SPONSORED CONTENT

Editor's note: Jackie Lorch is VP, global knowledge management, at Dynata, Shelton, Conn. She can be reached at Jackie.Lorch@dynata.com.

Consumer media consumption has undergone a rapid transformation in the last few years, driven by the evolving digital landscape and pace of change within the marketplace. The emergence of on-demand and streaming platforms, as well as the rise of adaptable sub-media, demonstrates we are no longer passive consumers of media, but active agents in the process. While this trend challenges the future of “broadcast” TV and radio, it’s not necessarily true that younger generations are wholly giving up TV for online media consumption. Rather than trading one for the other, younger generations are actually consuming more media – and consuming it differently in the age of streaming devices, on-demand platforms and cord-cutters. Brands must consider these kinds of trends and respond in their marketing strategies to remain competitive and reach their targeted consumers.

Consumer media consumption has undergone a rapid transformation in the last few years, driven by the evolving digital landscape and pace of change within the marketplace. The emergence of on-demand and streaming platforms, as well as the rise of adaptable sub-media, demonstrates we are no longer passive consumers of media, but active agents in the process. While this trend challenges the future of “broadcast” TV and radio, it’s not necessarily true that younger generations are wholly giving up TV for online media consumption. Rather than trading one for the other, younger generations are actually consuming more media – and consuming it differently in the age of streaming devices, on-demand platforms and cord-cutters. Brands must consider these kinds of trends and respond in their marketing strategies to remain competitive and reach their targeted consumers.

The 2020 Dynata Global Trends Report explores the underlying attitudes and behaviors that drive consumer trends, including media consumption. Leveraging Dynata’s global scale, deep relationships with consumers, and the industry’s largest fully-permissioned first-party dataset, the report aims to enrich research data and insights for better, faster decision-making.

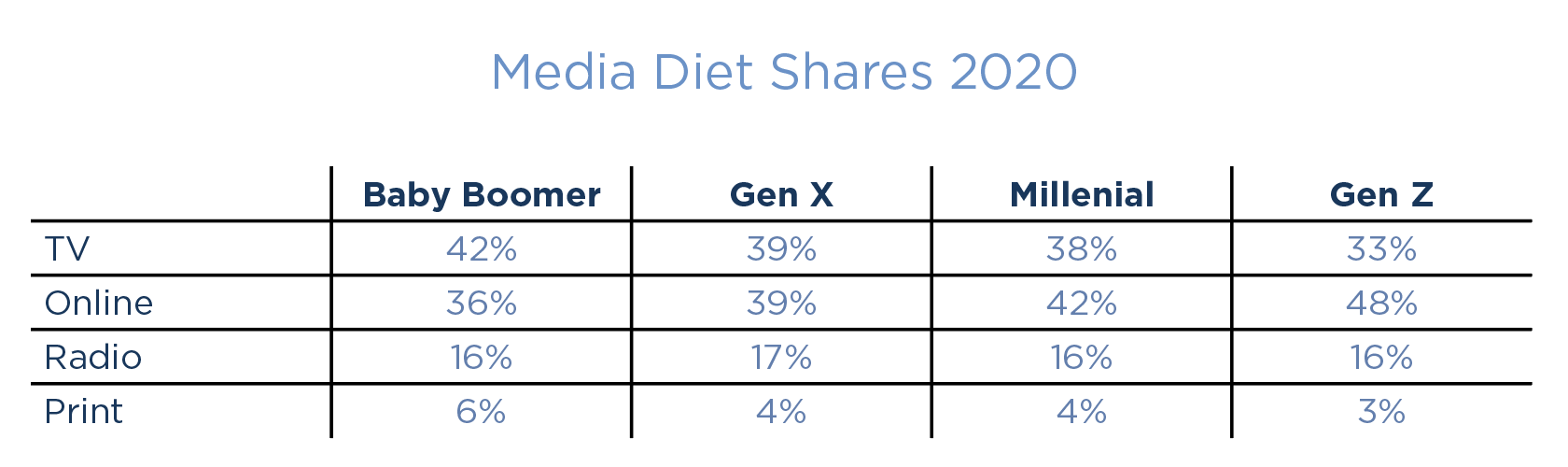

When brands consider media consumption, a key focus is the opportunity for target audiences to see their advertisements. Roughly 90% of all ad spend is concentrated in online, television, radio and print, with four-fifths of that expenditure going towards online and television. The 2020 Dynata Global Trends Report found that media consumption, in terms of hours spent, roughly mimics these proportions.

The data illuminates striking generational differences, not only in total hours spent with media but also in the share each media type (TV, online, radio, print) commands. The youngest generation, Gen Z, spends over 75% more time with media than Baby Boomers. Television’s share of the media diet declines with age, as does print, while radio remains static, with only online showing any growth. If this continues, it will have a long-term effect on overall media consumption patterns.

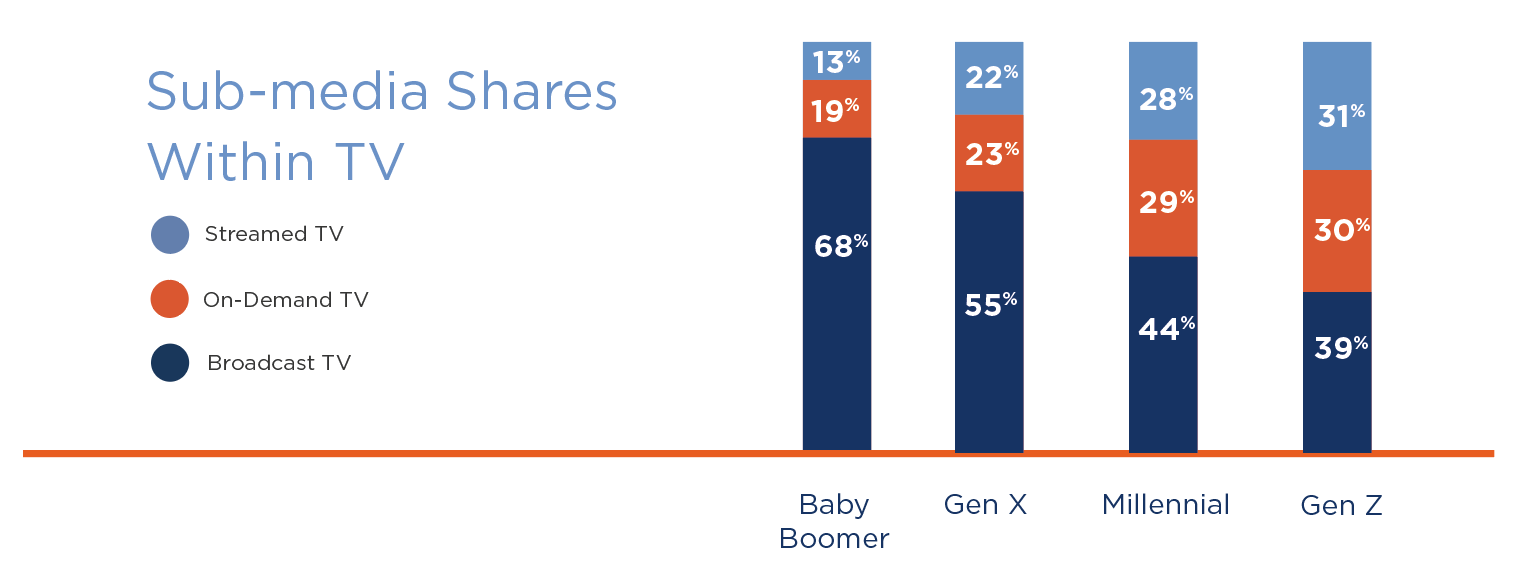

Media diet differences are relatively small between Baby Boomers and Millennials, but this depends on how you define “TV” or “radio.” When considering television media, for example, the 2020 Dynata Global Trends Report concentrates on three areas where ads can be viewed: broadcast (live) TV, on-demand services (or catch-up TV) and streaming services, which are not subscription-based therefore funded by advertising. For each successively younger generation, the balance shifts away from broadcast TV towards on-demand and, most dramatically, streaming services. The “winning” medium is the one that offers free choice, convenience and is, increasingly, app-based and therefore unshackled from the TV itself. In order to continue reaching consumers, especially younger generations, brands must shift their advertising efforts to this sub-channel, and away from “broadcast” TV. With many more channels to watch, devices on which we can consume TV content, technologically advanced TVs, and more ways in which content can be consumed, “appointment” TV is a thing of the past. It is critical that marketers rethink what it means to “watch TV” altogether and implement targeting strategies focusing more on consumer behavior and less on programming towards specific time slots.

The report depicts a similar story in “radio,” if you consider radio listening to music that you don’t own. While the generations listen to roughly the same number of hours of radio, they tune in differently. Similar to television, we observe a drop-off in the amount of broadcast radio consumed, with the slack picked up by streamed music services.

On the rise within both TV and radio is the sub-media that is adaptable, customizable and programmable by an algorithm based on your input, with online media leading the way in maximizing user control. Baby Boomers are the only generation that consume more TV media (42% of total media diet) than online media (36%). Gen Z’ers spend over twice as many hours online as Baby Boomers and almost twice as much as Gen X. Each successive generation is consuming more online content and spending more time in front of a screen.

However, with so many channels, devices and platforms, capitalizing on this abundance of screen time remains difficult, as marketers are faced with new obstacles caused by duration challenges, the quantity of consumer touchpoints, and complex paths to purchase.

Respond strategically to media consumption trends with sharper cross-channel targeting...

In today’s fragmented media environment, reaching the right consumer – during their duration with a particular media channel (and platform or service) – requires sharper cross-channel targeting and stronger, deeper profiling.

The first step to optimizing your targeting strategy is understanding your consumers on psychological, attitudinal and behavioral levels. Target audiences can no longer be defined in simple demographic terms, such as gender and age group. To continue reaching consumers, marketers need to collect deeper insights about the attitudes, goals, interests and behaviors of their desired audiences. These insights will provide a better understanding of how they consume and engage with media content, which media channels they use most frequently, outlets and publishers they prefer, the devices they own, and how they make purchase decisions.

To achieve this, marketers can overlay their CRM data with richly-attributed, fully-permissioned first-party data to create custom audience segments. For more accurate look-alike models, match your CRM and first-party data with reliable third-party data. Once you’ve connected the insights revealed by first-, second- and third-party data sources, develop custom audience segments that can be deployed through DMPs and DSPs. Maintaining a pulse on media consumption trends to identify which channels – and sub-media – are most effective for reaching your target audiences (i.e., on-demand TV vs “broadcast” TV vs streaming services) is critical as well. Deeper audience profiling coupled with knowledge of changing media consumption habits can mitigate advertising waste by helping you allocate advertising budgets towards specific channels and platforms more effectively.

As media consumption habits continue to shift from traditional forms of viewing, such as “appointment” broadcast TV, brands also require the flexibility to program against content and duration challenges (i.e., binge-watching). More accurate targeting will ensure that you are focusing your marketing efforts on individual consumers who are in-market rather than, for example, programming towards a specific television time slot, which is likely to reach a number of individuals who are not interested in your product or service. Leverage targeting and activation solutions that offer real-time quick testing and the ability to optimize in-flight cross-channel campaigns to ensure the necessary adaptability for reaching consumers across the fragmented media environment.

A better understanding of when and where your target audience is consuming media, deeper profiling and the ability to activate against these insights, will allow you to identify optimal media channels for reaching target consumers. In today’s media environment, developing a one-to-one targeting strategy that reaches specific audiences wherever they are most likely to consume media is essential to forge strong connections with the right consumers. To remain competitive, marketers must sharpen their targeting, remain fluid in their thinking and keep a constant pulse on consumer media consumption habits.