A worthwhile trip

Editor's note: Joe Beier is executive vice president on the consumer and shopper insights team at research firm GfK. Jason Boyd is vice president of consumer and shopper insights at GfK.

It’s not just that some purchase journeys have become more complex – this goes without saying, given all the devices and touchpoints that influence buying decisions. But today’s journeys are also much more diverse; in many cases, for example, consumers still want to buy things in the quickest ways possible – one reason that Amazon has become such a retail powerhouse.

It’s not just that some purchase journeys have become more complex – this goes without saying, given all the devices and touchpoints that influence buying decisions. But today’s journeys are also much more diverse; in many cases, for example, consumers still want to buy things in the quickest ways possible – one reason that Amazon has become such a retail powerhouse.

This diversity of journeys makes it more essential than ever for marketers to home in on the evolving purchase paths for their categories. Simply knowing the steps – from desire to active shopping to buying – is Job 1 for every purchase journey program.

At the same time, the need to understand clearly which elements of a journey really moved the needle toward purchase has never been greater. With so many places where marketers can invest – social media, in-banner ads, in-store promos, traditional media campaigns – knowing which ones really make a difference for a given category is core information.

Today, it is up to researchers and their clients to take the search for purchase journey insights to a new level. Simply relying on tried-and-true sources is not enough; there are no cookie-cutter solutions anymore. Insights leaders need to become active seekers, to begin their own journeys toward truly differentiated data and learning.

We all know that researchers and marketers have more data about consumer purchase journeys than ever before. From online searches to loyalty card records to media use, information about consumer behavior has never been more abundant. But that data is often from diverse sources and combining data sets is not something that most researchers have mastered. In the past there was never a reason nor the material to work with.

To become great curators of purchase journey stories, researchers need to step out of their comfort zones – and not just in the realm of analytics. The opportunities and challenges of today’s consumer insights ecosystem demand more than wonkishness; they require a greater focus on marketers’ business priorities and needs, deeper connections with all stakeholders in the research process and a commitment to making a difference, not just in the realm of statistics but on the bottom line.

Understanding purchase journeys today requires a strategic mind-set, in which researchers think beyond any individual “project” and instead create a start-to-finish commitment to identifying, tracking down, fusing and acting on learnings. For any individual product or brand, purchase journeys are beginning and ending all the time and the nature of purchase journeys changes with technologies and lifestyles. Recent GfK research shows, for example, that:

- “omnishopping” has increased in even non-durable categories such as cleaning products, packaged food and beverages;

- more than half of consumers now say they purchased a product that they heard about via social media;

- Millennials are more likely to say they used a smartphone than a computer to shop in the past six months, while Boomers favor computers by almost 4-to-1.

So how can researchers today stay a step ahead of the purchase journey landscape – bringing their organizations the insights they require to make wise investments in a truly cluttered retail environment? How can they get the purchase journey insights that they – and their brands – need and deserve? Here are five essential tips to keep in mind and incorporate into your insight and activation processes.

Begin with the end in mind. It may sound counterintuitive but working backwards is a great way to enrich your purchase journey work. This means putting as much thought into pre-study preparation as into the data-gathering itself. Think of it simply as asking a lot of questions about the end of your project but doing so before you even get started.

Researchers need to actively explore:

- What fundamental business questions or opportunities will this study address?

- What will my organization do differently once these findings are in hand versus today?

- Which aspects of my in-market execution does the study need to inform?

- Who are the key audiences for the findings (in and/or outside) and what are we going to be asking them to do?

- What is hypothesized/known about the category purchase journey today?

Addressing these “working backwards” questions defines two key pillars of any purchase journey effort. First we have to understand who needs to support our work – the stakeholder team, coming from many different departments. From marketing and insights to category management and innovation, it is key to know who will be relying on your work and have to help make it a reality.

The “working backwards” approach also helps us develop a learning and activation plan, laying out the full breadth of your efforts and seeing what is really feasible. In some ways, this is just Project Management 101 but many times some basic considerations can be overlooked. How compatible is the plan with timing and budget realities? How will we socialize our findings, to be sure they live and breathe in the organization? Considering these ahead of time can save huge amounts of frustration and wasted effort later on.

Enhance journey work with behavioral data. Passive digital behavioral tracking gives us a powerful window onto what consumers actually do, compared to what they report later on. Passive data from computers and mobile devices can be combined with panel profile insights and custom surveys to understand the “whys” behind consumer actions as well as their offline behavior. We can learn: which Web pages/apps an individual opens; what keyword phrases a consumer uses on search engines; when and how much time someone spends on sites; and navigational patterns, such as where people come from and go to.

Leverage the full power of data integration. Data integration may seem like table stakes for purchase journey work today but how you approach combining data will hugely affect the value of your output. Be methodical and clear about your options, using three key steps:

Insights review. To connect the dots on what you already know, thoroughly explore what related studies you have already done.

Gap assessment. To prioritize insight needs, it is essential to see clearly what is missing and rank the importance of those gaps.

Learning priorities. Scope and prioritize your learning for both qual and quant research. Where do you need to go next?

Stages that made a difference

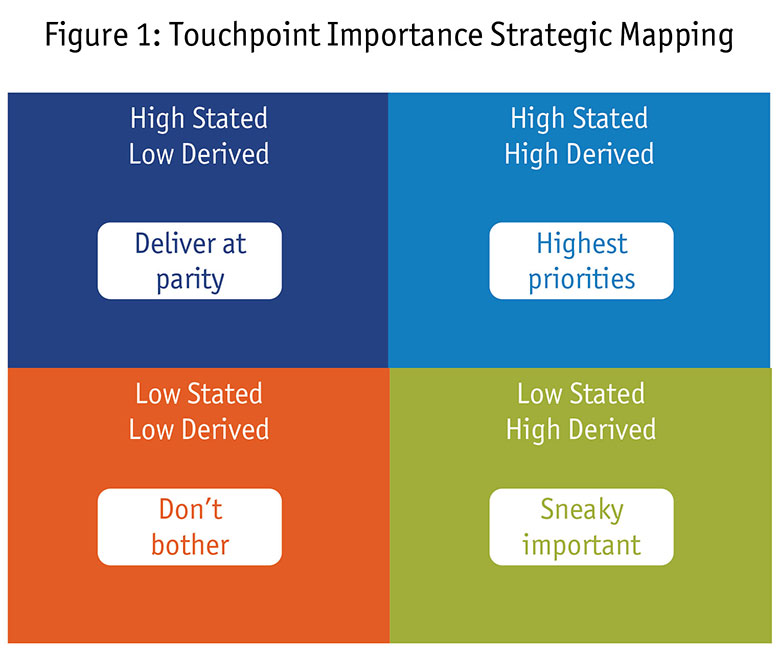

As we noted earlier, there can be a foundational disconnect between what people say they do while shopping and what they actually do. Statistical modeling can identify the derived (not just stated) key touchpoint influencers – the stages in the purchase journey that made a difference (Figure 1).

Was it comparing devices featured online, handling and demo-ing the item in-store or looking for ratings and reviews in social media that really pushed the decision in a certain direction? Advanced modeling can unlock these secrets.

Was it comparing devices featured online, handling and demo-ing the item in-store or looking for ratings and reviews in social media that really pushed the decision in a certain direction? Advanced modeling can unlock these secrets.

Once we know the derived influencers, we can map them to guide strategic execution. We can look, for example, at key disconnects between touchpoint usage and influence to understand where mere use data might mislead us in terms of our marketing investments.

Activate like you mean it

Purchase journey insights mean nothing if they never become real-world actions. Connecting insights to your business and inspiring stakeholders to put them into gear requires planning and strategic tools. From workshops to portals to journey maps, bringing the data alive through visuals and hands-on interaction adds depth to your findings and makes their relevance clear. In share-back workshops, for example, you can identify specific, high-value, insights-driven strategies and activations by connecting the dots across multiple sets of data.

We also recommend action-planning workshops to engage a more cross-functional audience with your insights. Unlike a share-back session, these workshops typically include cross-functional teams, synthesize key findings across multiple studies and provide breakout exercises and teamwork.

Activation – and what comes after – is so essential to an effective purchase journey and mostly outside the scope of what a researcher might have thought was his or her “job” just a few years ago.

Ultimately, empowering your colleagues to make informed business decisions is critical in the rapidly evolving shopper landscape. Working collaboratively toward outcomes of the workshop, providing data portals that can support ad-hoc queries and developing external selling collateral are just a few examples of steps you can take. Seek out scalable data solutions that allow you to refresh your insights frequently; opportunities will be missed by waiting multiple years to redo a purchase journey study.

The challenges and rewards of purchase journey work today are clear. The availability of so much data – and the demand for such an advanced level of insight – requires that researchers truly expand their horizons. The good news is that resources for taking all of these essential steps are already available – for those who know the importance of looking.

Be sure to investigate thoroughly and activate fully on your journey to a new world of learning.