Tips for structuring online pricing surveys

Editor’s note: Rasto Ivanic is co-founder and CEO of GroupSolver, a San Diego, Calif.-based market research tech company. Balbina De La Garza, marketing manager, Emma Kearns, marketing coordinator, and Sarah Parker, marketing coordinator, GroupSolver, also contributed to the article.

A variety of external factors influence pricing decisions, and a well-executed pricing survey is uniquely suited to exploring those associated with customers’ purchase decisions. These decision-related factors include what features they perceive as valuable and what they are willing to pay for them; the price premium they place on the product brand; and more.

While there are many approaches to pricing research, we present five ways to acquire this information, starting with a simple baseline approach that provides directional pricing information and ending with a comprehensive pricing method that can help not only optimize pricing, but it can reliably estimate impact on market shares and product line profitability. Choosing which approach to deploy depends on the stage of the development cycle the product is at, the speed and precision of information we seek, and of course the budget.

1. Baseline survey.

Early in the development process, it may be enough to initially ask customers a simple question to name the price they are willing to pay for the product or services. It is asked in a free text format that allows respondents to enter the price they would be willing to pay. This is the fastest and easiest way to establish a starting price.

If consumers are familiar with the product or service category, their answers to this question can provide a general idea of what prices may work in the marketplace. But there are limitations. This feedback will not take into account competitor products and other market factors, nor will it help product manager understand how the product drives consumer’s willingness to pay.

2. Price rating scale.

With a pricing scale question, researchers can determine how likely the respondent would be to pay a given price for a product, from “very likely” to “very unlikely.” These types of questions help to gauge a price point’s likely acceptance, and they are particularly helpful in pricing research for products that are novel or too conceptual for consumers to be able to come up with a specific dollar figure. Like the first approach, the benefit of scale questions is speed while trading off insights about the specific drivers of value respondents attach to the product or understanding why.

Both the baseline survey and price rating scale approaches trade nuance and precision for speed and simplicity of execution. However, when considering competitive impacts or gaining a deeper understanding of drivers of consumer purchase decisions are needed, it is better to opt for a more nuanced approach, such as the Van Westendorp pricing model or a conjoint analysis.

3. The Van Westendorp pricing model.

The Van Westendorp pricing model is a price sensitivity meter for indirectly measuring consumers’ pricing perceptions using series of survey questions that follow a basic description of the product or service. First, respondents are asked to name a price point at which they believe the product or service would be so inexpensive as to be of questionable quality. Then they are similarly asked for the price points at which they would deem the product:

- A good value.

- Slightly expensive but still worth considering.

- Too expensive to purchase.

Cumulative frequency graphs can be used with this data to create a model that show pricing points for both value and premium positioning as well as an acceptable range for the optimal pricing.

The Van Westendorp pricing model is relatively easy to implement and can provide better insights than stand-alone questions about willingness to pay, but it still lacks two major useful features: it does not provide the context that comes with allowing respondents to compare competitive products and their prices, which can heavily influence purchase decisions; and it does not consider any product features, other than the price. Without these insights, researchers cannot measure which product feature adds the most value to the product or what combination of features will be the most profitable.

The Van Westendorp model can be used in tandem with conjoint analysis to gain more in-depth data.

4. Conjoint analysis.

Conjoint analysis is a flexible method that can be used to assess the perceived value of a product or service’s features and it can provide data to model competitive dynamics a new product may experience after launch. Sample attributes that can be evaluated using conjoint analysis include the packaging, product design, benefit claims, brand promise and more.

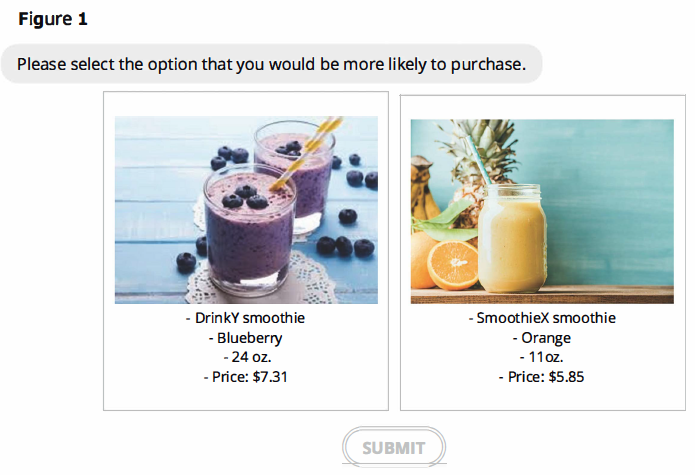

The most common and effective type of conjoint analysis is choice-based, also known as discrete choice approach. It combines product attributes into groups to create product profiles that are used to test product concepts. Respondents are asked to make choices between different product concepts that are made of randomized attributes and presented at random prices (Figure 1).

Because this method emulates the typical buying experience of choosing between alternative product options, it is more likely to give researchers accurate data about consumers' willingness to pay and the choices they are likely to make from the competitive set. Researchers can isolate data about the direct impact of specific product features while also understanding competitors’ product profiles.

With conjoint pricing analysis, researchers can see how much value consumers place on specific product attributes and which combination they are willing to pay the most for. Profit-maximizing product prices can then be set accordingly.

5. Market share modeling.

Market share modeling can be the cherry on top of pricing research, particularly when used alongside data-rich conjoint modeling. This simulation-based approach enables researchers to measure how a product at a given price will impact a brand’s market share (i.e., the percentage of sales the company captures within the shelf). Based on general equilibrium economic theory, share modeling uses cross-price elasticities and other estimated model parameters to simulate many thousands of individual consumer decisions in the context of the product shelf. This allows the researcher to see economic outcomes of “what if” scenarios, such as tweaking product prices, its features or even simulating the outcomes of competitor’s strategic moves.

Pricing a product or service

Accurately pricing a product or service is one of the most critical management decisions any company can make. It can mean the difference between a flop with millions of dollars wasted on product’s development or a runaway success that fuels company’s future. Strategically inserting customer research such as pricing and concept testing surveys and analyses during the product development process is a smart way of reducing risk for a go-to-market strategy and ensuring a product’s ultimate success.