined consumers’ overall interest in the different benefits and rewards in their primary credit card. We also asked these decision makers how features ranked in importance – which features are nice-to-have, which are must-have and which tip the scales when choosing between two cards.

Assume consumers want them

The fact that so many features are available suggests that issuers assume consumers want them – after all, issuers take on considerable expense when adding more benefits to a product offering. But perhaps that assumption is just what marketers think consumers want.

In fact, our survey results suggest that cardholders don’t know as much as you might expect about their existing card benefits. We found that over 80 percent of consumers are not fully aware of all the benefits their card offers. It seems likely that many of the features attached to cards are going unused or, even worse, are unknown to cardholders.

Does that make rewards unimportant or even unattractive? Certainly not. Our research shows that consumers do care about the benefits offered by their credit cards. Indeed, we found clear patterns in the ways and levels to which consumers value card benefits. Some benefits are important to nearly all cardholders. And, beyond those must-haves, there’s a pattern by user age. What each cardholder wants is a package of rewards that is relevant to his or her lifestyle.

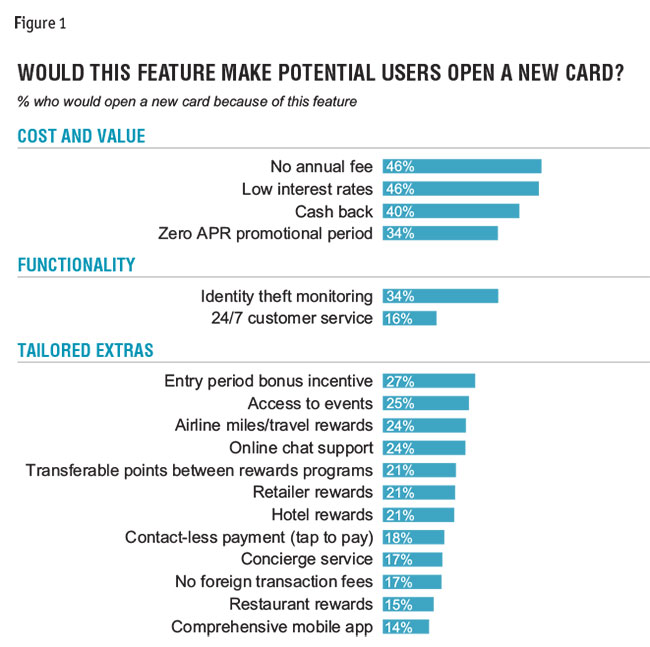

Value is the dominant feature that cardholders want. In our survey results, value-related features rated the highest. A card’s annual fee, interest rate, cash-back level and a zero-APR promotional period are the most important benefits for card consideration and adoption (Figure 1).

Functionality also ranks as a must-have. Identity-theft monitoring and 24/7 customer service are highly desired by cardholders. In the modern era of electronic transactions and round-the-clock access, cardholders have come to expect that their credit card will be a cop on the beat, so to speak – that it will protect and serve.

It’s only after these critical features are established – good value, protection and support – that rewards-oriented features play a role. These are the more glamorous benefits: access to events, travel and retailer rewards, for instance. Tellingly, a higher percentage of respondents marked these features as nice-to-have – something they would value but would not rank as their top priority. However, we found that these tailored extras can be a tipping point for consumers in choosing one card over another. The impact of any one reward is diffuse, though, as different consumers have different needs.

Masterful at matching

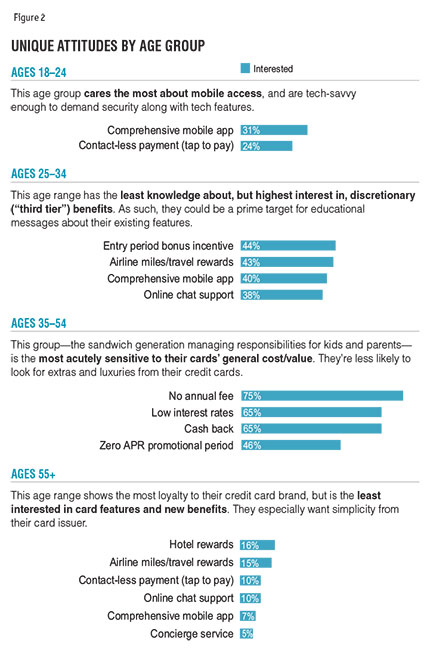

If the impact of any one reward is low, it’s all the more important that card issuers are masterful at matching the right reward with the right consumer. As with any financial decision, we found that consumer preferences are broadly defined by what stage of life each survey participant is in (Figure 2). Using age as a proxy for life stage within our omnibus data, we found interesting and consistent differences in reward rankings.

Tech for the youngest. Unsurprisingly, the youngest cohort, respondents ages 18-25, are the most focused on technology offerings. They showed the strongest preference for mobile access and tap-to-pay availability and are tech-savvy enough to demand security along with tech features.

Up-and-comers want lifestyle perks. Of the two age groups in the middle, the younger end (ages 25-34) is more likely to be interested in lifestyle benefits like airline miles and travel rewards. They typically have the time and opportunity to take advantage of these benefits and would choose a card with an introductory bonus offer that sent them on their way. However, they also demonstrated the least knowledge about the benefits they already have. Cardholders in this demographic could be a prime target for educational messages about their existing features.

The sandwich generation seeks value. Finally, cardholders ages 35-54 show a strong preference for value above all else. They’re the most likely age group to be managing responsibilities and expenses for children and maybe even aging parents. This cohort is less likely to look for extras and luxuries from their credit cards and more likely to seek retailer rewards that compensate them for what they’re already doing.

Simplicity for the most mature. The 55+ crowd is the most loyal to their current card. They have figured out what they need and so other benefits are less likely to push them to a new card. Better travel rewards would impact some, as they are likely to have the financial means to enjoy them. And “making it easier” with tap-to-pay and online chat support is attractive for some.

Package of benefits

For a credit card offer to cut through the clutter and appeal to a consumer, it must offer a package of benefits targeted to that consumer’s personal needs.

For issuers, this means identifying the different needs of potential cardholders and crafting the offer that can best meet those needs. Our preliminary research uncovered some important foundational insights for that process. First, the typical cardholder is not aware of all of his or her card’s benefits and therefore, adding more features to the package is unlikely to inspire adoption. Second, all consumers care most about a card’s value and functionality. Rewards and extras are unlikely to sway any decision-maker unless they are thoughtfully paired with benefits that cover those value and functionality bases. And third, different age groups show distinctive preferences for what they want in a credit card. A deeper look at life stage, demographics, psychographics and purchase behavior would enable a more precise targeting strategy.

Perhaps the time has come for an a la carte approach that allows consumers to customize their own card. An offer that allows consumers to choose their preferred cost benefit (e.g., no annual fee or a lower interest rate) and the rewards they most need would be extremely compelling. Additionally, an offer that provides the option of trading cost for reward features – such as accepting a yearly fee to get airline miles, hotel points or an entry-period bonus – would be even more appealing to the right customer. With a customized card, cardholders would be aware of all its features, feel a stronger connection to its benefits and likely increase use of the card.

Barriers and friction points

These kinds of insights are just the beginning of the acquisition process. Identifying the needs of your target consumers and customizing your offering will not, unfortunately, guarantee acquisition. Issuers also need to determine where to place the offer and how to engage with consumers. Furthermore, issuers need to understand the barriers and friction points that are pushing their offer out of consideration.

This means mapping the path that consumers take to their card choice and knowing where and why the decision is being made. It’s not enough to customize the benefits being offered to consumers; you also need to customize the channel, the messaging and the reasons to believe so that you are meeting each consumer at the right spot in their path with your offer. Ultimately, a properly articulated path will speed the decision process and help issuers to achieve more with their efforts.

The right starting point

As marketing strategies get more complex, it’s important to remember that all of the decisions marketers make along the way rely on assumptions about a market; the right starting point is needed. In the case of credit card holders, our research into benefits preferences yielded some important foundational insights, like the idea that cardholders may not share the same view of card benefits as marketers. According to our data, the typical cardholder is not looking for more features from his or her credit card. To us, this suggests that “feature creep” could be a prime example of how it’s important to consider your assumptions about your consumers.

References