Playing nice with legal

Editor's note: Bruce Isaacson is president of MMR Strategy Group, an Encino, Calif., research company.

Although much has been written about the relationship between marketing and departments such as sales or product development, very little has been written about the relationship between marketing and legal. In many companies, it is not a cozy one. Marketers have the responsibility of attracting consumers and increasing revenues, while the legal department must keep marketing communications from causing trouble. These days, it seems that neither has an easy assignment.

Marketing and legal may interact in the area of claim substantiation. Claims convey the benefits of a product or service to customers, often by comparing with competitors. While claims can help increase sales, they can also involve risk. Claim substantiation is the process of making sure that supporting evidence is in place for statements made in advertisements, point-of-sale materials, sales brochures, product packaging and other locations.

This article focuses on claims involving consumer perceptions. These types of claims are often supported with surveys. For example, surveys can help determine which automobile is preferred by families with kids, which toothpaste tastes the most minty or whether a drugstore shampoo leaves hair as manageable as a shampoo sold in expensive salons. When your claims involve consumer perceptions, the guidelines in this article can help reduce your marketing risk.

A serious matter

Companies can face legal fees, penalties and marketplace restrictions if their marketing communications do not meet the rules and regulations intended to protect consumers. Compliance is a serious matter and is enforced by a variety of authorities and venues, including the National Advertising Division of the Better Business Bureau, the federal court system and government agencies such as the Food and Drug Administration and the Federal Trade Commission (FTC).

Although the requirements vary, these authorities generally aim to ensure that the claims companies make to their customers can reasonably be expected to be true. The key word is “reasonable.” In 1984, the FTC issued the “reasonable basis doctrine” 1, which states that:

-

Marketers must have a basis for substantiation before making a claim.

-

The evidence for the basis must be “reasonable” when judged by factors such as the type of claim, the risk of a false claim, the cost of developing substantiation, generally accepted principles for claim substantiation and other factors.

There are similar expectations in other venues. Although the standards, expectations and process vary, the expectation is that if you make a claim, you can support it with reasonable evidence. Reasonability is usually evaluated from the standpoint of the typical consumer, who is not necessarily an expert, who encounters the claim under conditions typical of the marketplace.

To the extent the evidence you provide as substantiation differs from that standard, all of these authorities exercise discretion is deciding how much it should count. For example, a court of law can accept or reject a survey based on how it was done or assign the survey greater or lesser weight.

Here are some guidelines to help you make sure your substantiation can support your claim.

Guideline No. 1

Phrase your claims to support marketing strategy while minimizing the burden for substantiation.

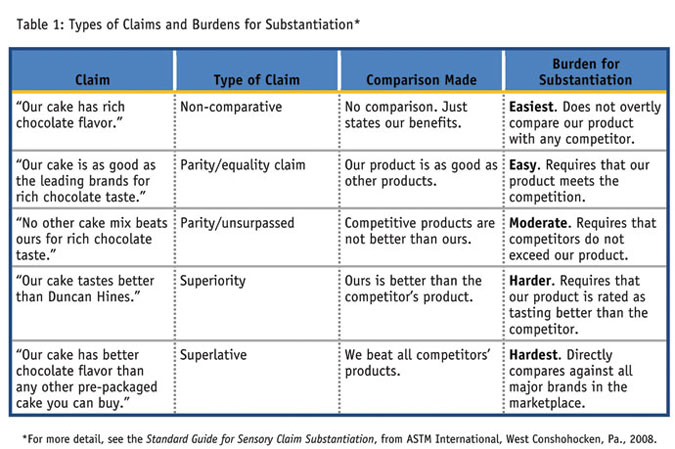

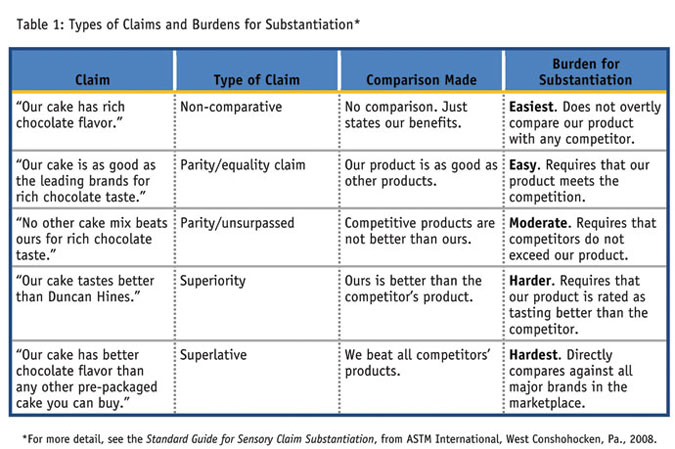

What may seem like minor changes in the wording of a claim can cause large differences in the burden for substantiation. Let’s consider a fictional pre-packaged cake mix, Ready-Bake cake mix. Imagine that the marketing team at Ready-Bake is evaluating different positioning for their product and is considering different wording for text on the package and advertising. As Table 1 shows, there are a variety of claims they might consider for the chocolate taste of their cake mix and each has different implications for developing evidence for substantiation.

The easiest claim is a non-comparative claim, where there is no claim against another product. The most difficult claim is a superlative claim, which states that a product is better than all other competitive products. In between, the product might reference a single product through a superiority claim or could reference a variety of other products through parity claims. Typically, the more competitors referenced and the more specific the reference for other competitors, the higher the burdens for substantiation.

Guideline No. 2

Gather evidence for claim substantiation in a manner that matches the claim with the marketplace as much as reasonably possible.

As we gather evidence to substantiate a claim, such as a consumer survey, the evidence should be gathered in a manner to match the conditions under which real customers encounter the product in the marketplace. This guideline has a number of implications for claim substantiation conducted by survey. In the survey:

-

Product forms should match the claim. For example, the Ready-Bake cake mix would be tested against other pre-packaged mixes and not pre-baked cakes.

-

Attributes should match the marketplace. Other product attributes, such as package size, package type and means of product usage (e.g., pump versus aerosol for hairspray) should match the typical conditions under which consumers referenced in the claim encounter the product. For the cake mix, we might test a mix of varieties or flavors that are typical of those matching the claim.

-

Product formulas and versions should be current. The survey should test the product formula or version that exists in the marketplace today.

-

Product conditions should be similar to the conditions that consumers encounter. The survey should test a product that is as similar as possible to the product that consumers encounter in the marketplace. For Ready-Bake, which is sold in supermarkets, it is best to purchase the mix for testing from a supermarket so that the product tested is identical to the product a consumer could purchase at retail. If we were to obtain the Ready-Bake product for our test from the factory, we might test a mix that is fresher than the mix that consumers could buy.

-

Markets and geography should match the footprint of the claim. Substantiation is market-specific. If a product is sold nationally, then the claims testing should be done nationally. If a product is only sold in certain regions, the testing should be done in those regions. For products sold in multiple but distinct markets or countries, research must be done in each distinct market or country.

As we seek to match the marketplace, a survey should interview respondents who represent customers and potential customers for the item being tested. The sample should match the category on factors such as age, gender and income and should not to omit key segments. For example, in product categories where children are part of the purchase process, we may need to interview parents and children together.

Beyond matching on demographics, the research should also screen for category involvement. Category involvement may not be only at the category level but at the level of the specific product, model or flavor in question. This is particularly true for usage or taste tests; it would not be wise to test our chocolate cake mix among consumers who do not like chocolate or to test a convertible among those who only drive SUVs.

Guideline No. 3

Gather evidence for claim substantiation using research methods appropriate to the claim.

The protocol for research to substantiate claims must be appropriate to the claims tested. Three important aspects of research design include research mode, research protocol and questionnaire design.

Let’s start with research mode. The two modes of research used most commonly for claims research are home-use tests, which are conducted at the respondent’s home, or central location testing, which is typically conducted in a research facility in a shopping mall or focus group facility. As with other aspects of substantiation research, the choice between a home-use test and a central location test will depend upon the circumstances. For example, the Ready-Bake cake mix should most likely be tested in-home, where the respondent can prepare it according to the package directions, while a packaged, pre-baked cake may be more appropriate to test at a central location facility.

The second aspect of research design is the order in which consumers are exposed to the products, ads or packages tested. Monadic testing is a common protocol where each brand is tested on its own and then the averages are compared across brands. In a monadic design, respondents evaluate one product in one interview, which provides a very clean read on that particular product but is relatively expensive and time-consuming.

By contrast, in sequential monadic testing, respondents evaluate several products one at a time in a sequential fashion and complete a survey after trying each one. After all products have been tried, they may also compare all the products tested. This technique is less costly and less time-consuming than a pure monadic design and the sequential monadic design can allow respondents to directly compare one product versus another. However, the research must be carefully executed to avoid various kinds of bias.

The third aspect is questionnaire design. Questionnaires for claim substantiation are different than questionnaires for other types of research. When designing a study to track brand image or customer satisfaction, a researcher may include additional questions that are peripherally helpful to the core questions of interest. For example, a brand tracking study may also include questions about customer buying behavior.

When substantiating claims, questionnaires must focus only on the claims of interest and nothing more. Authorities who evaluate surveys for claim substantiation often have an inherent assumption that statements measured later in a long questionnaire could potentially be biased by statements measured earlier. As a result, claims questionnaires must be short and specific to the attributes relevant to the claims being made.

Guideline No. 4

When testing a number of claims, each claim stands on its own merits and must closely match the data.

A claim substantiation questionnaire may test a number of different claims and marketers can use the results that support their product, even if other results do not. For example, if we test Ready-Bake cake against competitors for moistness, chocolate taste and velvety texture and Ready-Bake is preferred on chocolate taste only, we can still use the results to support a claim based purely on chocolate taste.

We can state claims that closely match the data even when the tested product did not “win” the test in the traditional sense of the word. For example, if consumers in our test compare Ready-Bake to homemade cakes and one-third of consumers prefer Ready-Bake, the research can substantiate a claim that “One in three consumers prefers Ready-Bake to homemade.” The statement is true and can be used. Whether it is helpful is another matter.

Statistically, what exactly does support mean? Almost always, analysis is conducted at the 95 percent level of confidence and analysis of claims data can involve a number of statistical tests specific to claims. For example, let’s imagine that we measured the preference for Ready-Bake over a competitive brand. Ready-Bake was preferred 52 percent of the time, while the competitor was preferred 48 percent. The analysis of the claims data would include a statistical calculation to determine our level of confidence that our mix is indeed preferred over the competitor.

Guideline No. 5

Involve multiple functions, probably including marketing, consumer insights and legal.

The data from a claim substantiation study can be conflicting. Some claims may be easier to substantiate, others less easy. Some claims may be more likely to invoke competitive reactions and lawsuits, others less likely. Given these considerations, is it best to design substantiation research and select claims using a multifunctional team with representatives from marketing, consumer insights/research and legal. The different perspectives are critical to the task of ensuring that a claim is effective, able to be substantiated and consistent with product strategy. Words like “contains,” “free” or “low-fat” may have very different meanings to a marketer than to a lawyer. Involving multiple perspectives helps yield a claim that is powerful and can be substantiated.

Substantiate first and claim second

If you follow these five guidelines, you can increase the likelihood that your claim is in compliance. As I mentioned, companies are obligated to substantiate first and claim second. In other words, substantiation should be in place before the claim is made.

There is no question that substantiation can be difficult, unpredictable and expensive. The standards for substantiation can be high. Authorities such as judges, juries and mediators must evaluate research presented in support of or in opposition to a claim and surveys conducted by experienced researchers are often criticized by smart lawyers, well-armed opposing experts and inquiring judges. Standards to evaluate surveys can vary from circuit to circuit, from judge to judge, from venue to venue and from year to year.

However, good research, corresponding to the principles described in this article, is more likely to hold up and carry the day. In this challenging environment, reasonable and well-conducted research has the best chance of prevailing.

References

1 See “FTC Policy Statement Regarding Advertising Substantiation," 104 F.T.C 648, 839 (1984).