Editor’s note: Anne Aldrich is partner at communications strategy research firm Artemis Strategy Group, Washington, D.C.

Recently, my firm conducted primary research measuring hundreds of activities and attitudes through qualitative research and a large quantitative study (n=3,041). We then mapped the rational-to-emotional forces that underlie health and financial decision motivations.

As part of this research, we asked Americans how they feel about their finances on several levels. One of the more interesting questions is how they believe they stack up to their peers.

Age

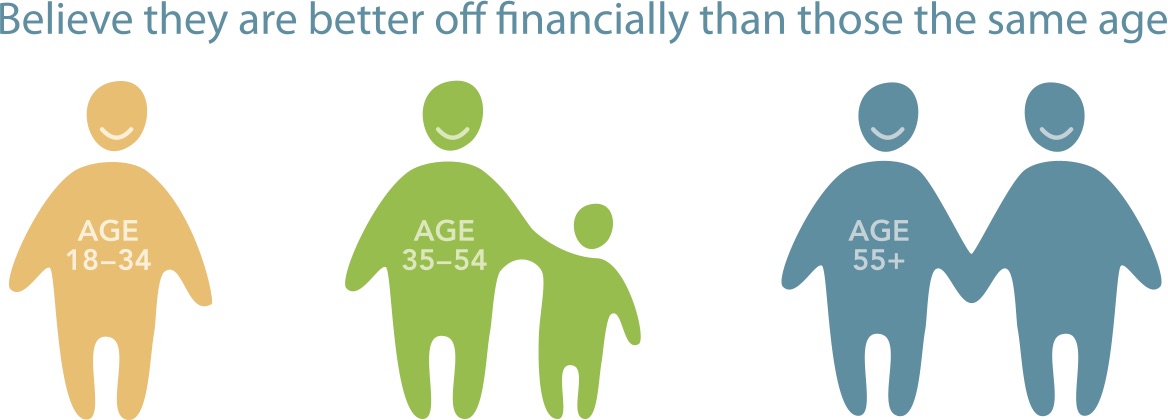

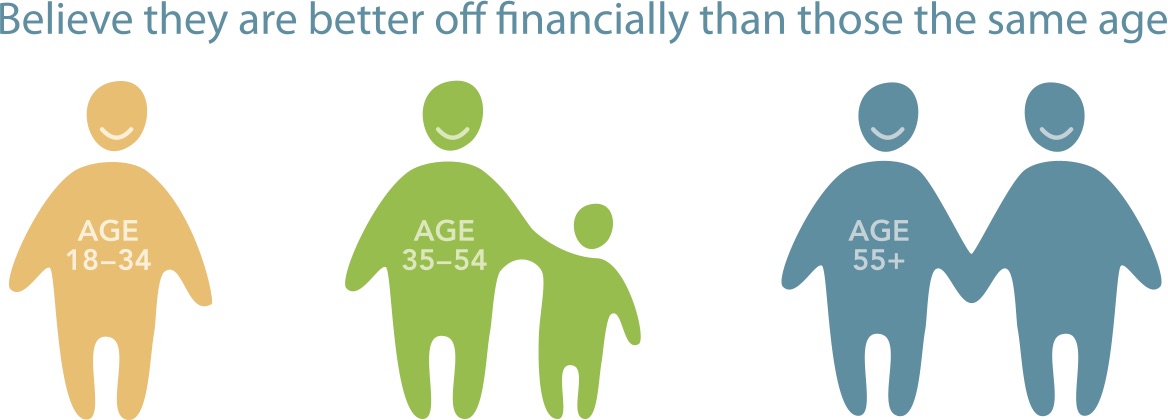

Confidence and anxiety are both tempered by age. Those under age 35 are more likely than their older counterparts to believe they are doing better financially than others their age.

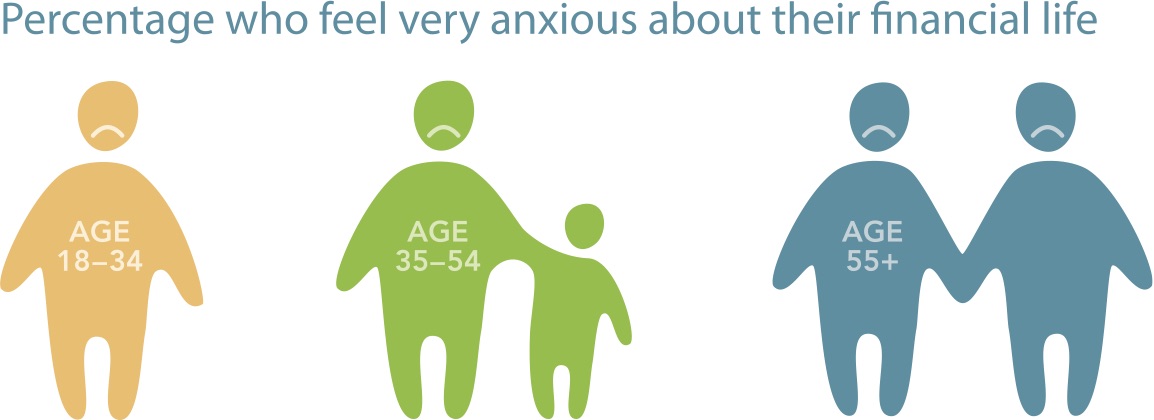

Despite this sense of relative well-being among their peers, younger Americans report the highest levels of financial anxiety.

Age and experience may moderate views about finances. Those over 55 have the lowest levels of financial anxiety.

Financial goals

Americans of all ages aspire to achieve a broad range of financial goals. At the same time, differences in these financial goals emerge by age.

Roughly one quarter of younger and middle-aged adults are still overcoming and recovering from setbacks, a reminder of the continuing damage wrought by the financial recession.

Younger adults are more likely than others to be focused on stabilizing their finances (20 percent), while older adults are more likely to be protecting what they have accumulated (34 percent).

Americans of different generations use varied approaches to meet their goals. We looked at four dimensions of financial actions that people take: managing/educating, saving, debt reduction and income-related actions. Overall, younger adults take more actions in each of these dimensions than those who are older.

To paraphrase a popular saying, young people have time and energy but less money; middle-aged people have money and energy but less time; and older people have time and money but less energy.

Offering balance in resources

We often want what we don’t – or can’t – have. Financial services marketers and advocates can help people of different generations by offering resources that balance the things each age group tends to lack.

Engage younger adults

Younger adults (18-34) feel relatively good financially, but they hope to have many fruitful years ahead of them and the future is unknown. They report higher levels of financial anxiety and admit to being overwhelmed. Younger adults want more money to take them to the next stage of their lives comfortably. They have the time and energy to go after it but not necessarily the know-how.

They consistently take action, particularly online, to manage their finances and they show a high degree of interest in seeking out advice through formal and informal channels.

Financial advocates and institutions can help them be smart about how to capitalize on their existing resources and save for the long term, as well as make sure they are anticipating the next stage in their lives, by engaging with them proactively.

- Engage!

- Start conversations that they can continue with their peers. Research shows that younger Americans are more likely than other generations to engage socially, either in person or via social media, about financial issues.

- Help alleviate anxiety and feelings of being overwhelmed by creating a plan together. Work on prioritization and focus, divvying things up into short- and long-term goals. Demonstrate that the future they want is achievable and show them the path to get there, starting today.

- Provide them with tools that are accessible through multiple channels – anytime, anywhere – so that they can work to increase their financial knowledge.

Support middle-aged adults

While younger adults are still figuring things out, middle-aged adults (35-54) appear to need the most immediate support. More than two out of 10 are recovering from a setback or overcoming the consequences of bad financial decisions, many feel most anxious about their financial goals and about four in 10 say they are anxious about having to live paycheck to paycheck. These sentiments likely arise from the many responsibilities (e.g., childcare, eldercare) and debt (mortgages, credit card debt) one can have at this time of life. They tend to have more financial resources than younger people but not the time to deal with growing those resources for their older age.

Middle-aged adults need financial institutions and advocates to provide support through simple, prepared solutions fine-tuned to their individual situations that don’t require too much effort. The key here is to be tactical.

- Support!

- Acknowledge that they are facing the challenge of recovering from the past and trying to build a solid financial future.

- Provide services and tools that help them manage specific life milestones (e.g., having children, buying a first home, taking care of elderly relatives, etc.).

- Many goals are shorter term in this stage. For those who aren’t struggling from financial setbacks – and even for some of those who are – it may be possible to tackle a big financial goal, like paying off a major loan, during these years. Provide simple solutions to help them get there.

Protect older adults

Older Americans (55+) are least likely to think they are doing better than others their age but it does not seem to bother them as much – they’ve come to terms with their financial situation. One-third think they are doing better than others their age, yet fewer than one quarter report high levels of anxiety about money.

At this point in their lives, they want to protect what they have and, ideally, make the most of their financial assets. Compared to younger adults, they are less engaged in financial management on a monthly basis and are less interested in knowledge and advice. They have less energy for all of this and would likely appreciate a financial organization or individual advisor who would handle their financial tasks.

- Protect!

- Research ways to best let clients know that you are there to protect everything they have worked so hard to build. Demonstrate your capability to manage the things clients may have less interest in at this point in their lives.

- Provide services and tools that help clients limit spending and reduce debt as well as maximize returns so they can maintain their desired lifestyle in retirement.