Going (digital) native

Editor's note: Aron Levin is a professor of marketing and director of the Marketing Research Partnership Program at Northern Kentucky University, Highland Heights, Ky. Brian Lamar is director of insights at Cincinnati-based EMI Research Solutions.

Social media has transformed the way companies communicate with their consumers and has given consumers unique ways of communicating with/about companies, sharing their consumer experiences, good and bad, with their friends/followers. As a result, brands have less control over their image and messaging than ever before.

Social media has transformed the way companies communicate with their consumers and has given consumers unique ways of communicating with/about companies, sharing their consumer experiences, good and bad, with their friends/followers. As a result, brands have less control over their image and messaging than ever before.

This article introduces a research methodology for measuring the extent to which consumers communicate about brands and consumption experiences on social media. Realizing that consumers now have a large degree of control on brands’ images and more influence over other consumers’ brand perceptions, our methodology includes survey questions for measuring how a consumer is influenced and influences others on social media, related specifically to products/consumer experiences.

Naturally, we expect that our measures of social media influence will vary by age. In particular, Millennials (18-34) are expected to be unique from other generations in their use of social media as consumers and the importance that it plays in forming attitudes toward products and brands. In 2015 Millennials overtook Baby Boomers as the largest cohort in the United States: There are now 75.4 million Millennials (18-34) in the U.S., compared with 74.9 million Baby Boomers (51-69). As “digital natives,” who have grown up in a world of unprecedented growth in technology, Millennials present challenges and opportunities to marketers. Millennials have largely shunned traditional forms of entertainment and media and spend an average of more than three hours a day on smartphones (Kantar 2015).

New research methodologies for understanding Millennials’ consumer behavior are now necessary. This article explores one such method and, after introducing it, we will explore our use of it to collect and analyze quantitative data that highlight differences and similarities between Millennials and other generations.

Largely irrelevant

Many Millennials claim that traditional advertising is largely irrelevant to them. “Millennials communicate with each other far more than any advertising campaign can. When trying to figure out whether something is worth buying, Millennials will go to their friends and social networks to see what people think. They use this collective filter to sort out research and other word-of-mouth style information when making decisions.” (Newman 2015, “Millennials don’t respond to ads.) Further, as digital natives, perhaps it is no surprise that they are more likely than other generations to skip and use technology to block ads (eMarketer 2015). Yet, despite of their claimed likelihood to avoid commercial messages, Millennials are twice as likely as any other generation to share ads online, according to a recent study (Mulloy 2016).

Our research aimed to combine demographic and attitudinal measures and extend existing work by a) creating measures of social sharing attitudes and behavior and b) collecting data to reveal how Millennials compare with other generations on these measures.

Going beyond the study of digigraphics (descriptive measures related to Internet/mobile/social media usage, such as how much time is spent on mobile devices and social media, as well as numbers of friends and/or followers on social media), these measures allow us to examine how often Millennials engage in brand-related sharing behavior, which could mean tweeting about a visit to a restaurant or tagging a brand in a post on Facebook.

The research reveals insights on how to identify which consumers are social media influencers, thus enabling marketers to better understand the challenge of reaching these consumers in ways that encourage them to influence others.

Phenomena that are not necessarily unique to Millennials – such as ad-skipping and -blocking and watching shows on Hulu, Amazon and Netflix – are creating new challenges for marketers who are trying to get their brand noticed and differentiated in an increasingly complex sea of entertainment and advertising. Thus, the social media sharing and influencing that is examined in the current research is especially important as marketers seek new ways to reach consumers, particularly social media-active Millennials who access sites through their smartphones.

Methodology

An online survey was administered to a national sample of 800 U.S. consumers recruited from an online consumer panel. Millennials comprised half of the sample. Quotas were established for 200 younger Millennials (18-24) and 200 older Millennials (25-34). For comparison purposes, 200 members of Generation X (35-50) and 200 Baby Boomers (51-65) were also surveyed.

Demographics

The total sample across the four age cohorts is 54 percent female, 46 percent male. Millennials differ from other generations on income (less likely to have a household income > $75,000) and marital status (more likely to be single). The data also show significant differences in ethnicity between Millennials and other generations, with young Millennials being the most diverse with 42 percent non-white.

Indeed more active

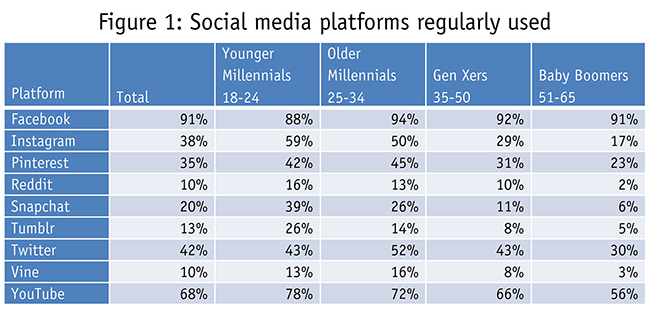

Digigraphic measures have been included in the current study and the data clearly show that, with the exception of Facebook, Millennials are indeed more active on other social media platforms, especially Instagram, Pinterest and Snapchat.

Not surprisingly, Millennials overall lead the way in terms of usage of various social media platforms (Figure 1). However, some differences emerge when comparing younger Millennials to older Millennials. Facebook and Twitter usage may have topped off at the older Millennial age group as younger Millennials are less likely to use these. Younger Millennials appear to be moving to other social media platforms such as Tumblr.

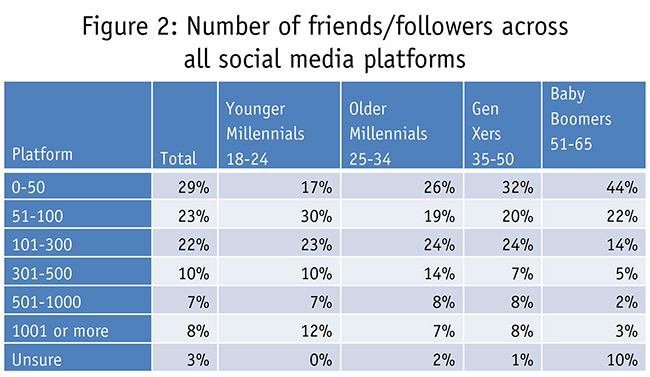

Another measure of digigraphics is the number of friends/followers on social media. This will obviously impact how influential an individual is on social media. When they post, especially about their experiences as consumers, how many people are potentially listening? As seen in Figure 2, 29 percent of younger and older Millennials report having at least 300 friends/followers, compared to 24 percent for Gen X and just 10 percent of Baby Boomers.

Very few differences exist when comparing the number of friends/followers between younger and older Millennials or between Millennials and Gen Xers. Despite the temptation to assume that Millennials are the only generation that is plugged-in constantly, our data show that Gen X is on par with Millennials on several of the measures. It is especially interesting to see that the Gen X cohort is just as likely as older Millennials to have more than 500 friends/followers.

Impact of others’ posts

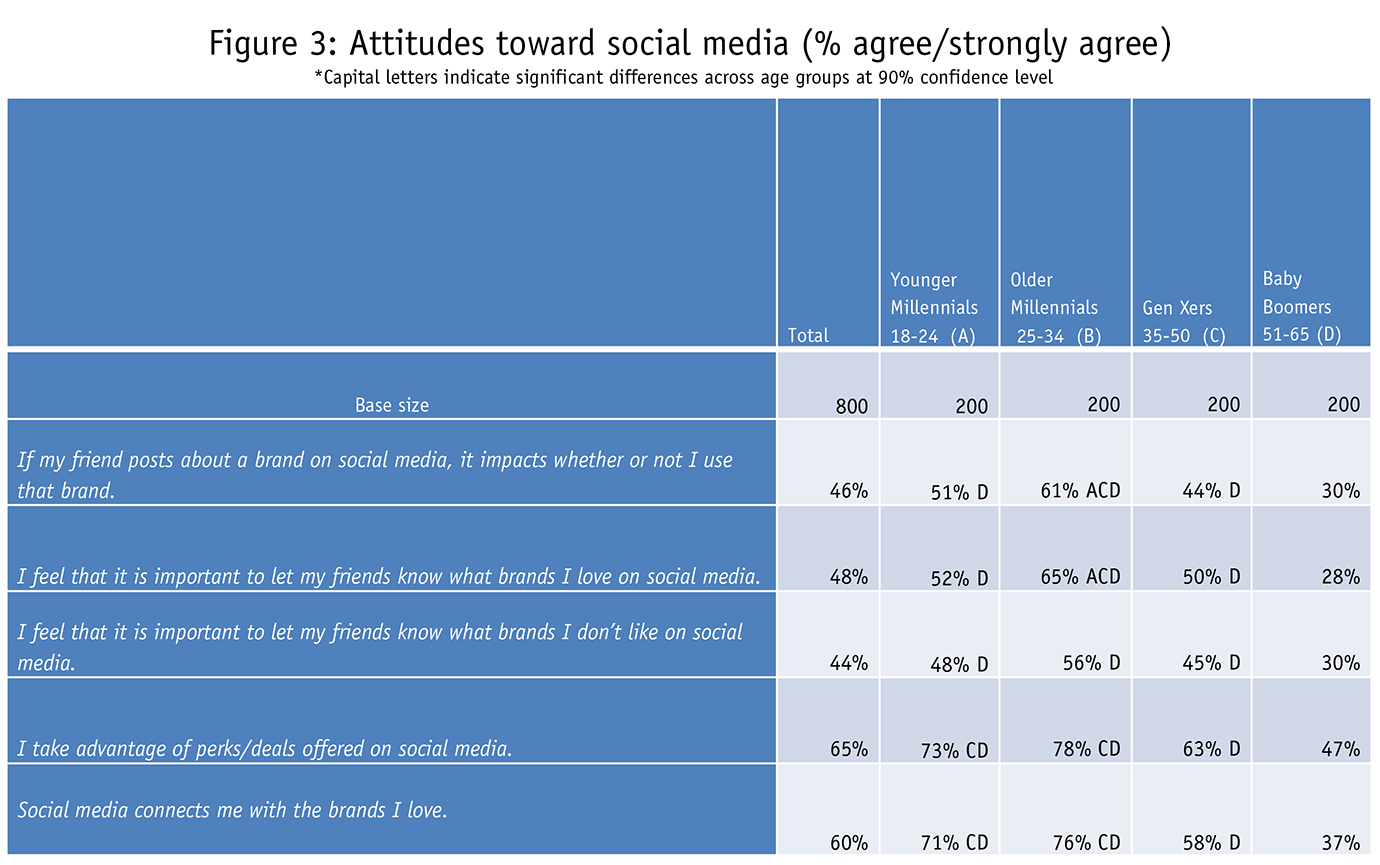

We added several measures of consumers’ attitudes toward social media and the impact that others’ posts have on their attitudes/purchases of brands/products. A series of questions was asked to gauge this impact, with the results summarized in Figure 3. Interestingly, the table reveals that older Millennials have a larger impact than all other generations on brand/product attitudes and behavior and older Millennials also appear to be more likely than other generations to be influenced by others on social media, with 61 percent who agree/strongly agree that “If my friend posts about a brand/product/service on social media, it impacts whether or not I use that brand,” compared to 51 percent for younger Millennials, 44 percent for Gen X and 30 percent for Baby Boomers. The following analyses include gender as well as age, in order to better understand how consumers differ in their brand activities and influence on social media.

Overall, Millennials connect with brands and allow social media to influence their purchase decisions much more than other generations. They’re also more likely to potentially influence others’ purchase decisions by sharing their experiences on social media. Older Millennials are slightly more involved than younger Millennials in connecting/sharing brand experiences. Females are more likely than males in all generations except younger Millennials to agree that “Social media connects me with the brands I love.” In addition, across all age categories, females are significantly more likely to take advantage of perks or deals offered by brands on social media.

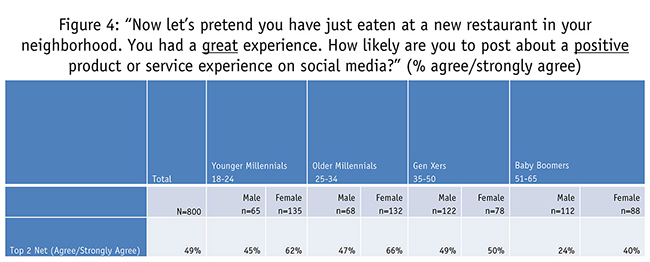

The findings in the current research are consistent with those of a large-scale study by Ipsos in 2016 which found that about half of respondents had made a positive or negative post about a consumer experience. Our findings also parallel those of Ipsos, as we found that consumers are slightly more likely to post positive experiences than negative ones. (Ipsos 2016)

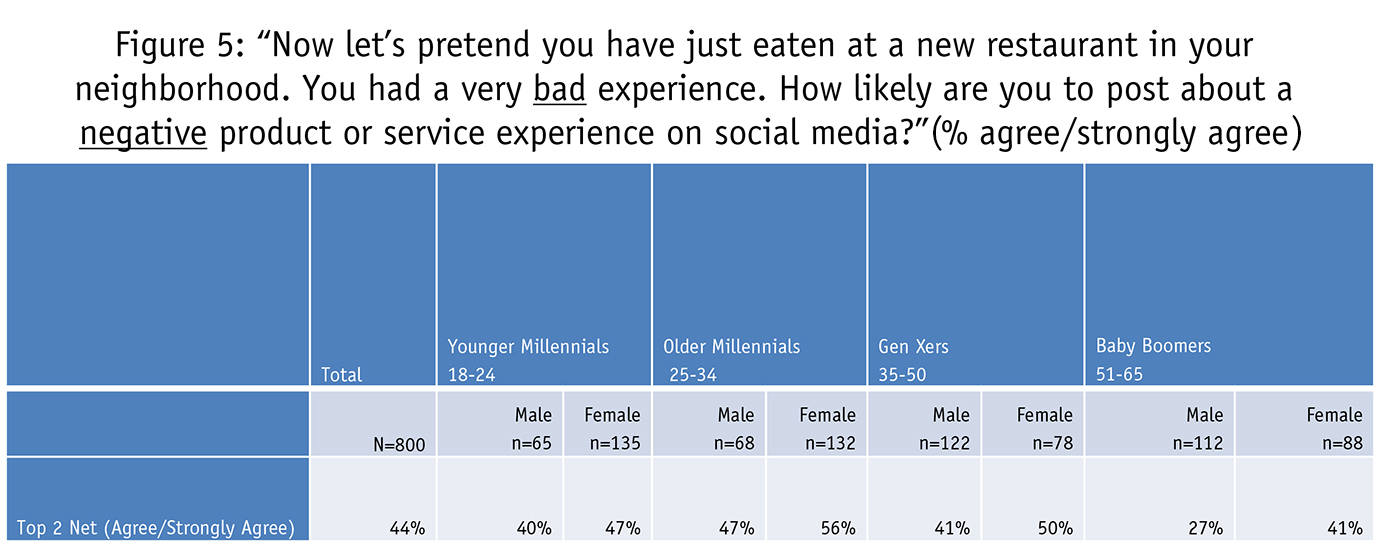

As the findings in Figures 4 and 5 illustrate, Millennials and Gen Xers claim to be more likely to share positive restaurant experiences on social media than negative restaurant experiences, while Baby Boomers state they’re equally likely to share a positive or negative experience. With the exception of Generation X, females are significantly more likely than males to post about positive experiences.

Similar to sharing positive experiences, females are more likely than males to share negative experiences, although the differences are not as large except within the Baby Boomer generation.

Different in many ways

For many years, Baby Boomers were by far the largest age cohort in the U.S., and thus represented the generation whose attention was most coveted by marketers. Although both cohorts are roughly the same size, Millennials are different in many ways from Baby Boomers and Generation X. Millennials are unique in terms of uses of technology and therefore research methodologies must keep up with technological advances. Further, as we have demonstrated, the Millennial generation can actually be subdivided into two distinct groups, younger Millennials (18-24) and older Millennials (25-34), each with very distinct attitudes and behaviors regarding sharing brand/consumer experiences on social media.

The research methodology introduced in this article could be modified to help better understand the next big generation that marketers have their eyes on, often referred to as Gen Z, those 12-17 who are even more connected to technology/social media than Millennials. This generation makes up 26 percent of the U.S. population and contributes $44 billion to the economy. By 2020, they will account for one-third of the U.S. population, certainly worth paying attention to and conducting further research on.

References

eMarketer (2015), “Nearly two in three Millennials block ads,” September 21, 2015.

Ipsos (2016), “Consumers share positive and negative experiences equally,” February 17, 2016. Press release.

Kantar (2015), “TNS study reveals Millennials spend nearly one day a week on their phones.” Press release.

Mulloy, Tara (2016), “Millennials are 112 percent more likely to share video ads,” May 12, 2016, unruly.com.

Newman, Daniel (2015), “Research shows Millennials don’t respond to ads,” Forbes, April 28, 2015.