How COVID-19 changed the way we shop and pay

Editor’s note: Kendrick Sands is head of consumer finance at global market research company Euromonitor International. This is an edited version of a post that originally appeared under the title, “Pandemic accelerates use of cards and adoption of financial services.”

The pandemic has had several short- and long-term impacts on those in the payments industry which have provided opportunities as well as challenges. More long-term effects include accelerated m-commerce (mobile commerce) payment value (an additional $3.8 trillion increase in m-commerce payment value is expected by 2026), greater financial service adoption and rapid contactless payment growth. The overall decline in consumer payment value, increases in the portion of consumer credit considered non-performing, and the shift to pay-now card functions are examples of short-term effects of the pandemic. These impacts were felt to varying degrees depending on the country but were experienced across both developed and developing markets.

Consumer conversion to cash alternatives

The migration of retail online accelerated rapidly during the pandemic and this trend is expected to continue. This movement was certainly underway prior to the emergence of COVID-19, but it accelerated during lockdown as consumers were limited in how they purchased goods. This is a long-term development because it has converted consumers who were hesitant to utilize cash alternatives and it increased card acceptance at merchants which previously did not accept financial cards for payments.

The portion of m-commerce that was proximity at the point of sale (POS) also increased to 41% globally in 2021, a significant rise from 10% noted during the previous five years. Proximity payments with mobile devices or contactless smart cards were struggling to gain traction among consumers and merchants. The need for reduced friction at the POS proved the use-case for the technology and will likely remain a component of in-store payments going forward. Ninety-two percent of financial cards were smart cards in the U.S. in 2021, up from 64% in 2016.

The portion of m-commerce that was proximity at the point of sale (POS) also increased to 41% globally in 2021, a significant rise from 10% noted during the previous five years. Proximity payments with mobile devices or contactless smart cards were struggling to gain traction among consumers and merchants. The need for reduced friction at the POS proved the use-case for the technology and will likely remain a component of in-store payments going forward. Ninety-two percent of financial cards were smart cards in the U.S. in 2021, up from 64% in 2016.

Lastly, the number of unbanked consumers over the age of 15 years in the 47 markets researched by Euromonitor International declined by 137 million from the start of the pandemic in 2019. Access to financial products and services has increased with broader mobile device adoption across the world. Digital-only banks can offer financial products and services at a lower cost or for free and are simpler and more transparent. The majority of the recently banked were in Asia Pacific where digital payment platforms are offering financial products to facilitate commerce. Driving financial products expands the potential customer base for their primary product or service.

Consumer spending bounces back

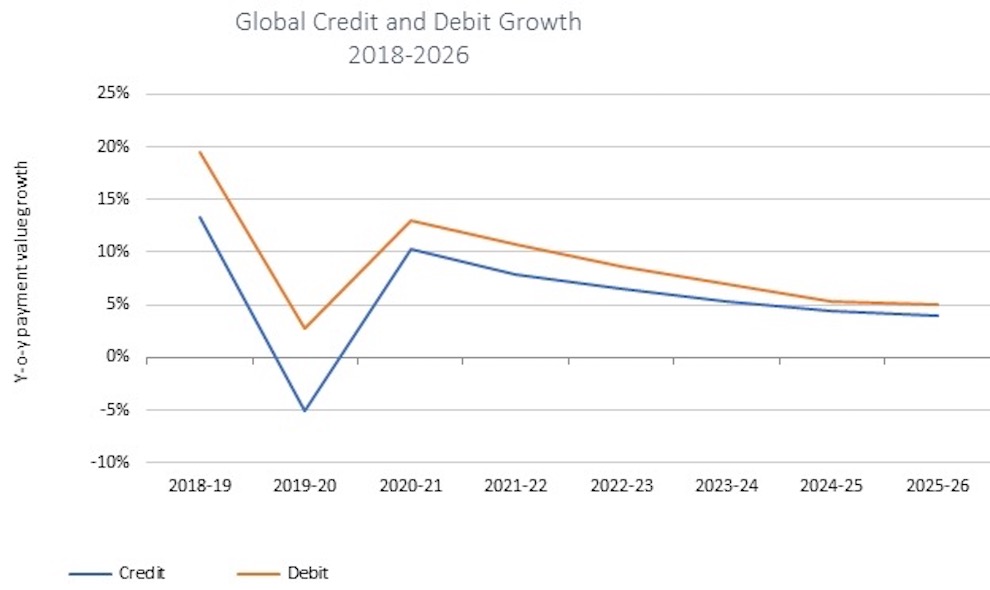

Consumer spending rebounded in 2021 after a marginal drop between 2019 and 2020. Within financial cards, debit payment value growth remained positive, while credit payment value experienced decline between 2019 and 2020. The rapid return to growth is largely due to consumers regaining confidence in the economic future as COVID-19 vaccines become widely available. With increasing numbers of consumers adopting financial products and services over the forecast period, debit payment value is predicted to maintain higher growth compared to credit. Debit is generally a consumer’s first financial card because it is available to a wider audience due to the low risk for financial institutions.

Source: Euromonitor International, Consumer Finance 2022 Edition

Source: Euromonitor International, Consumer Finance 2022 Edition

The impact of the pandemic on consumer payments will persist for years to come in the form of rising m-commerce value, greater access and adoption of financial cards and services, and increased adoption of contactless payments through smart cards or mobile devices. In the short-term, while the non-performing consumer credit rate increased, it is expected to decline over the forecast period. Total consumer payment value has rebounded and is expected to continue to grow. Consumer credit payment value has also recovered and is predicted to record consistent growth over the forecast period. Non-performing consumer credit value increased by 15% from 2019 to 2020 and 11% from 2020 to 2021. The consistent increase could be a result of financial institutions offering repayment relief during the pandemic. In the previous recession, the non-performing loan rate spiked 32% from 2008 to 2009 but declined consistently in the following years.