Editor’s note: Rina Plapler is partner at marketing firm MBLM, New York.

MBLM has released its 2015 Brand Intimacy Study report, which contains rankings of brands based on emotion. The study looks at the responses of 6,000 consumers and 52,000 brand evaluations across nine industries in the U.S., Mexico and United Arab Emirates. The report is part of MBLM’s broader and continued exploration of brand intimacy.

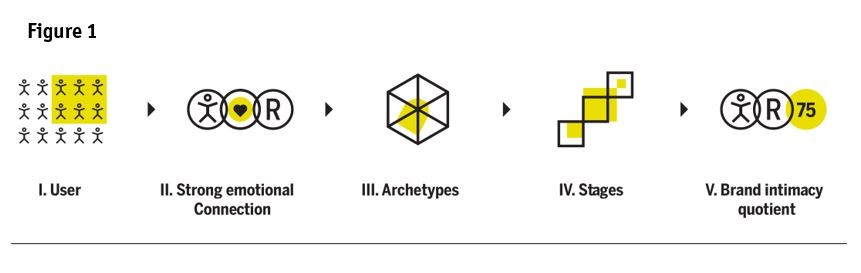

Quantitative research was used to determine the brand intimacy model, which looks to five key components (Figure 1) that contribute to building intimate brand relationships: the user, strong emotional connection, archetypes, stages and the brand intimacy quotient. The model culminates in a performance score for each brand. This article breaks down the key components that determine the brand intimacy score and looks at the overall findings from the 2015 report.

Core components

I. User

In our research, a user is defined as someone between the ages of 18 and 64 who has used the brand within the last 12 months. The user is the first component in the model because a consumer cannot be intimate with a brand he or she has not engaged with or repeatedly tried.

2. Strong emotional connection

A strong emotional connection is the second key requirement and the foundation of intimacy. The greater the emotional connection between a brand and consumer, the more powerful the relationship. A strong emotional connection is determined by the degree of overall positive feelings a customer has toward a brand and the extent to which a person associates the brand with key attributes.

3. Archetypes

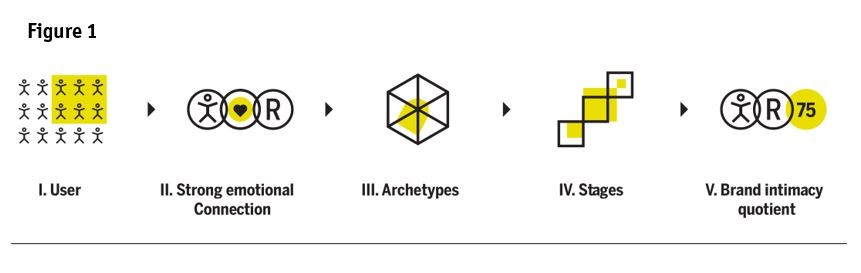

Archetypes showcase the characteristics of intimate brands. The study focuses on six archetypes, shown in Figure 2.

4. Stages

Three stages, shown in Figure 3, reveal and measure the depth and degree of intensity of an intimate brand relationship.

5. Brand intimacy quotient

The score assigned to each brand from 1 to 100 is called the brand intimacy quotient. This quotient is based on prevalence (the percentage of users who are intimate) and intensity (where the relationship is on the spectrum of three stages: sharing, bonding and fusing). It is a shorthand score that demonstrates how a brand is performing relative to its ability to create intimate brand relationships and it enables comparisons to other brands in the same category or to the industry average.

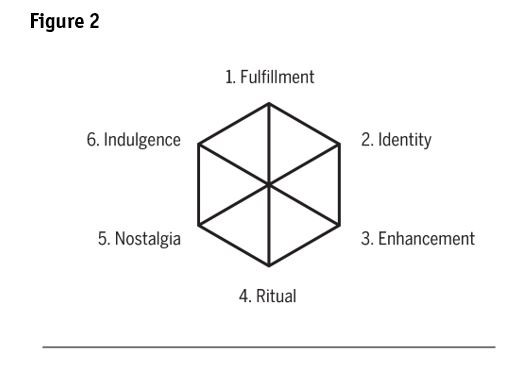

The goal of the ongoing study is to measure, validate and better understand how emotions impact brand relationships and further show which brands are most successful at creating these bonds. The team compiled the Top 10 companies using the Brand Intimacy Rankings, Fortune 500 and Standard & Poor’s 500 lists. For each brand, the team gathered the reported revenue and profit/loss for the years 2005 through 2014 from the brand’s annual reports and/or Form 10-Ks. From the data, the team calculated the average year-over-year growth rates for both revenue and profit for the 10-year period (Figure 4).

Study findings

Overall, study findings show that 25 percent of people surveyed have intimate brand relationships. Those under 35 tend to have emotional relationships with technology, entertainment and retail brands, while those over 35 have stronger connections with consumer packaged goods.

Figure 5 provides a list of the Top 10 most intimate brands in 2015. Among the Top 10, Apple is in first place, as it is in many surveys. Samsung, in 10th place, is the only other technology brand to make this list. Four of the Top 10 brands are in the automotive industry, suggesting this category has a high potential for creating intimacy between its brands and consumers. In the U.S., retail came in second. Two very different retail brands made the Top 10 list: Amazon, an online marketplace that promises a breadth of offerings, and Whole Foods, a more upscale brick-and-mortar supermarket catering to those seeking fresh foods. The health and beauty industry came in third.

Travel and leisure came in as the poorest-performing category in the U.S. Fulfillment is the archetype most associated with this category. Perhaps this explains the challenges for the travel and leisure industry, which include an increase in complexity and a focus on safety and security risks. Despite the inclusion of some well-crafted experience and luxury brands, it appears travel and leisure as a category has considerable opportunity to improve its brand intimacy performance.

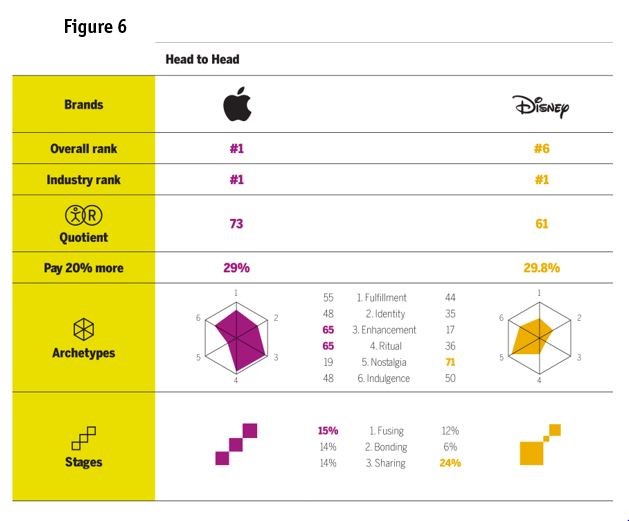

Looking across the rankings, it’s apparent that a brand may own a specific archetype in the hearts and minds of consumers, or it may be notable for its degree of sharing, bonding or fusing customers. Figure 6 shows a side-by-side look at two leading brands from the study, providing a brief overview of the components that contribute to each ranking.

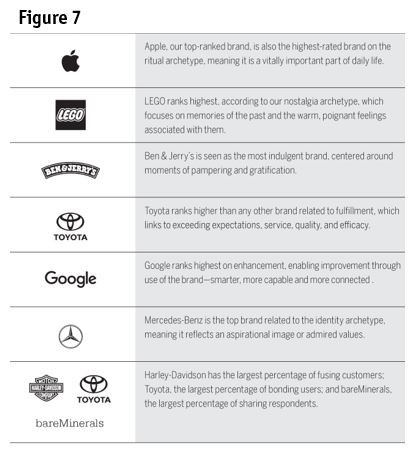

Although some brands are strong across multiple archetypes and stages, there are a few unique examples of brands with a prominent pull from one particular archetype or stage, as detailed below and in Figure 7.

- Lego ranked highest for its associations with nostalgia;

- Google ranked No. 1 for enhancement, enabling improvement through use of the brand and 16th overall; and

- Ben and Jerry’s was seen as strongest on indulgence.

Automotive industry takes the lead

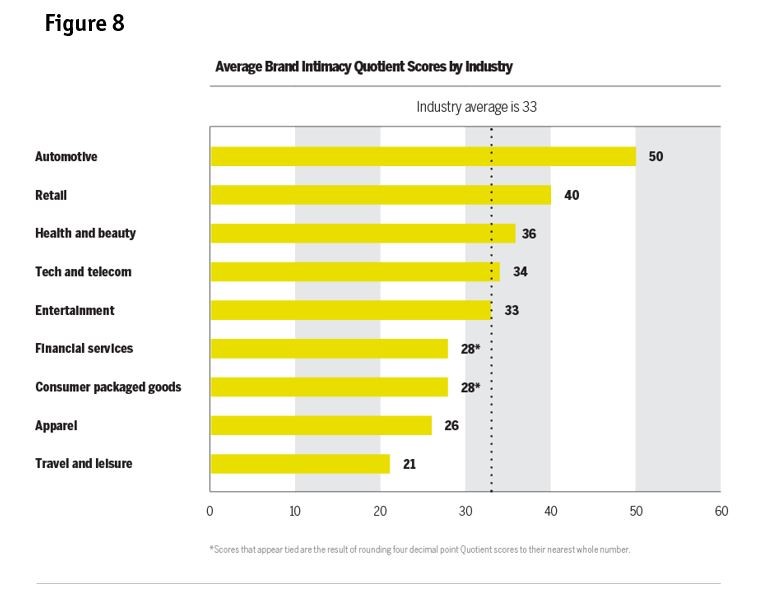

Automotive is the strongest-performing industry in the U.S., Mexico and the UAE, with an average quotient of 50, as shown in Figure 8. (The average quotient across all nine categories is 33.) This is to be expected given the close relationship people have with their cars and motorcycles – as well as the aspirational nature of this industry.

It’s clearly an industry with great capacity for intimate relationships. Fulfillment and identity are the strongest category archetypes, highlighting the importance of performance and image. Mercedes-Benz is the top brand overall related to the identity archetype, meaning it reflects an aspirational image or admired values. Harley-Davidson is notable for its extremely high rates of fusing (10 percent), the highest of all brands surveyed in our research. Harley-Davidson was also the No. 1 brand among men.

Toyota has a strong percentage of bonding consumers (21 percent), another advanced stage. The company also ranked highest for fulfillment, which centers on exceeding expectations and performance.

Anticipating the role of consumer emotion

Brand intimacy is the essential relationship between a person and a brand that transcends purchase, usage and loyalty. As brands continue to anticipate the role of emotion in terms of building intimacy and loyalty with consumers, consistent measurement will become increasingly important to fostering the ultimate brand relationships and creating long-term value.

Methodology

During the spring of 2015, Praxis Research Partners conducted an online quantitative survey among 6,000 consumers in the U.S. (3,000), Mexico (2,000) and the UAE (1,000). Respondents were screened for age (to be in the age range of 18-to-64) and annual household income ($35,000 or more) in the U.S. and for socioeconomic levels in Mexico and the UAE (socioeconomic levels: A, B and C). Quotas were established to ensure that the sample mirrored census data for age, gender, income/socioeconomic level and region.

Respondents completed a 20-minute survey that delved into the emotional connections that consumers have with brands across nine industries: automotive; health and beauty; financial services; retail; travel and leisure; apparel; technology and telecommunications; entertainment; and consumer packaged goods.

We modeled data from over 6,000 interviews and approximately 52,000 brand evaluations to quantify the mechanisms that drive intimacy.