Editor’s note: Frankline Kibuacha is digital marketing and outreach manager at market research firm GeoPoll, Kenya. This is an edited version of a post that originally appeared under the title, “Report: The economic impact of COVID-19 in Africa.”

In this article, I will look at the economic impact of the COVID-19 pandemic in sub-Sahara Africa, focusing on how personal and household incomes have changed, how consumer spending habits have shifted and the financial outlook for the next few months.

Personal finances

Many industries are suffering the brunt of a forced change in lifestyle due to government imposed COVID-19 restrictions. Numerous businesses have closed down or reduced capacity, leading to income and job losses for many people.

The World Bank, in its biannual economic analysis for the region in March 2021, projects sub-Saharan Africa will see moderate economic growth this year, rebounding from the COVID-19-induced recession of 2020. However, the resurgence of the pandemic is dampening those projections, and many are at risk of suffering further setbacks to their personal finances and living standards.

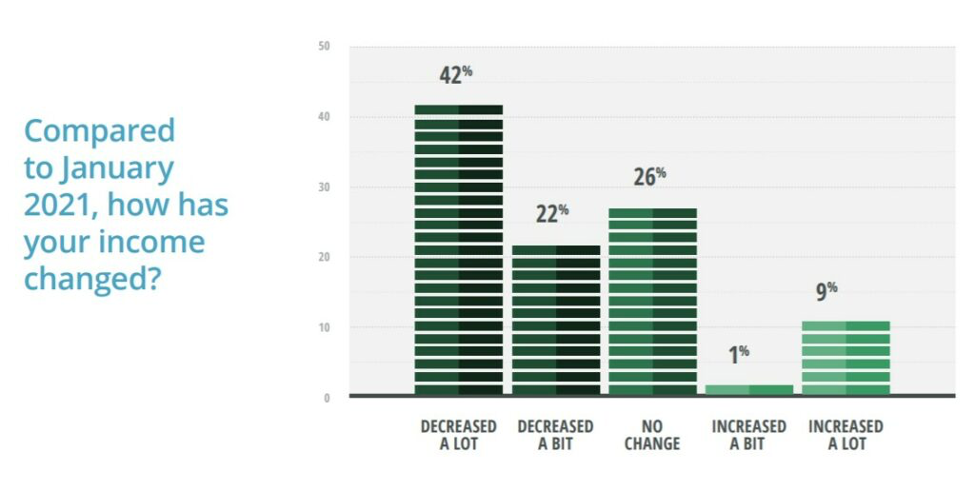

In GeoPoll’s November 2020 study on the ongoing impact of COVID-19 (registration required), 79% of respondents stated their income had decreased since June 2020. Our current study shows that downward trend continuing with 64% saying their income has decreased since January 2021. The largest segment (42%) say it has decreased a lot.

In Kenya, the recent resurgence of the pandemic and renewal of government restrictions around the time the survey ran appears to have had a severe economic impact, with 79% of respondents in the country reporting a decrease in income. Young people in Kenya appear to be particularly affected, with 66% of respondents ages 15-25 saying their income has decreased a lot. Only 10% of respondents across countries said their income has increased even a bit.

Changes to consumer spending

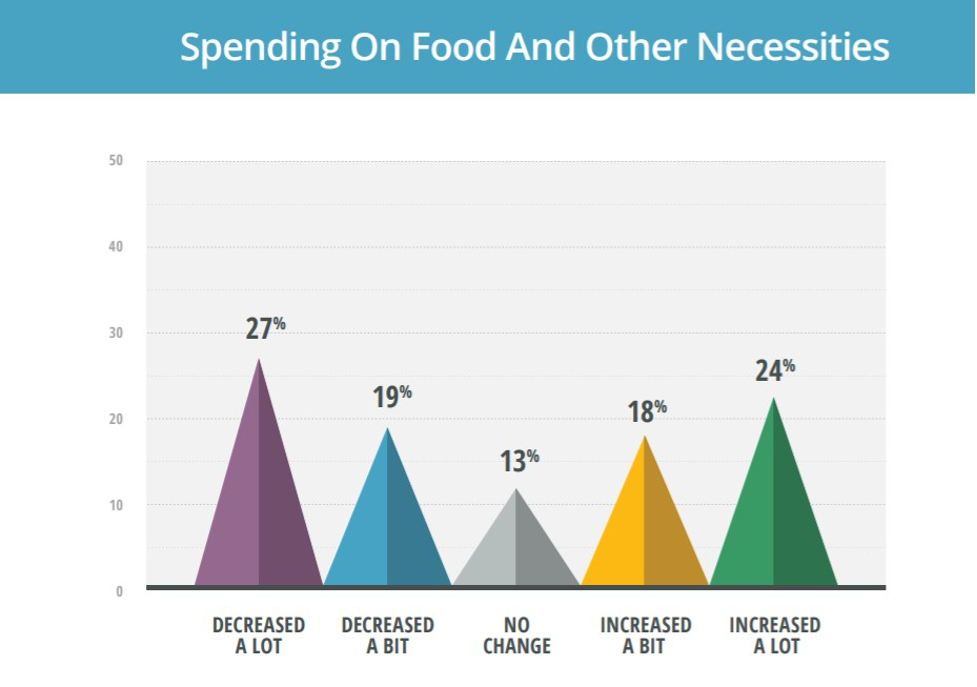

Spending on food and other necessities has fluctuated significantly since the start of 2021. When asked to compare their current spending on food and other necessities to three months ago, most respondents choose the extremes, saying it either decreased a lot (27%) or increased a lot (24%). Only 12% of respondents say it has not changed.

Nigeria’s inflation rate rose to 18.17% in March 2021, hitting a four-year peak due to the impacts of COVID-19. Food inflation in particular rose to 22.95%, putting even more pressure on households facing rising unemployment and shrinking incomes. In our study, 68% of respondents in Nigeria say that their spending on food and other necessities has increased since January 2021. Almost half (47%) say it has increased a lot.

The overwhelming reason why respondents across countries say their spending on food and other necessities has decreased is that they have less money (76%). For respondents that say their spending on food and other necessities has increased, 85% claim the increase is because prices have gone up. In Nigeria, that number rises to 94%.

With 64% of respondents saying their income has decreased since January 2021, it is understandable that 60% of respondents say their spending on nonessential items has also decreased. In Kenya, where 79% of respondents experienced a decrease in income, 51% say their spending on nonessential items has decreased a lot. It is likely a matter of prioritizing essentials such as food over nonessentials such as fashion items.

Most respondents across countries (65%) say the reason why their spending on nonessential items has decreased is because they have less money. Almost 18% say it is because they are spending more elsewhere – likely on food and essentials. Of the relatively few respondents that say their spending on nonessential items has increased, 77% attribute the increase to a rise in prices. In Nigeria, 90% attribute it to a rise in prices.

The near future

The prevalent drop or stagnation in income in sub-Saharan Africa has understandably impacted consumer finances and spending.

Across countries, most respondents (53%) say they are extremely concerned about paying expenses in the next three months.

The level of concern is particularly high in Mozambique with 70% of respondents saying they are extremely concerned, in line with World Bank’s assessment that a sizeable number of Mozambicans could fall back into poverty as a result of the pandemic. Conversely, in the Democratic Republic of Congo almost half (46%) of respondents say they are not concerned at all about paying expenses. That is 12% higher than Côte D’Ivoire and more than double the other four countries included in this study.

Looking ahead, respondents have polarized views about their financial future. When asked to rate their optimism about their financial situation improving in the next three months, 37% are not at all optimistic and 35% are extremely optimistic. Respondents ages 26-35 are slightly more optimistic than the other age groups with 38% saying they are extremely optimistic. Women are more likely to be extremely optimistic than men (38% to 32%).

Nigeria stands out as having the brightest outlook for the future. Despite the tumultuous first few months of 2021, 46% of respondents in Nigeria are extremely optimistic about their financial situation improving in the next three months. Respondents in the Democratic Republic of Congo are the most skeptical, with only 27% extremely optimistic and 54% not at all optimistic. According to the United Nations, one-third of the Democratic Republic of Congo’s population is currently facing acute hunger due to conflict and the economic impacts of COVID-19, providing possible context for that skepticism.

Methodology

The research was conducted between March 24 and April 12, 2021, and was run in six countries (Côte D’Ivoire, the Democratic Republic of Congo, Kenya, Mozambique, Nigeria and South Africa), with some countries completing data collection earlier than others. Sample size was 400 per country and 2,400 total, which provides a 5% margin of error and a 95% confidence interval.